Japan Food Logistics Market

Japan Food Logistics Market Size, Share, and COVID-19 Impact Analysis, By Transportation Mode (Roadways, Railways, Seaways, and Airways), By Service Type (Cold Chain, and Non-Cold Chain), and Japan Food Logistics Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Food Logistics Market Insights Forecasts to 2035

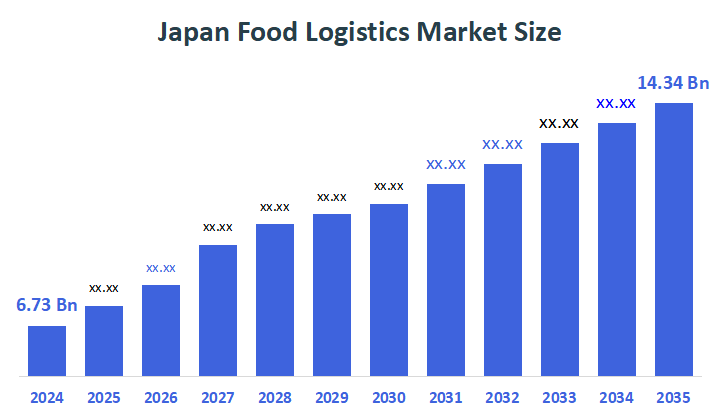

- The Japan Food Logistics Market Size Was Estimated at USD 6.73 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.12% from 2025 to 2035

- The Japan Food Logistics Market Size is Expected to Reach USD 14.34 Billion by 2035

According to a research report published by Decisions Advisors, the Japan food logistics market size is anticipated to reach USD 14.34 billion by 2035, growing at a CAGR of 7.12% from 2025 to 2035. The food logistics market in Japan is driven by rising demand for packaged foods, quick e-commerce growth, sophisticated cold-chain technologies, and growing automation to address labor shortages and enhance productivity and market expansion.

Market Overview

The food logistics market is an integrated process that revolves around the planning, management, and transport of food products from producers to end-users. This market includes the activities of storage, cold chain maintenance, packaging, handling, inventory control, warehousing, and distribution, which are all done to guarantee food safety, freshness, and prompt delivery throughout the supply chain. The Japan food logistics market is poised for a growth spurt as efficient distribution systems are becoming a necessity with the increasing demand for packaged and convenient foods, along with the quick penetration of e-commerce.

The government of Japan is assisting with food logistics through the adoption of supply chain and cold chain subsidies. The "Logistics Productivity Improvement Promotion" programme, for example, supports the digitalisation, standardisation, and cold-chain equipment adoption to make the distribution of food better. The supply chain strengthening measures of the Agriculture Ministry offer subsidies for the establishment of efficient logistics and export networks. Furthermore, through digital food-distribution model subsidies, the support of up to ¥25 million is provided for ICT and automation aimed at cold chain and transport optimisation.

There are opportunities for the improvement of refrigerated transport infrastructure, the use of robots to overcome the lack of manpower, and data-driven supply chains. The recent partnership between MOL Logistics and Daito Koun, which is aimed at food logistics services, is an example of the industry's efforts toward better service and growth through collaboration.

Report Coverage

This research report categorizes the market for the Japan gelatin market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan food logistics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan food logistics market.

Driving Factors

The food logistics market in Japan is driven by the demand for pre-packaged, ready-to-eat, and convenience foods in Japan, in addition to the growth of e-commerce and online grocery platforms. Government funding for supply chain modernization and food exports is also creating a wider range of opportunities to use technology and create more efficient and effective technology-enabled logistics operations in Japan. The continued importance placed on food safety, temperature-sensitive distribution, and food traceability also contributes to the growth of advanced cold-chain infrastructure. The labor shortages in the logistics industry are accelerating the adoption of automation, robotics, and digital fleet management.

Restraining Factors

The food logistics market in Japan is mostly constrained by high operational costs that are mainly caused by energy-intensive cold-chain requirements, labor shortages, and increased transportation costs. Additionally, inadequate infrastructure, strict food safety laws, and limited warehouse space in highly populated areas are other factors that hinder the scalability and efficiency of logistics operations.

Market Segmentation

The Japan food logistics market share is classified into transportation mode and service type.

- The roadways segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan food logistics market is segmented by transportation mode into roadways, railways, seaways, and airways. Among these, the roadways segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that road transportation provides the greatest flexibility, quicker delivery for short and medium distances, extensive national highway networks, and excellent suitability for last-mile and chilled food distribution. Roadways are the primary source of income since the majority of packaged and perishable food items depend on trucks for prompt, temperature-controlled delivery.

- The cold chain segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan food logistics market is segmented by service type into cold chain, and non-cold chain. Among these, the cold chain segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Japan has a significant demand for temperature-controlled storage and transportation due to its large consumption of perishable commodities, including seafood, dairy, fresh produce, and frozen meals. Reliable cold-chain systems are now the most important revenue-generating segment due to strict food safety laws, rising packaged food demand, and the growth of e-commerce grocery deliveries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan food logistics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yamato Transport Co., Ltd.

- Nippon Express Holdings, Inc.

- Nichirei Logistics Group Inc.

- Konoike Transport Co., Ltd.

- Senko Co., Ltd.

- Meito Transportation Co., Ltd.

- Best Logistics Partners Co., Ltd.

- Maruha Nichiro Corporation

- Nichirei Corporation

- Regional & Specialized 3PL Providers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Yusen Logistics Group acquired the international cold-chain ISO 31512 certification for its food low-temperature storage and transport services in the overseas market, thus granting the company a role in raising the bar for global food logistics quality standards.

- In October 2025, Nippon Express (NXHD) decided to pour money into ASEAN fresh-produce e-commerce cold-chain networks as a way to further develop and strengthen the Japan logistics firms' presence in that region.

- In August 2024, MOL Logistics and Daito Koun Co., Ltd. entered into a strategic partnership that will allow them to provide better food logistics services and to upgrade the capabilities of their warehouses at the same time.

- In June 2024, Nichirei, Ajinomoto Frozen Foods, Nissui, and Maruha Nichiro jointly announced a project aimed at bringing about a collaborative logistics system for frozen food, which will improve efficiency and help overcome the problem of labor shortage in the sector.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan food logistics market based on the below-mentioned segments:

Japan Food Logistics Market, By Transportation Mode

- Roadways

- Railways

- Seaways

- Airways

Japan Food Logistics Market, By Service Type

- Cold Chain

- Non-Cold Chain

FAQ’s

Q: What is the Japan food logistics market size?

A: Japan food logistics market size is expected to grow from USD 6.73 billion in 2024 to USD 14.34 billion by 2035, growing at a CAGR of 7.12% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the demand for pre-packaged, ready-to-eat, and convenience foods in Japan, in addition to the growth of e-commerce and online grocery platforms. Government funding for supply chain modernization and food exports is also creating a wider range of opportunities to use technology and create more efficient and effective technology-enabled logistics operations in Japan. The continued importance placed on food safety, temperature-sensitive distribution, and food traceability also contributes to the growth of advanced cold-chain infrastructure.

Q: What factors restrain the Japan food logistics market?

A: Constraints include high operational costs that are mainly caused by energy-intensive cold-chain requirements, labor shortages, and increased transportation costs.

Q: How is the market segmented by service type?

A: The market is segmented into cold chain, and non-cold chain.

Q: Who are the key players in the Japan food logistics market?

A: Key companies include Yamato Transport Co., Ltd., Nippon Express Holdings, Inc., Nichirei Logistics Group Inc., Konoike Transport Co., Ltd., Senko Co., Ltd., Meito Transportation Co., Ltd., Best Logistics Partners Co., Ltd., Maruha Nichiro Corporation, Nichirei Corporation, Regional & Specialized 3PL Providers, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 190 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |