Japan Family Offices Market

Japan Family Offices Market Size, Share, and COVID-19 Impact Analysis, By Type (Single-family Office, Multi-Family Office, and Virtual Family Office), By Service Type (Financial Planning, Strategy, Governance, Advisory, and Others), and Japan Family Offices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Family Offices Market Insights Forecasts to 2035

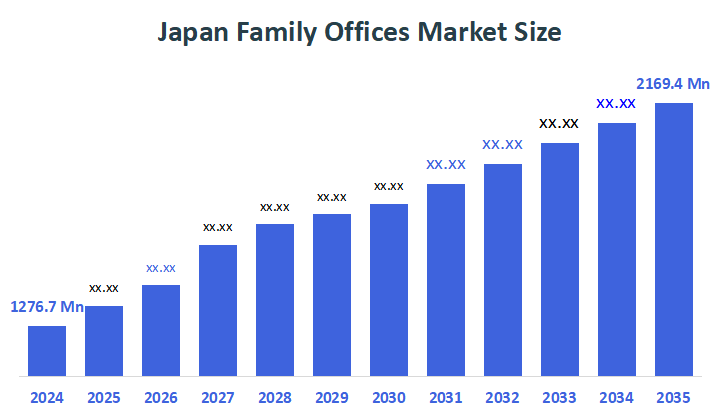

- The Japan Family Offices Market Size Was Estimated at USD 1276.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.94% from 2025 to 2035

- The Japan Family Offices Market Size is Expected to Reach USD 2169.4 Million by 2035

According to a research report published by Decisions Advisors, the Japan family offices market size is anticipated to reach USD 2169.4 million by 2035, growing at a CAGR of 4.94% from 2025 to 2035. The family offices market in Japan is driven by rising high-net-worth individuals, generational wealth transfer, growing succession planning requirements, expanding investment opportunities, regulatory modernization, technology adoption, increased interest in alternative assets, and a greater emphasis on structured philanthropy.

Market Overview

Family offices deal with the management of financial, investment, and personal activities of ultra-high-net-worth and high-net-worth families. Family offices also provide integrated services, including wealth management, succession planning, structuring of estates, tax optimisation, philanthropy coordination, and risk management. Through selective subsidies and initiatives, the Japanese government is backing the development of family offices and allied financial services. The Financial Start-Up Support Program allocates up to ¥20 million (approximately USD 140K) for the initial setting-up costs of asset management and finance companies. The Green Finance & Market Entry Subsidy in Tokyo gives up to ¥50 million in the first year and gradual support afterward, whereas larger Tokyo corporate support can go up to ¥750 million for office installation, consultancy, and recruiting. All these actions are to support the creation and growth of asset management and wealth management services for affluent families in Japan. The recent media coverage of the growing visibility of services offered by Family Offices has led to an increase in the awareness of service offerings from Industry Associations such as the Japan Family Office Association, which actively promotes and supports Best Practices and Standard Professional Standards for the sector.

Report Coverage

This research report categorizes the market for the Japan family offices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan family offices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan family offices market.

Driving Factors

The family offices market in Japan is driven by the transfer of wealth from one generation to the next, as well as the demand for proper estate planning that is going to be structured. On the other hand, the investment opportunities, transparent regulations, and government financial aid are all factors that help the market to grow. Technology in wealth management has come up with digital platforms and analytics that make it easier for the service to run. Moreover, wealthy families' growing interest in alternative investments, ESG-focused portfolios, and philanthropy has been the major driver of family office services adoption and expansion in Japan.

Restraining Factors

The family offices market in Japan is mostly constrained by high operational and setup costs, complicated regulatory compliance, and the lack of knowledge among new high-net-worth families. Besides, the shortage of people in specialized wealth management and the changes in tax regulations could be a deterrent to the growth and acceptance of the market.

Market Segmentation

The Japan family offices market share is classified into type and service type.

- The single-family office segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan family offices market is segmented by type into single-family office, multi-family office, and virtual family office. Among these, the single-family office segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Single-family offices offer fully customized wealth management, succession planning, estate structuring, and investment strategies to a single ultra-high-net-worth family. The increasing number of UHNW people in Japan demands private, individualized services designed to preserve wealth over generations. SFOs are more appealing than multi-family or virtual offices due to their capacity to incorporate family governance, philanthropy, and customized investment opportunities, which propels their market leadership.

- The financial planning segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan family offices market is segmented by service type into financial planning, strategy, governance, advisory, and others. Among these, the financial planning segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because high-net-worth families place a high value on wealth preservation, tax optimization, and structured investment management, the financial planning segment dominates the Japanese family offices industry. The greatest revenue share and demand are driven by its crucial role in protecting and expanding family assets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan family offices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Money Forward Private BANK, Inc.

- Private BANK Co., Ltd.

- Modern Family Office, Inc.

- Family Office Japan Co., Ltd.

- Wealth Planning

- Deloitte Tohmatsu Family Office Services LLC

- Grant Thornton Japan

- Mizuho Trust & Banking Co., Ltd.

- SMBC Nikko Wealth Management

- EY Japan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In March 2024, Money Forward Private BANK, Inc., introduced a family office service to ultra-high-net-worth individuals. Money Forward has partnered with Private BANK for this venture and provides custom-tailored services.

- In June 2024, Deloitte Tohmatsu officially announced its baby office within Japan and began providing more robust advisory and professional governance support.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan family offices market based on the below-mentioned segments:

Japan Family Offices Market, By Type

- Single-family Office

- Multi-Family Office

- Virtual Family Office

Japan Family Offices Market, By Service Type

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

FAQ’s

Q: What is the Japan family offices market size?

A: Japan family offices market size is expected to grow from USD 1276.7 million in 2024 to USD 2169.4 million by 2035, growing at a CAGR of 4.94% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the transfer of wealth from one generation to the next, as well as the demand for proper estate planning that is going to be structured. On the other hand, the investment opportunities, transparent regulations, and government financial aid are all factors that help the market to grow. Technology in wealth management has come up with digital platforms and analytics that make it easier for the service to run.

Q: What factors restrain the Japan family offices market?

A: Constraints include high operational and setup costs, complicated regulatory compliance, and the lack of knowledge among new high-net-worth families.

Q: How is the market segmented by service type?

A: The market is segmented into financial planning, strategy, governance, advisory, and others.

Q: Who are the key players in the Japan family offices market?

A: Key companies include Money Forward Private BANK, Inc., Private BANK Co., Ltd., Modern Family Office, Inc., Family Office Japan Co., Ltd., Wealth Planning, Deloitte Tohmatsu Family Office Services LLC, Grant Thornton Japan, Mizuho Trust & Banking Co., Ltd., SMBC Nikko Wealth Management, EY Japan, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 190 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |