Japan E-Axle Market

Japan E-Axle Market Size, Share, and COVID-19 Impact Analysis, By Component Type (Combining Motors, Power Electronics, Transmission, and Others), By Vehicle Type (ICE Vehicles, Electric Vehicles), By Drive Type (Forward Wheel Drive, Rear Wheel Drive, All Wheel Drive, and Others), and Japan E-Axle Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan E-Axle Market Insights Forecasts to 2035

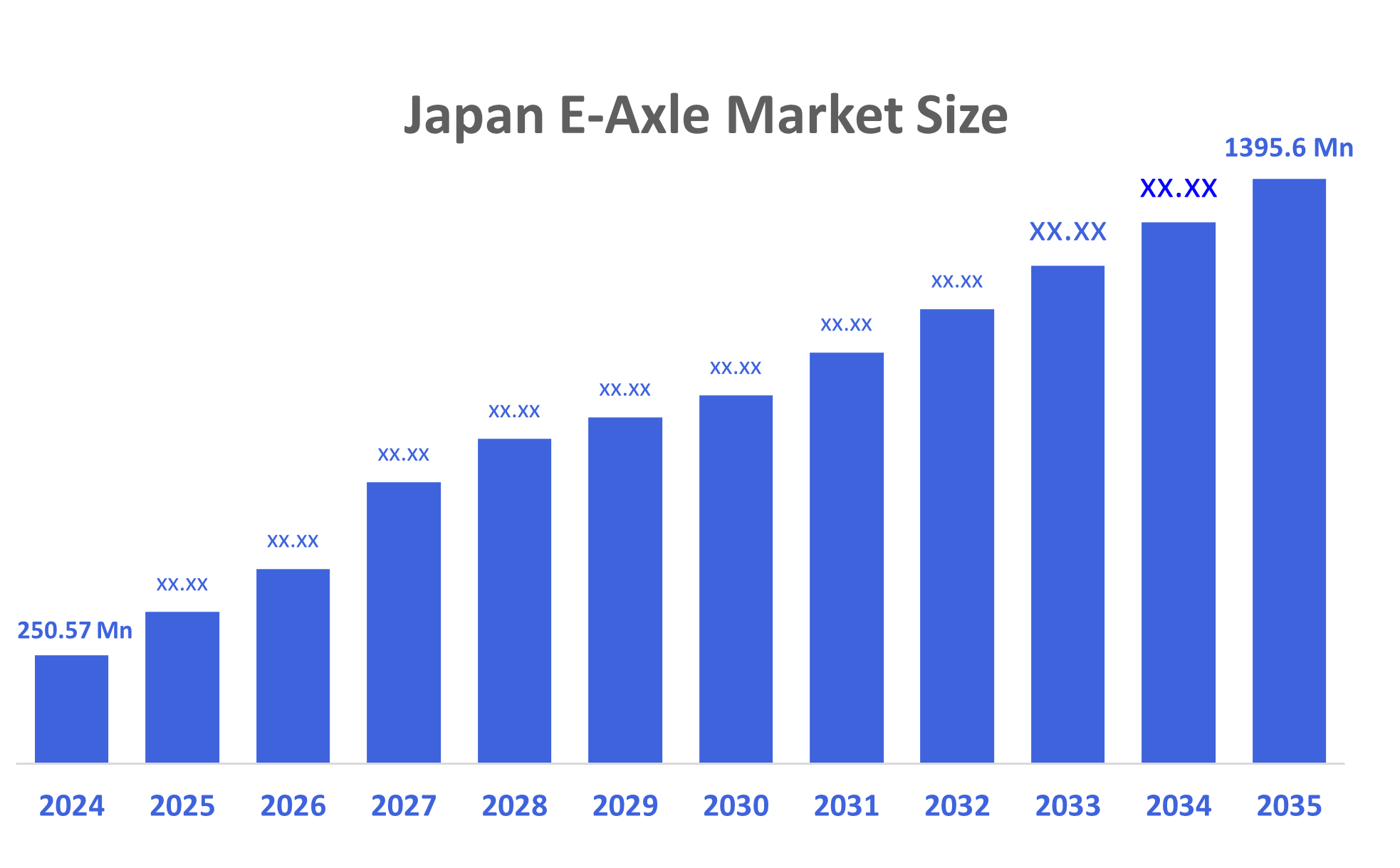

- The Japan E-Axle Market Size Was Estimated at USD 250.57 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 16.9% from 2025 to 2035

- The Japan E-Axle Market Size is Expected to Reach USD 1395.6 Million by 2035

According to a research report published by Decisions Advisors, The Japan E-Axle Market Size is Anticipated to reach USD 1395.6 Million by 2035, growing at a CAGR of 16.9% from 2025 to 2035. The Japan e-axle market is driven by rising electric vehicle adoption, stringent emission regulations, advancements in compact powertrain integration, government incentives supporting electrification, and growing demand for energy-efficient mobility solutions from consumers and automakers seeking performance, reliability, and cost-effective manufacturing.

Market Overview

The Japan e-axle market refers to the industry focused on designing, producing, and integrating electric drive axles that combine motors, power electronics, and transmission systems into a compact unit for electric and hybrid vehicles. This market supports Japan shift toward cleaner mobility by enabling efficient drivetrain solutions, improving vehicle performance, and reducing manufacturing complexity for automakers. The Japan e-axle market is on a dynamic path of growth, primarily due to the increased availability in the adoption of electric vehicles (EVs) and backing of government policies. Areas of consumer demand regarding eco-friendly transportation, along with Japan's promise of net-zero emissions by 2050, is driving the market. This trend is causing for the more compact and efficient e-axle systems, with electric motors, power electronics, and transmissions packaged into one system to provide increased performance and use of the vehicles space. In addition, the practice of urbanization and short driving distances available in Japan make EVs equipped with e-axles particularly attractive for passenger or commercial deliveries. All main OEM' manufacturers such as Nissan and Toyota, are also increasing their portfolios focused on EVs to support demand for advanced e-axle technologies.

The two largest developments focused on the Japan e-axle market, are an increase in technological advancement and strategic partnerships. The popularity of open cooperation has pushed OEMs to collaborate as manufacturers are willing to invest in R&D to produce sustainable design choices for lighter weight, lightweight and high efficiency e-axles for increased range and overall efficiency of EVs. 4D vehicle dynamics modelling partnered with investment and collaboration with their partners such as Aisin collaborating, with Subaru for next generations e-axle systems to provide next-level capacity. Also exciting are advancements in smart technologies, such as IoT-based diagnostics and metrics that can provide V2X communication to increase service efficiency and less vehicle down-time.

Report Coverage

This research report categorizes the market for the Japan e-axle market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan e-axle market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan e-axle market.

Driving Factors

The e-axle markets in Japan are driven by substantial financial incentives and infrastructure investments, significantly boosting e-axle demand as EV penetration increases. For 2024, the Ministry of Economy, Trade, and Industry raised its Clean Energy Vehicle (CEV) subsidy budget to JPY 129.1 billion, an almost 35% increase from the previous year, offering up to JPY 850,000 for BEV purchases and JPY 550,000 for PHEVs, making electrified vehicles more affordable for consumers.

Simultaneously, the number of government-subsidized EV chargers surged by 270%, from 3,077 units in 2022 to 11,397 in 2023, significantly expanding fast charging networks and reducing range anxiety. This has allowed more consumers to consider BEVs and PHEVs with e-axles. As a result, EV market share in Japan has been steadily growing. Projections indicate that Japanese EV market revenues will rise to c. USD 7.2 billion by 2025, supporting the growth of e-axle adoption as OEMs localize production to meet demand. With continued subsidies and charging infrastructure expansion, Japan’s policy environment will drive sustained growth in e-axle production and adoption.

Restraining Factors

The e-axle market in Japan is restrained by high production costs, limited charging infrastructure, technological complexities, supply chain challenges, and slow EV adoption in certain segments, affecting large-scale deployment and manufacturer profitability.

Market Segmentation

The Japan e-axle market share is categorized by component type, vehicle type and drive type.

- The transmission segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan e-axle market is segmented by component type into combining motors, power electronics, transmission, and others. Among these, the transmission segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by rising demand for compact, efficient drivetrain systems, advancements in lightweight transmission technologies, improved energy efficiency needs, and increasing integration of multi-speed solutions to enhance EV performance and driving range.

- The electric vehicles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan e-axle market is segmented by vehicle type into ice vehicles, electric vehicles. Among these, the electric vehicles segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to increasing consumer adoption of EVs, strong government incentives, expanding charging infrastructure, automakers’ focus on electrification, and rising demand for efficient, low-emission mobility solutions across Japan’s automotive market.

- The all wheel drive segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan e-axle market is segmented by drive type into forward wheel drive, rear wheel drive, all wheel drive, and others. Among these, the all wheel drive segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by increasing demand for enhanced vehicle stability, improved traction in diverse road conditions, rising adoption of high-performance EVs, and advancements in integrated AWD e-axle systems offering superior power distribution and efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan e-axle market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BluE Nexus

- Aisin Corporation

- Denso Corporation

- Nidec Corporation

- Hitachi Astemo

- Musashi Seimitsu Industry

- Yamaha Motor Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2024, Renesas Electronics and Nidec Corporation introduced an 8-in-1 proof-of-concept e-axle system. This system integrates eight components, including the motor, inverter, gearbox, DC/DC converter, and onboard charger, into a single unit, aiming to enhance efficiency and reduce vehicle weight.

- In October 2024, Yamaha Motor Co. Ltd. announced its partnership in developing an electric sports coupe, referred to as Project V, led by Caterham EVo Ltd. Yamaha is contributing its expertise to develop an e-axle tailored for this high-performance vehicle, targeting future mass production.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan E-Axle Market based on the below-mentioned segments:

Japan E-Axle Market, By Component Type

- Combining Motors

- Power Electronics

- Transmission

- Others

Japan E-Axle Market, By Vehicle Type

- ICE Vehicles

- Electric Vehicles

Japan E-Axle Market, By Drive Type

- Forward Wheel Drive

- Rear Wheel Drive

- All-Wheel Drive

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |