Japan Food Safety Testing Market

Japan Food Safety Testing Market Size, Share, By Test (Allergen Testing, Chemical & Nutritional Testing, Genetically Modified Organism Testing, Microbiological Testing, Residues & Contamination Testing, And Other), By Technology (Traditional, Rapid, Convenience Based, Polymerase Chain Reaction, Immunoassay, And Chromatography & Spectrometry), By Application (Meat, Poultry & Seafood Products, Dairy Products, Processed Food, Beverages, Cereals & Grains, And Others), And Japan Food Safety Testing Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Food Safety Testing Market Size Insights Forecasts to 2035

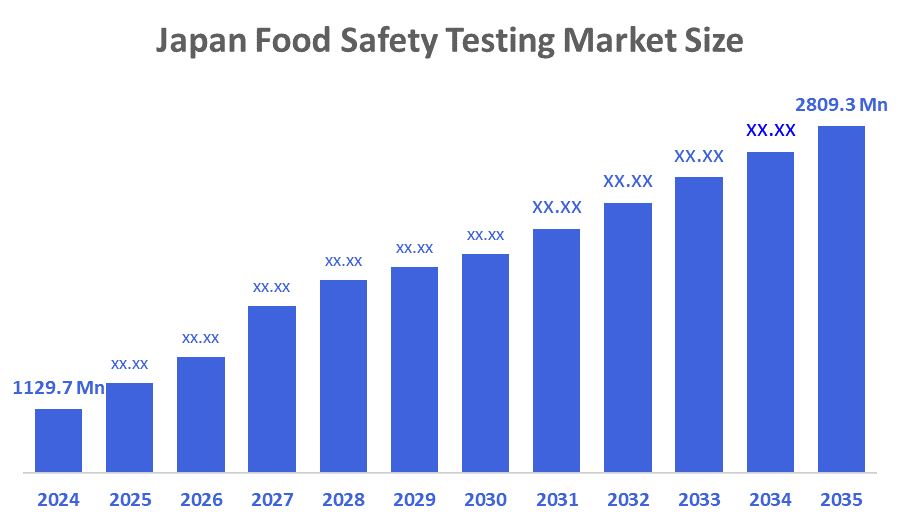

- Japan Food Safety Testing Market Size 2024: USD 1129.7 Mn

- Japan Food Safety Testing Market Size 2035: USD 2809.3 Mn

- Japan Food Safety Testing Market CAGR 2024: 8.63%

- Japan Food Safety Testing Market Segments: Test, Technology, and Application

Japan Food Safety Testing Market Size consists of the many different types of analytic services, instruments and procedures that are used to evaluate and confirm the safety, quality, and compliance of food products within Japan. Testing methods include microbiological testing, chemical testing, allergen testing, GMO Testing, residue testing, and contamination testing to identify hazards, confirm regulatory compliance, and detect foodborne illnesses or contamination-related events. This Market is Crucial for the protection of public health and helps companies and governments meet regulatory requirements. Factors driving the growth of this market include increased consumer awareness about food safety and quality issues and increased demand for safe and traceable food products, as well as the introduction of more stringent regulatory frameworks and food safety standards by Japanese authorities.

The food safety testing in Japan are backed by government support, The Ministry of Health, Labour and Welfare (MHLW) has established food safety requirements and regulations to protect the health of the public through comprehensive test and inspect processes under the Food Sanitation Act. According to Japan's food poisoning surveillance report for the previous year, there were over 1,000 reported food poisoning incidents, with approximately 14,000 victims affected. This is an indication of ongoing issues associated with food safety, and the need for a good testing and inspecting system continues to be a necessity for ensuring food safety in Japan.

As technology advances, Japanese food safety testing providers are now using new technologies, including PCR and next-generation sequencing, the process of testing for dangerous pathogens has become much easier, quicker, and more precise than ever before. At the same time, new immunoassays, biosensors, and high-performance chromatography have also improved the chemical or toxin detection process. In addition, by combining automation and AI with laboratory information management systems, laboratories now have greater productivity, less chance of human error, and the ability to conduct real-time analytics of collected data, which helps ensure quality control of test samples both in laboratories and food production facilities.

Market Dynamics of the Japan Food Safety Testing Market:

The Japan food safety testing market is driven by the increase in consumer awareness of food safety and quality, grown demand for safe and traceable food, stringent regulations and requirements for food safety, increasing concern over foodborne illness and food contamination, demand for processed and convenience food production and consumption, and expanded domestic and international food trade has led to a need for increased testing protocols for food products.

The Japan food safety testing market is restrained by the high operating costs for expensive testing equipment, need for skilled workers to operate, complex regulations and compliance requirements, fragmented demand across multiple testing segments, difficulties in harmonizing food safety standards between countries, and pressure from customers to ensure that laboratories incorporate new contaminants into their testing methods on an ongoing basis.

The future of Japan's food safety testing market is bright and promising, with versatile opportunities emerging from the new portable and rapid on-site-test devices development and commercialised for near real-time results, growth in the area of imported food testing services, as well as in the implementation of blockchain and other digital traceability platforms to improve transparency in the food supply chain, an increase in the amount of testing done for allergens, organic and non-GMO Products, environmental contaminants and will grow partnerships between producers of food, testing laboratories and technology companies to co-develop solutions to meet evolving regulatory and consumer needs.

Market Segmentation

The Japan Food Safety Testing Market share is classified into test, technology, and application.

By test:

The Japan food safety testing market is divided by test into allergen testing, chemical & nutritional testing, genetically modified organism testing, microbiological testing, residues & contamination testing, and other. Among these, the microbiological testing segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Stringent food safety rules, making it essential for compliance with standards like HACCP, high public health risk, consumer demand, and unique food culture all contribute to the microbiological testing segment's largest share and higher spending on food safety testing when compared to other test.

By technology:

The Japan food safety testing market is divided by technology into traditional, rapid, convenience based, polymerase chain reaction, immunoassay, and chromatography & spectrometry. Among these, the traditional segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The traditional segment dominates because of established reliability for identifying microorganisms, widely accepted by regulations, versatile and cost effective technology, and extensive used across food processing.

By application:

The Japan food safety testing market is divided by application into meat, poultry, & seafood products, dairy products, processed food, beverages, cereals & grains, and others. Among these, the meat, poultry, & seafood products segment accounted for the highest share in 2024 and is predicted to grow at a significant CAGR over the projected period. High risk of contamination associated with animal products, strict regulatory standards, strong demand in coastal areas, and rigorous safety testing to prevent foodborne illness all contribute to the meat, poultry, & seafood products segment's dominance and higher spending on food safety testing when compared to other application.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan food safety testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Food Safety Testing Market:

- Eurofins Scientific

- SGS AG

- Intertek Group PLC

- Merieux NutriSciences

- TUV SUD

- ALSV Food & Pharmaceutical

- Biosero Inc.

- IDEXX Laboratories

- Food & Drug Safety Centre

- Nelson Laboratories

- Shimadzu Corp.

- Asahi Kasei Microdevices

- Thermo Fisher Scientific

- Others

Recent Developments in Japan Food Safety Testing Market:

In September 2025, Shimadzu Corporation released two new i-Series HPLC Analysers for food safety testing designed for rapid and high-sensitivity testing of controlled components like mycotoxins and synthetic antimicrobials in food raw materials.

In June 2025, the final version of the positive list system for plastics used in food contact materials came into effect, following a transitional period. This required that only approved substances be used, necessitating rigorous testing for chemical migration and heavy metals using methods like Atomic Absorption Spectroscopy and Inductively Coupled Plasma Mass Spectrometry.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan food safety testing market based on the below-mentioned segments:

Japan Food Safety Testing Market, By Test

- Allergen Testing

- Chemical & Nutritional Testing

- Genetically Modified Organism Testing

- Microbiological Testing

- Residues & Contamination Testing

- Others

Japan Food Safety Testing Market, By Technology

- Traditional

- Rapid

- Convenience Based

- Polymerase Chain Reaction

- Immunoassay

- Chromatography & Spectrometry

Japan Food Safety Testing Market, By Application

- Meat, Poultry, & Seafood Products

- Dairy Products

- Beverages

- Cereals & Grains

- Others

FAQ

Q: What is the Japan food safety testing market size?

A: Japan food safety testing Market is expected to grow from USD 1129.7 million in 2024 to USD 2809.3 million by 2035, growing at a CAGR of 8.63% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the increase in consumer awareness of food safety and quality, grown demand for safe and traceable food, stringent regulations and requirements for food safety, increasing concern over foodborne illness and food contamination, demand for processed and convenience food production and consumption, and expanded domestic and international food trade has led to a need for increased testing protocols for food products.

Q: What factors restrain the Japan food safety testing market?

A: Constraints include the high operating costs for expensive testing equipment, need for skilled workers to operate, complex regulations and compliance requirements, fragmented demand across multiple testing segments, difficulties in harmonizing food safety standards between countries, and pressure from customers to ensure that laboratories incorporate new contaminants into their testing methods on an ongoing basis.

Q: How is the market segmented by test?

A: The market is segmented into allergen testing, chemical & nutritional testing, genetically modified organism testing, microbiological testing, residues & contamination testing, and others.

Q: Who are the key players in the Japan food safety testing market?

A: Key companies include Eurofins Scientific, SGS AG, Intertek Group PLC, Merieux NutriSciences, TUV SUD, ALSV Food & Pharmaceutical, Biosero Inc., IDEXX Laboratories, Food & Drug Safety Centre, Nelson Laboratories, Shimadzu Corp., Asahi Kasei Microdevices, Thermo Fisher Scientific, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 179 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |