Japan Employment Screening Services Market

Japan Employment Screening Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Criminal Background Checks, Education and Employment Verification, Credit History Checks, Drug and Health Screening, and Others), By Organization Size (Small and Medium Enterprises, Large Enterprises), and Japan Employment Screening Services Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Employment Screening Services Market Insights Forecasts to 2035

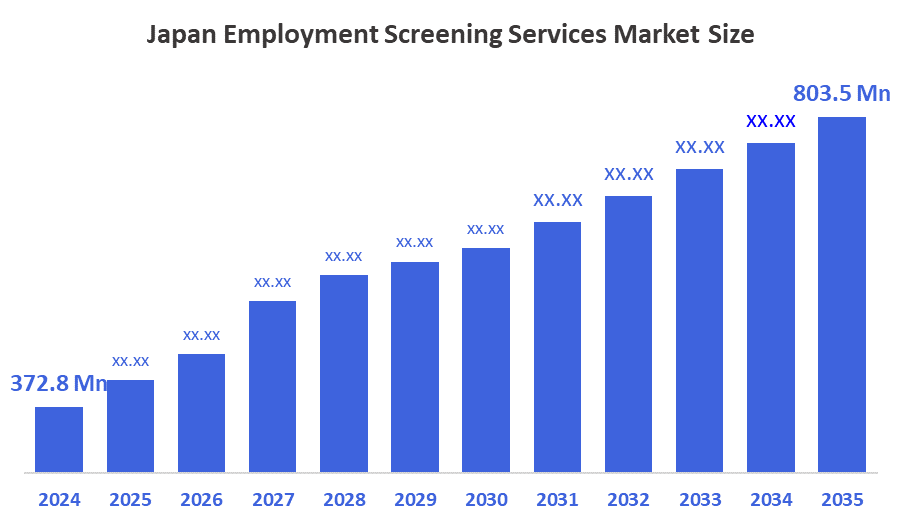

- The Japan Employment Screening Services Market Size Was Estimated at USD 372.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.23% from 2025 to 2035

- The Japan Employment Screening Services Market Size is Expected to Reach USD 803.5 Million by 2035

According to a research report published by Decisions Advisors, the Japan Employment Screening Services Market Size is Anticipated to Reach USD 803.5 Million by 2035, growing at a CAGR of 7.23% from 2025 to 2035. The employment screening services market in Japan is driven by Stricter compliance requirements, more automation in hiring, and the growing emphasis on labor integrity.

Market Overview

The market for employment screening services comprises strategies and tactics used by businesses to evaluate candidates' credentials, backgrounds, and reliability before hiring them. Background checks, criminal investigations, employment and education verification, credit checks, identity checks, pre-employment drug testing, and reference checks are all examples of employment screening services. In order to give employers quicker and more accurate research, employment screening companies frequently use digital services platforms, AI-driven analytics, and automated verification technologies. Japan's market for employment screening services is growing as employers focus on compliance, workplace safety, and efficient hiring in a restrictive labour market. The government's framework, especially through the Act on the Protection of Personal Information (APPI), and the enhanced scrutiny by the Personal Information Protection Commission, forces employers to manage candidate data and vendor practices, leading to further demand for compliance. Further, cross-border hiring, HR systems integration, and screening for security-sensitive companies are offerings that show increased demand. Most recently, there is growing interest in ensuring screening services address accuracy, turnaround, and consideration for expanding screening compliance through proposed security clearance changes.

Report Coverage

This research report categorizes the market for the Japan employment screening services market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan employment screening services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Japan employment screening services market.

Driving Factors

The employment screening services market in Japan is driven by companies increasingly prioritizing hiring for workplace safety, and it is expected that regulatory compliance which began with the Act on the Protection of Personal Information (APPI), will rise with further implementation of the guidelines along with a growing interest in remote/hybrid hiring which has necessitated more rigorous screening processes for identity, qualifications and background checks. Expanding hiring in areas like IT, finance, and manufacturing is increasing the demand for checks such as criminal background, education validation, and skills assessments. Other contributing factors are Japan's aging labor force and a growing reliance on foreign workers, increasing the need for standardized, thorough, and reliable screening solutions to mitigate hiring risks while maintaining the quality of the workforce.

Restraining Factors

The employment screening services market in Japan is mostly constrained by regulations from the APPI, which limit what public records can be examined and incur high compliance costs, while limiting incoming and outgoing public records for inspection. Additionally, limited public access to some of these records, cultural norms surrounding personal information, and a hiring culture that has traditionally relied on trust and relationships have contributed to slower adoption of broad-based and complete screening services.

Market Segmentation

The Japan employment screening services market share is classified into service and organization size.

- The education and employment verification segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan employment screening services market is segmented by service type into criminal background checks, education and employment verification, credit history checks, drug and health screening, and others. Among these, the education and employment verification segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This sector is the most extensively used screening service because it is utilized in every industry. This segment's dominance is further reinforced by Japan's growing hiring of foreign workers, which raises the requirement for stringent international credential verification.

- The large enterprises segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan employment screening services market is segmented by organization size into small and medium enterprises, large enterprises. Among these, the large enterprises segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. High-volume hiring is handled by large Japanese organizations, particularly in IT, manufacturing, finance, and multinational operations, necessitating organized and legal screening procedures. This segment's dominance is further reinforced by its increased spending and use of technology-driven, outsourced screening solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan employment screening services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- J-SCREEN

- Santsu Co., Ltd.

- KIGYOU SERVICE

- AMS Inform

- First Advantage Japan

- KPMG Japan

- D-Quest / DQ Investigation & Intelligence

- Japan PI

- Tokyo Management Research (TMR)

- eeCheck

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2025, the new "Japanese DBS" system will expand to encompass more child-facing workplaces beyond schools, starting in December 2026.

- In April 2025, MyNavi published its "2025 Employment Policy Report," detailing an increase in investment in hiring transparency, data security, and screening.

- In March 2024, the Cabinet approved the bill for the "Japanese DBS," which requires a future sex offender check for 20 years in frontline child-facing roles.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan employment screening services market based on the below-mentioned segments:

Japan Employment Screening Services Market, By Service Type

- Criminal Background Checks

- Education and Employment Verification

- Credit History Checks

- Drug and Health Screening

- Others

Japan Employment Screening Services Market, By Organization Size

- Small and Medium Enterprises

- Large Enterprises

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 212 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |