Japan Fluoropolymer Films Market

Japan Fluoropolymer Films Market Size, Share, and COVID-19 Impact Analysis, By Application (Barrier Films, Release Films, Microporous Films, and Security Films), By End-Use (Automotive, Construction, Aerospace & Defence, Packaging, Industrial, Electrical & Electronics, and Others), and Japan Fluoropolymer Films Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Fluoropolymer Films Market Size Insights Forecasts to 2035

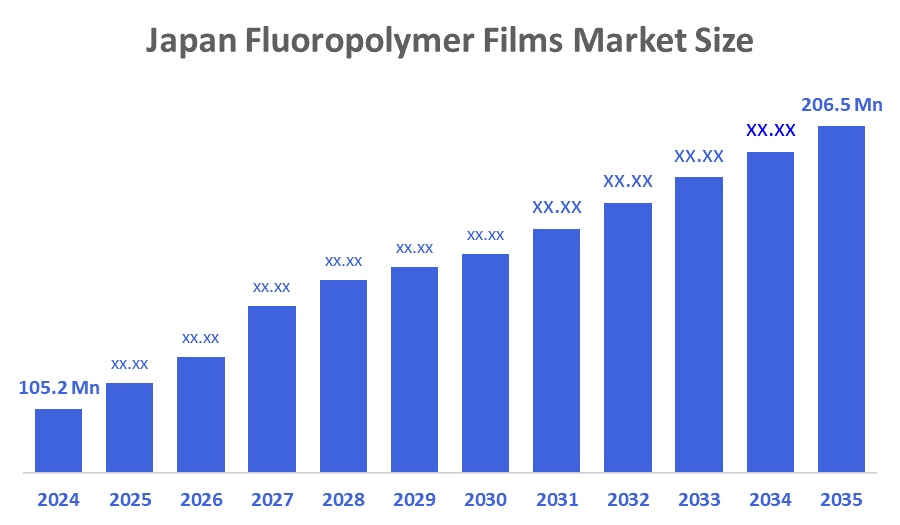

- The Japan Fluoropolymer Films Market Size Was Estimated at USD 105.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.32% from 2025 to 2035

- The Japan Fluoropolymer Films Market Size is Expected to Reach USD 206.5 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Fluoropolymer Films Market Size is anticipated to Reach USD 206.5 Million by 2035, growing at a CAGR of 6.32% from 2025 to 2035. The fluoropolymer films market in Japan is driven by the rising demand for semiconductors and high-performance electronic devices. These films are utilised in electrical devices for PCBs, capacitors, and semiconductor packaging.

Market Overview

Fluorinated polymers are used to produce fluoropolymer films, which are a refined material film with remarkable chemical resistance, high temperature stability, and low friction properties. Polytetrafluorothylene (PTFE), Fluorinated Ethylene Propylene (FEP), and Perfluoroalkoxy (PFA) are examples of fluorine and carbon-based polymers that are mostly made by film extrusion. They have extraordinary heat resistance, electrical insulation, resistance to weather and UV rays, a non-stick surface, mechanical strength, and, in some grades, transparency. Protective coatings, cable insulation, solar cell glazing, pharmaceutical cap liner, electronics, automotive and aerospace components, and chemical-resistant lines are some of the main uses. They are working in the form of anti-grey coverings and architectural textiles, and in the form of insulators and dielectrics in electronics. Additionally, fluoropolymer films act effectively in challenging circumstances that require strong resistance to chemicals and rust without deteriorating. Fluoropolymer films are extremely flexible and are in great demand due to their internal properties, including friction, flame retardation, water repellency, optical clarity, and a lower coefficient of resistance to weathering and solvents. Japan has taken an important government-backed initiative to enhance the domestic fluoropolymer film industry. The government has also implemented strict rules related to organic pollutants like PFOA to protect human health and the environment.

Report Coverage

This research report categorizes the market for the Japan fluoropolymer films market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan fluoropolymer films market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan fluoropolymer films market.

Driving Factors

The fluoropolymer films market in Japan is driven by growing demand from the automotive, medical, and electronics sectors as a result of its remarkable insulating, thermal, and chemical resistance. In addition, the necessity for high-performance materials in building and packaging, technological developments, and the increase of renewable energy and solar photovoltaic applications all contribute to the market's expansion.

Restraining Factors

The fluoropolymer films market in Japan is mostly constrained by high costs of production and technology, making fluoropolymer films too expensive for general application. Also, broader adoption is further impeded by environmental concerns, strict laws, and intricate production processes, particularly in price-sensitive industries and applications that demand cost-effective alternatives.

Market Segmentation

The Japan fluoropolymer films market share is classified into application and end-use.

- The barrier films segment accounted for the largest market revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan fluoropolymer films market is segmented by application into barrier films, release films, microporous films, and security films. Among these, the barrier films segment accounted for the largest market revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Fluoropolymer barrier films are highly effective in shielding products from different environmental elements such as oxygen, moisture, and UV radiation. Fluoropolymer barrier films efficiently address concerns related to contamination and spoilage of food products by effectively preventing them.

- The construction segment is expected to grow at a significant CAGR over the forecast period.

The Japan fluoropolymer films market is segmented by end-use into automotive, construction, aerospace & defence, packaging, industrial, electrical & electronics, and others. Among these, the construction segment is expected to grow at a significant CAGR over the forecast period. The need for films in the construction industry is being driven by the fluoropolymer films strong performance in challenging weather conditions, such as exposure to UV rays, dampness, and extremely high or low temperatures. Also, its low maintenance requirements reduce building maintenance expenses and enhance its beauty.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan fluoropolymer films market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daikin Industries, Ltd.

- AGC Chemicals

- Asahi Kasei Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan fluoropolymer films market based on the below-mentioned segments:

Japan Fluoropolymer Films Market, By Application

- Barrier Films

- Release Films

- Microporous Films

- Security Films

Japan Fluoropolymer Films Market, By End-Use

- Automotive

- Construction

- Aerospace & Defence

- Packaging

- Industrial

- Electrical & Electronics

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |