Japan Energy Gels Market

Japan Energy Gels Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Carbohydrate Gels, Isotonic/Electrolyte Gels, and Caffeinated Gels), By Flavor Type (Flavored, Citrus & Tangy Flavors, Berry & Tropical Fruit Flavors, Coffee Flavors, Dessert-Inspired Flavors, Other Flavors, and Unflavored), and Japan Energy Gels Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Energy Gels Market Insights Forecasts to 2035

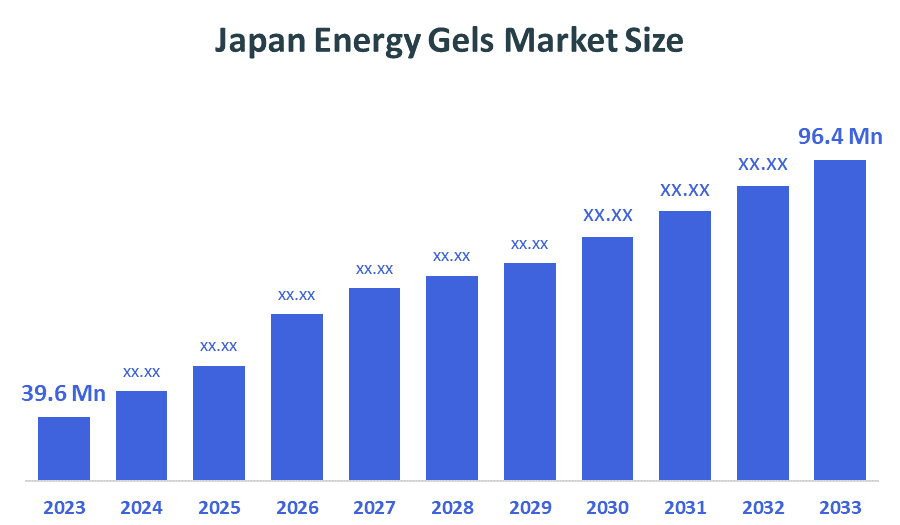

- The Japan Energy Gels Market Size Was Estimated at USD 39.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.42% from 2025 to 2035

- The Japan Energy Gels Market Size is Expected to Reach USD 96.4 Million by 2035

According to a Research Report Published by Decision Advisior & Consulting, the Japan energy gels market size is anticipated to reach USD 96.4 million by 2035, growing at a CAGR of 8.42% from 2025 to 2035. The energy gels market in Japan is driven by growing awareness of fitness, increased involvement in endurance sports, growing need for easy nutrition, busy lifestyles, an emphasis on the health of the aging population, and increased availability through online and retail channels.

Market Overview

The Japan energy gels market signifies the entire process of making, selling, and using the fast-absorbing, carbohydrate-rich, nutritionally-rich, and energy-providing gels mainly aimed at athletes, those who care about fitness, and regions of the country where endurance sports are played throughout Japan. The market is growing as a result of these elements, as well as rising health and nutrition consciousness among baby boomers and lower-class consumers. The demand for these goods has significantly increased since more people than ever before are engaging in endurance sports, hectic schedules necessitate on-the-go nutrition, and a general increased focus on preventative health care due to greater longevity.

Japan supports the energy gels industry by means of government actions in the fields of sports and health. The Japan Sport Council has allocated roughly ¥288 billion for the promotion of sports through subsidies since 2002, which goes to training athletes and community sports. Additionally, the Japan Sports Agency pays for high-performance sports science and nutrition programs, which ultimately leads to an increased demand for sports nutrition products, thus indirectly supporting the energy gels industry.

The technological progress in formulating through better digestibility, electrolyte balance, and clean-label ingredients has made the product more attractive. The market for plant-based, natural formulations, as well as e-commerce expansion, is an area of opportunity. Recent activities involve the launching of new products, sports sponsorships, and innovations by the leading food and nutrition companies in Japan.

Report Coverage

This research report categorizes the market for the Japan gelatin market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan energy gels market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan energy gels market.

Driving Factors

The energy gels market in Japan is driven by people becoming more aware of health and fitness, more people participating in endurance sports like cycling and running, and increased demand for convenient nourishment while engaged in tasks. The increasing number of people with busy lifestyles (e.g., urban living) and the increasing number of older individuals seeking easily accessible energy sources are additional drivers for growth within the Japanese energy gel market. Growth has also come from expanded availability of energy gels through e-commerce channels, large amounts of convenience stores, and tremendous innovation among Japanese-based food manufacturers regarding formulating new flavors and digestibility.

Restraining Factors

The energy gels market in Japan is mostly constrained by high prices, inadequate knowledge of the product among non-athlete consumers, stringent food labeling and health claim regulations, taste preferences for traditional foods, and competition from other types of snacks and drinks as its restrictions.

Market Segmentation

The Japan energy gels market share is classified into product type and flavor type.

- The carbohydrate gels segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan energy gels market is segmented by product type into carbohydrate gels, isotonic/electrolyte gels, and caffeinated gels. Among these, the carbohydrate gels segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because they offer quick, quickly absorbed energy, are frequently advised for endurance exercises, accommodate Japanese taste and digestive preferences, and are widely accessible through sports, fitness, and convenience retail channels, carbohydrate gels are the most popular.

- The flavored segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan energy gels market is segmented by flavor type into flavored, citrus & tangy flavors, berry & tropical fruit flavors, coffee flavors, dessert-inspired flavors, other flavors, and unflavored. Among these, the flavored segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because Japanese customers have a strong preference for pleasant taste profiles, enhanced palatability, and variety, all of which lessen flavor fatigue during endurance exercises and promote repeat purchases among recreational and athletic users.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan gelatin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Otsuka Pharmaceutical Co., Ltd.

- Meiji Holdings Co., Ltd.

- Ajinomoto Co., Inc.

- Suntory Holdings Limited

- Asahi Group Holdings, Ltd.

- Morinaga & Co., Ltd.

- Yakult Honsha Co., Ltd.

- Kirin Holdings Company, Ltd

- Calpis Co., Ltd.

- DHC Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, ENERGY, a prominent brand in the energy sector, introduced a new Melon Soda flavor in Japan. The flavored energy gel incorporates an upcycled aroma ingredient from Hokkaido melons and combines fast and slow energy sources, thus providing a refreshing choice for sportsmen and active people.

- In August 2025, the energy gel presented a new Honey Lemon flavor, which was released on August 27 in Japan. The product was developed by Daito Suisan, who gave it the name "elegant and potent energy-boosting gel" as it contains palatinose for sustained energy along with honey and magnesium.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisior has segmented the Japan energy gels market based on the below-mentioned segments:

Japan Energy Gels Market, By Product Type

- Carbohydrate Gels

- Isotonic/Electrolyte Gels

- Caffeinated Gels

Japan Energy Gels Market, By Flavor Type

- Flavored

- Citrus & Tangy Flavors

- Berry & Tropical Fruit Flavors

- Coffee Flavors

- Dessert-Inspired Flavors

- Other Flavors

- Unflavored

FAQ’s

Q: What is the Japan energy gels market size?

A: Japan energy gels market size is expected to grow from USD 39.6 million in 2024 to USD 96.4 million by 2035, growing at a CAGR of 8.42% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by people becoming more aware of health and fitness, more people participating in endurance sports like cycling and running, and increased demand for convenient nourishment while engaged in tasks. The increasing number of people with busy lifestyles (e.g., urban living) and the increasing number of older individuals seeking easily accessible energy sources are additional drivers for growth within the Japanese energy gel market. Growth has also come from expanded availability of energy gels through e-commerce channels, large amounts of convenience stores, and tremendous innovation among Japanese-based food manufacturers regarding formulating new flavors and digestibility.

Q: What factors restrain the Japan energy gels market?

A: Constraints include by high prices, inadequate knowledge of the product among non-athlete consumers, stringent food labeling and health claim regulations, taste preferences for traditional foods, and competition from other types of snacks and drinks as its restrictions.

Q: How is the market segmented by product type?

A: The market is segmented into carbohydrate gels, isotonic/electrolyte gels, and caffeinated gels.

Q: Who are the key players in the Japan energy gels market?

A: Key companies include Otsuka Pharmaceutical Co., Ltd., Meiji Holdings Co., Ltd., Ajinomoto Co., Inc., Suntory Holdings Limited, Asahi Group Holdings, Ltd., Morinaga & Co., Ltd., Yakult Honsha Co., Ltd., Kirin Holdings Company, Ltd, Calpis Co., Ltd., DHC Corporation, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 176 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |