Japan Fluoropolymers Market

Japan Fluoropolymers Market Size, Share, and COVID-19 Impact Analysis, By Product (Polytetrafluoroethylene, Polyvinylidene Fluoride, Fluorinated Ethylene Propylene, Fluoroelastomers, and Others), By Application (Automotive, Electrical & Electronics, Construction, and Industrial Equipment), and Japan Fluoropolymers Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Japan Fluoropolymers Market Insights Forecasts To 2035

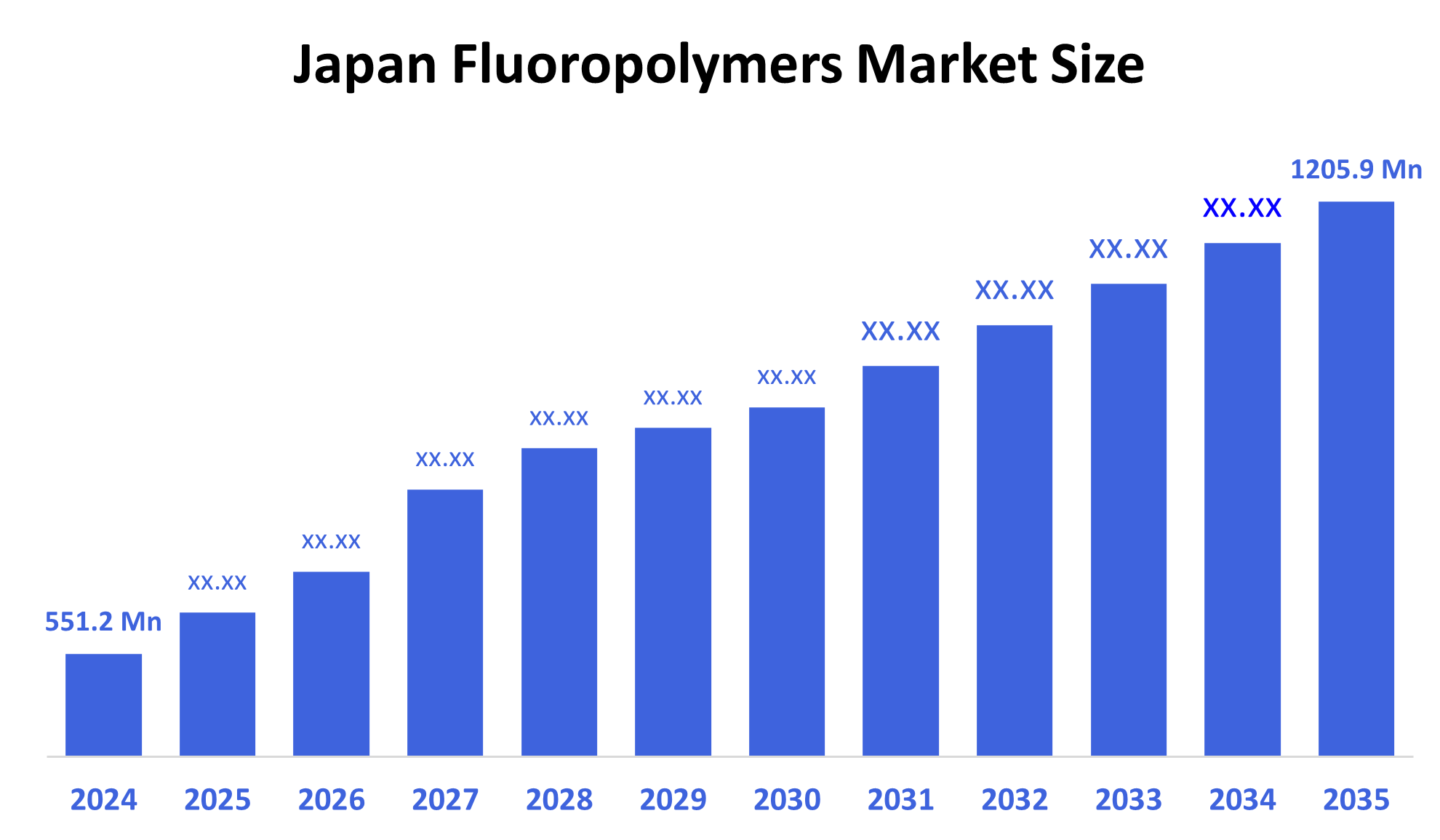

- The Japan Fluoropolymers Market Size Was Estimated at USD 551.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.38% from 2025 to 2035

- The Japan Fluoropolymers Market Size is Expected to Reach USD 1205.9 Million by 2035

According to a research report published by Decision Advisors, the Japan Fluoropolymers market size is anticipated to reach USD 1205.9 million by 2035, growing at a CAGR of 7.38% from 2025 to 2035. The Fluoropolymers market in Japan is driven by its unique performance characteristics and broad range of uses in sectors like chemical processing, electronics, automotive, and construction.

Market Overview

Fluoropolymers are a specific type of polymer with specific chemical and physical characteristics due to the presence of fluorine atoms in their molecular structure. They are famous for their low friction and non-stick properties as well as their remarkable flexibility for heat, chemicals, solvents, and weathering. Polytetrafluoroethylene is the most famous type and is sold under the Teflon brand. Strong carbon-fluorine bonds, which are the most stable in organic chemistry, are the main benefits of fluoropolymers. Due to their extraordinary durability and inertia, these materials are perfect for use in challenging situations. They are resistant to UV light, can tolerate high temperatures, and most are unaffected by corrosive compounds. These characteristics set fluoropolymers apart from other plastics and make them useful in areas where durability and dependability are necessary. They are used to line up tanks, valves, and pipes in the chemical industry to prevent rust. Due to their dielectric strength and thermal stability, fluoropolymers such as fluorinated ethylene propylene (FEP) provide high-demonstration insulation for wires and cables in electronics. Automotive and aerospace sectors employ them for sealing, gaskets, and coatings that tolerate high stress and temperature fluctuations.

Report Coverage

This research report categorizes the market for the Japan fluoropolymers market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan fluoropolymers market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan fluoropolymers market.

Driving Factors

The fluoropolymers market in Japan is driven by strong government programs, such as the adoption of Industry 4.0 and Society 5.0, significant R&D expenditures, and leadership in electronics, robots, and automobiles. Innovation in healthcare, smart infrastructure, and the growing demand for sustainable energy all contribute to growth. Furthermore, despite demographic concerns, Japan maintains its competitiveness through automation, digital transformation, and international alliances.

Restraining Factors

The fluoropolymers market in Japan is mostly constrained by population decline, lack of workers, and sluggish policy changes. Growth and long-term sustainability across industries are further hampered by high production costs, international competition, and environmental concerns over industrial processes.

Market Segmentation

The Japan fluoropolymers market share is classified into product and application.

- The polytetrafluoroethylene segment accounted for the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The Japan fluoropolymers market is segmented by product into polytetrafluoroethylene, polyvinylidene fluoride, fluorinated ethylene propylene, fluoroelastomers, and others. Among these, the polytetrafluoroethylene segment accounted for the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is due to its chemical inertness, and it is extremely resistant to corrosive and aggressive agents. Additionally, because PTFE can tolerate high temperatures without losing its mechanical qualities, it is widely used in gaskets, seals, and chemical processing equipment.

- The industrial equipment segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan fluoropolymers market is segmented by application into automotive, electrical & electronics, construction, and industrial equipment. Among these, the industrial equipment segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The fluoropolymers are essential for the production of heat-resistant components, dielectric materials for antennas, and coatings for PCBs. Fluoropolymers are also in high demand for battery components, wire insulation, and thermal management as a result of the automotive industry's expansion of electric vehicles (EVs).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan fluoropolymers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daikin Industries, Ltd.

- AGC Inc.

- Nippon Fusso Co., Ltd.

- Daikin Finetech, Ltd.

- Technos Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Japan fluoropolymers market based on the below-mentioned segments:

Japan Fluoropolymers Market, By Product

- Polytetrafluoroethylene

- Polyvinylidene Fluoride

- Fluorinated Ethylene Propylene

- Fluoroelastomers

- Others

Japan Fluoropolymers Market, By Application

- Automotive

- Electrical & Electronics

- Construction

- Industrial Equipment

FAQ’s

Q: What is the market size of the Japan fluoropolymers industry in 2024?

A: The Japan fluoropolymers market was valued at USD 551.2 million in 2024.

Q: What is the expected market size by 2035?

A: The market is projected to reach USD 1205.9 million by 2035, growing at a CAGR of 7.38% from 2025 to 2035.

Q: What factors are driving the growth of Japan’s fluoropolymers market?

A: Key drivers include government initiatives (Industry 4.0, Society 5.0), high R&D spending, demand from automotive, electronics, and industrial equipment, as well as applications in clean energy and healthcare innovation.

Q: What are the main restraints in the market?

A: Challenges include Japan’s shrinking population, labor shortages, high production costs, global competition, and environmental concerns related to fluoropolymer processing.

Q: Which product segment holds the largest market share?

A: Polytetrafluoroethylene (PTFE) accounted for the largest share in 2024, driven by its superior chemical inertness, thermal resistance, and broad industrial applications.

Q: Which application segment dominates the market?

A: Industrial equipment was the leading application in 2024, supported by demand for heat-resistant components, wire insulation, PCB coatings, and battery materials.

Q: Who are the key companies in the Japan fluoropolymers market?

A: Major players include Daikin Industries, Ltd., AGC Inc., Nippon Fusso Co., Ltd., Daikin Finetech, Ltd., and Technos Corporation, among others.

Q: What is the forecast period covered in the report?

A: The forecast period for the Japan fluoropolymers market is 2025 to 2035, with historical data from 2020 to 2023 and base year 2024.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |