Japan General Surgical Devices Market

Japan General Surgical Devices Market Size, Share, And COVID-19 Impact Analysis, By Product Type (Surgical Sutures, Surgical Staplers, Surgical Scalpels, Surgical Retractors), By Application (Hospitals, Ambulatory Surgery Centres, Speciality Clinics) And, By Geographic Region (Kanto Region, Kansai Region, Chubu Region, Kyushu Region). Scope And Forecast. The Japan General Surgical Devices Market Insights, Industry Trend Forecasts To 2035.

Report Overview

Table of Contents

Japan General Surgical Device Market Insights Forecasts to 2035

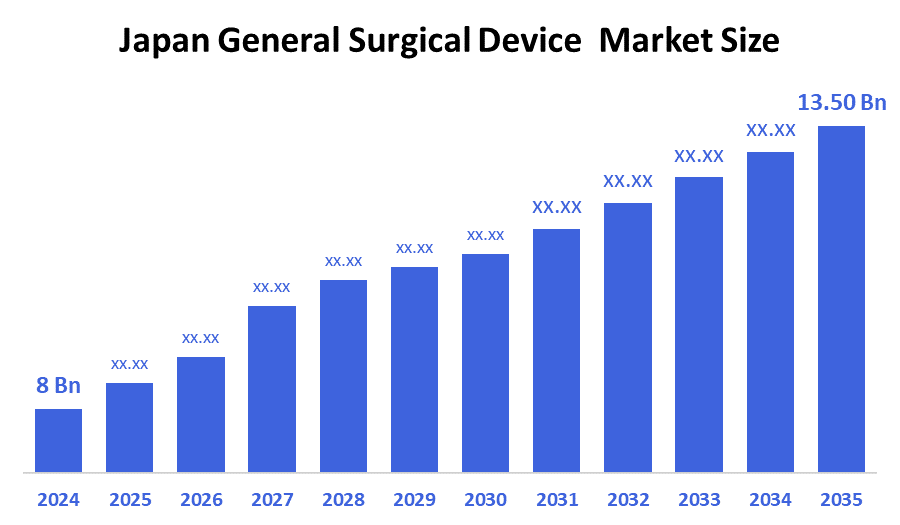

- The Japan General Surgical Devices Market Size Was Estimated at USD 8 Billion In 2024.

- The Market Size is Expected to Grow at a CAGR of Around 4.87% from 2025 to 2035.

- The Japan General Surgical Devices Market Size is Expected to Reach USD 13.50 Billion by 2035.

According to a research report published by decision advisor & Consulting, the Japan General Surgical Devices Market size is predicted to reach USD 13.50 billion by 2035, growing at a CAGR of 4.87% from 2025 to 2035. The Japan general surgical devices market is driven by continuous rapid device innovation (robotics, AI, 4k/8k imaging), age-driven escalation in surgical volumes, Remote-proctoring reimbursement, and accelerating adoption.

Market Overview

The Japan general surgical devices market includes every reusable or single-use instrument or powered platform whose primary intent is to cut, dissect, seal, or provide access during open or minimally invasive procedures performed in Japan hospitals, ambulatory surgical centres, and speciality clinics. This definition bundles handheld instruments, laparoscopic sets, electrosurgical generators, wound-closure consumables, trocars, and robotic or computer-assisted systems. The Japan general surgical devices market is driven by continuous rapid device innovation (robotics, AI, 4k/8k imaging), age-driven escalation in surgical volumes, Remote-proctoring reimbursement, and accelerating adoption.

Growing health awareness, rising demand for low-calorie alternatives, expanding food and beverage industry, urbanisation, changing consumer preferences, and increasing diabetic population drive growth. General surgical devices are instruments utilised in various surgical procedures across medical facilities in Japan. These devices are designed to assist surgeons in performing precise incisions, closures, and tissue manipulation during surgical interventions. Furthermore, these instruments are essential for maintaining surgical site sterility, ensuring procedural accuracy, and promoting optimal patient outcomes in traditional and minimally invasive surgeries.

Report Coverage

This research report categorises the market for the Japan general surgical devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan bath soap market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan general surgical devices market.

Driving Factors

Rapid device innovation like robotics, AI, 4k/8k imaging, age-driven escalation in surgical volumes, Remote-proctoring reimbursement, and accelerating adoption. Growing health awareness, rising demand for low-calorie alternatives, expanding food and beverage industry, urbanisation, changing consumer preferences, and increasing diabetic population drive growth.

Restraining Factors

- High Device Costs: Premium surgical devices and advanced surgical technologies are associated with significant costs. The high pricing of sophisticated surgical instruments is presenting a challenge for smaller healthcare facilities and is impacting market growth.

- Regulatory Compliance: Strict regulatory requirements are imposed for surgical device approval in Japan. Complex and time-consuming approval processes are affecting the introduction of new surgical devices to the market and are increasing compliance-related costs.

- Healthcare Labour Shortages: Japan is experiencing a shortage of skilled healthcare professionals. The limited availability of trained surgical staff is affecting the optimal utilisation of advanced surgical devices and impacting market expansion.

Market Segmentation

The Japan general surgical devices market share is categorized into product type and application.

- The surgical suture devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan general surgical devices market is segmented by product type into surgical sutures, surgical staplers, surgical scalpels, surgical retractors and others. Among these, the surgical sutures segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven due to surgical sutures are widely used across a range of specialities, from general surgery to orthopaedics, owing to their versatility and effectiveness in promoting healing. The increasing number of surgical procedures and the advancement in suture materials, such as biodegradable and antimicrobial options, further support the dominance of this segment. While Surgical Staplers and other devices are crucial in specific procedures, Surgical Sutures remain the most commonly used and essential device in the market.

- The hospital segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan general surgical devices market is segmented by Application into hospitals, ambulatory surgery centres and speciality clinics. Among these, the hospital segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven due to the hospitals are equipped with advanced surgical facilities and have a high volume of patients requiring surgical interventions, driving the demand for surgical devices. Additionally, the continuous advancements in hospital infrastructure and surgical technology contribute to the growth of this segment. While Ambulatory Surgery Centres and Speciality Clinics play important roles in specific surgeries, the comprehensive services and resources available in hospitals ensure their market dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan general surgical devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Olympus Corporation

- MANI, Inc.

- M A Corporation

- GUNZE Limited

- Nipro Corporation

- ShinMedico Inc.

- FUN company: Fuji?Flex Co., Ltd.

- Yasui Co., Ltd.

- Takashima Sangyo Co., Ltd.

- Charmant Group Medical Division

- Gadelius Medical K.K.

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2025, Juntendo University Hospital and Intuitive Surgical agreed to open Japan’s first da Vinci Total Program Observation Site to train multi-department teams and expand robotic surgery capacity.

- In May 2024, OrthAlign launched its Lantern navigation system in Japan through its longstanding distribution partner, adding to the orthopaedic digital toolkit.

- In April 2024, Asensus Surgical signed a lease deal with Sendai Tokushukai Hospital for a Senhance Surgical System, marking continued placement of digital-laparoscopy consoles.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. decision advisor has segmented the Japan general surgical devices Market based on the following segments.

Japan General Surgical Devices Market, By Product Type

- Surgical sutures

- Surgical Staplers

- Surgical Scalpels

- Surgical Retractors

- Others

Japan General Surgical Devices Market, By Application

- Ambulatory Surgery Centres

- Speciality Clinics

FAQ.

Q. What is the current size of the Japan general surgical devices market?

A. The Japan general surgical devices market was valued at USD 8 billion in 2024 and is projected to reach USD 13.50 billion by 2035, growing at a CAGR of 4.87% from 2025 to 2035.

Q. Which segment dominates the Japan general surgical devices market?

A. The surgical sutures segment dominates the market due to its essential role in wound closure, broad clinical use, and continuous advancements in suture materials such as biodegradable and antimicrobial variants.

Q. Which application segment holds the largest market share in 2024?

A. The hospital segment holds the largest share in 2024, driven by a high volume of complex and emergency surgeries and continuous investment in advanced surgical technologies.

Q. Which region leads the Japan general surgical devices market?

A. The Kanto Region leads the market owing to its dense population, advanced healthcare infrastructure, and concentration of top-tier hospitals and surgical centres, including those in Tokyo.

Q. Who are the key players in the Japan general Surgical devices market?

A. Major Players include Olympus Corporation, Terumo Corporation, Nipro Corporation, MANI, Inc., M A Corporation, GUNZE Limited, ShinMedico Inc., Fuji Flex Co., Ltd., Yasui Co., Ltd., and Charmant Group Medical Division.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 191 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |