Japan Disposable Hygiene Products Market

Japan Disposable Hygiene Products Market Size, Share, And COVID-19 Impact Analysis, By Product Type (Baby Diapers, Adult Diapers, Feminine Hygiene Products, Tissue & Wipes), By Distribution Channel (Supermarkets/Hypermarkets, Drug Stores/Pharmacies, Online Platforms), By End User (Infant, Adult), By Application (Household, Institutional) And Japan Disposable Hygiene Products Market Insights, Industry Trend, Forecast To 2035

Report Overview

Table of Contents

Japan Disposable Hygiene Products Market Insights Forecasts to 2035

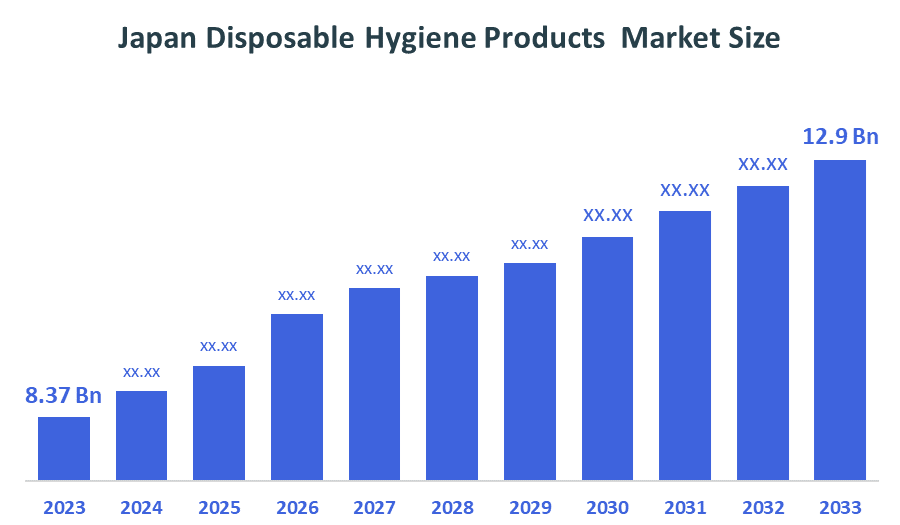

- Japan Disposable Hygiene Products Market Size Was Estimated at USD 8.37 Billion in 2024.

- The Market Size is Expected to Grow at a CAGR of Around 4.01% from 2025 to 2035.

- Japan Disposable Hygiene Products Market Size is Expected to Reach USD 12.9 Billion by 2035.

According to a research report published by Decision Advisior & Consulting, the Japan Disposable Hygiene Products Market size is anticipated to reach USD 12.9 Billion by 2035, growing at a CAGR of 4.01% from 2025 to 2035. The Japan Disposable Hygiene Products Market is experiencing a surge in demand for adult incontinence products due to the increasing number of aging population and the growing awareness of hygiene. The market is also influenced by the elderly care industry trend of the rising number of the elderly care-facilities besides the continuous innovation in absorbent materials and the product comfort aspect.

Market Overview

Disposable hygiene products are single-use items that are necessary to keep one's self clean, manage body fluids, and provide comfort. The significant products include baby diapers, adult incontinence products, feminine hygiene products, wipes, and tissue paper. Such products are available without any hassles in places like homes, hospitals, nursing homes, and other institutions, where they serve as a means of elevating hygiene and making the process of caregiving more efficient. In Japan, which has a population 29.1 % of aged 65+ in 2023, aging is the reason for demand of adult diapers. It is noted that in 2023 Japan imported disposable hygiene products worth USD 243.7 million and exports worth USD 96.4 million. Among the technological innovations is Unicharm’s horizontally recycled nappies and the next generation adult diapers with superior absorbent.

The government encourages the reduction of waste through different initiatives, a plan to lower the share of discarded diapers in general waste by 7% by 2030.Innovative products based on eco-friendly materials, the use of healthcare at home, and institutional purchasing supported by the growth of e-commerce platform and eldercare infrastructure are some of the future Japan disposable hygiene products market opportunities which make it a high potential market for domestic and international players.

Report Coverage

This research report categorizes the market for the Japan disposable hygiene products market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan disposable hygiene products market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan disposable hygiene products market.

Driving Factors

The Japan disposable hygiene products market is driven by a rising aged population and a growing demand for adult incontinence and premium hygiene products. Consumer adoption is being facilitated by the rising awareness of personal hygiene and sanitation. To begin with, technological innovations such as advanced absorbent materials and eco-friendly disposable solutions are attracting consumers by enhancing product performance and comfort. Besides, the market expansion is being facilitated by the growing number of e-commerce platforms and institutional procurement in hospitals and eldercare facilities.

Restraining Factors

The high production costs of top-quality hygiene products make them less affordable. Regulations that are very strict in terms of the use of chemicals and the disposal of waste have the effect of increasing the requirements to be complied with. A low level of consumer awareness of environmentally friendly alternatives is the main reason for the slow uptake. There is fierce competition between the local and foreign players, which puts pressure on the prices and profit margins.

Market Segmentation

The Japan disposable hygiene products market share is categorized by product type, distribution channel, end user, and application.

- The baby diapers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan disposable hygiene products market is segmented by product type into baby diapers, adult diapers, feminine hygiene products, and tissue & wipes. Among these, the baby diapers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Growth is essentially driven by the rising demand for high-quality, hypoallergenic diapers, the increasing number of working mothers who need convenient childcare solutions, and the innovations such as wetness indicators and ultra-soft fabrics, which not only enhance the comfort but also make the skin less irritated.

- The supermarkets/hypermarkets segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan disposable hygiene products market is segmented by distribution channel into supermarkets/hypermarkets, drug stores/pharmacies, and online platforms. Among these, the supermarkets/hypermarkets segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is facilitated by large store chains, in-store promotions, and the option of buying in bulk. Buyers prefer brick-and-mortar stores in order to get products immediately, because of the assortment, and the presence of brands they trust, which is the reason for the continuous revenue stream.

- The adult segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan disposable hygiene products market is segmented by end user into infant and adult. Among these, the adult segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment is supported by the aging population trend and a rise incontinence awareness. The main reasons that drive the segment are advanced absorbent materials, discreet designs, and specially made products for institutional care that give users the ability, and therefore seniors and caregivers, freedom.

- The household segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan disposable hygiene products market is segmented by application into household and institutional. Among these, the household segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment's growth is mostly resulting from the hygiene needs daily met, the use of high-quality tissue and wipes for personal and family hygiene, and the growing antibacterial and eco-friendly product awareness, which is the major factor for repeated household purchases and the preference of trusted brands.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within The Japan disposable hygiene products market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unicharm Corporation

- Kao Corporation

- Daio Paper Corporation

- Oji Holdings Corporation

- Procter & Gamble Japan

- Kimberly?Clark Japan

- Nippon Paper Industries Co., Ltd.

- Pigeon Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2025, Unicharm Corporation in partnership with Fuji Clean, has been working on a new "dry cleaning method" for recycling used disposable diapers, which drastically reduces water usage compared to the traditional method and allows for the recycling infrastructure to be scaled up. This innovation is in line with circular economy objectives, contributes to environmental sustainability, and may promote the diaper recycling implementation to be widespread in Japan.

- In September 2025, Unicharm Corporation was awarded the excellence award in the ESG category at the Sustainable Japan Award for its horizontal recycling initiative "RefF," which converts used disposable diapers into hygienic raw materials. The acknowledgment is a leader signal to the industry about the company's sustainability efforts and facilitates the adoption of recycled hygiene products in domestic markets at a larger scale.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035.Decision Advisior has segmented the Japan Disposable Hygiene Products Market based on the below-mentioned segments:

Japan Disposable Hygiene Products Market, By Product Type

- Baby Diapers

- Adult Diapers

- Feminine Hygiene Products

- Tissue & Wipes

Japan Disposable Hygiene Products Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Drug Stores/Pharmacies

- Online Platforms

Japan Disposable Hygiene Products Market, By End User

- Infant

- Adult

Japan Disposable Hygiene Products Market, By Application

- Household

- Institutional

FAQ’s

Q. What is the projected market size & growth rate of the Japan disposable hygiene products market?

A. Japan disposable hygiene products market was valued at USD 8.37 billion in 2024 and is projected to reach USD 12.9 billion by 2035, growing at a CAGR of 4.01% from 2025 to 2035.

Q. What are the key driving factors for the growth of the Japan disposable hygiene products market?

A. The market is driven by a growing elderly population, increasing demand for adult incontinence products, rising hygiene awareness, expansion of elderly care facilities, and continuous innovation in absorbent materials and product comfort.

Q. What are the restraining factors in the Japan disposable hygiene products market?

A. High production costs of premium hygiene products, strict regulations on chemical use and waste disposal, limited awareness of eco-friendly alternatives, and intense competition among domestic and international players restrain market growth.

Q. What are the top players operating in the Japan disposable hygiene products market?

A. Unicharm Corporation, Kao Corporation, Daio Paper Corporation, Oji Holdings Corporation, Procter & Gamble Japan, Kimberly Clark Japan, Nippon Paper Industries Co., Ltd., Pigeon Corporation, Others

Q. What segments are covered in the Japan disposable hygiene products market report?

A. The market is segmented based on Product Type, Distribution Channel, End User, and Application.

Q. Which product type segment held the largest market share in 2024?

A. The baby diapers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period due to premium quality, convenience, and innovative features.

Q. Which distribution channel segment held the largest market share in 2024?

A. The supermarkets/hypermarkets segment accounted for the largest revenue market share in 2024, supported by wide store networks, in-store promotions, and bulk purchase options.

Q. Which end user segment dominated the market in 2024?

A. The adult segment dominated the market in 2024, driven by the ageing population and increasing awareness of incontinence solutions.

Q. Which application segment accounted for the largest market share in 2024?

A. The household segment held the largest revenue share in 2024, due to daily hygiene needs, preference for antibacterial and eco-friendly products, and repeated household purchases.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 150 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |