Japan Hospital Bed Market

Japan Hospital Bed Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Electric Beds, Semi-Electric Beds, and Manual Beds), By Application (Acute Care, Long-Term Care, Psychiatric Care, Maternity Care, and Home Care), By End Users (Hospital, Clinics, and Ambulatory), and Japan Hospital Bed Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Hospital Bed Market Size Insights Forecasts to 2035

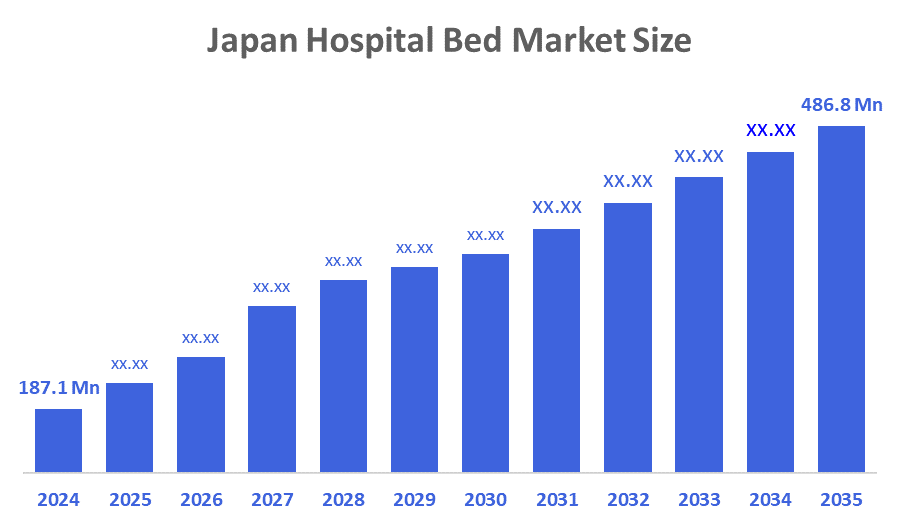

- The Japan Hospital Bed Market Size Was Estimated at USD 187.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.08% from 2025 to 2035

- The Japan Hospital Bed Market Size is Expected to Reach USD 486.8 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Hospital Bed Market Size is anticipated to Reach USD 486.8 Million by 2035, Growing at a CAGR of 9.08% from 2025 to 2035. The Hospital Bed market in Japan is driven by the expansion of the aging population, which is causing the continuous increase in adoption of advanced healthcare technologies.

Market Overview

Hospital beds are uniquely designed medical beds that enable a patient to stay comfortable, secure, and supported during hospitalization or extended care. Hospital beds typically consist of height adjustment, head and foot positioning, side rails, wheels, and electronic operation. The government in Japan has invested in public health initiatives, facilitating the demand for more modern hospital beds. In addition, facilities have surged to understand infection control since the pandemic, which has led to innovative hospital bed designs utilizing materials that are easy to sanitize. Consequently, this evolution demonstrates a lively, evolutionary hospital bed market in Japan that incoming's technological advances and public social needs. Real-time patient monitoring is made possible by investing in smart hospital beds that integrate technology, such as data analytics and Internet of Things connections, to take advantage of prospects in the Japanese hospital bed market. Manufacturers now have the chance to work with tech firms to develop integrated solutions as health institutions place more emphasis on enhancing patient outcomes and operational effectiveness. There are also indications of a shift towards modular and space-efficient designs of beds, which will be able to fit into the confined spaces in urban hospitals. Along with that, recent changes in healthcare legislation have highlighted the need for patient-centered care and raised expectations for beds to have more than basic functionality.

Report Coverage

This research report categorizes the market for the Japan hospital bed market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan hospital bed market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan hospital bed market.

Driving Factors

The hospital bed market in Japan is driven by a rapidly aging population, which has led to a higher prevalence of chronic diseases and a longer length of stay in hospitals. The modernization of healthcare infrastructure, along with the government’s funding to upgrade medical facilities and improve long-term care, also propels market growth. Rapid advancements in technology, particularly with smart beds that facilitate more effective patient monitoring and comfort, drive up adoption rates. Additionally, rising patient demands for increased accommodation while in care and improving the recovery phase are extremely pertinent in driving growth alongside the focus on improving access to care and efficiency within the healthcare spectrum.

Restraining Factors

The hospital bed market in Japan is restrained by the strict regulatory approval, high advanced bed costs, reimbursement restrictions, personnel difficulties, oversupply in some areas, infrastructural limitations, a fragmented market with tiny hospitals, low profit margins, and a sluggish transition to home-care models.

Market Segmentation

The Japan hospital bed market share is classified into product type, application, and end users.

- The electric beds segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hospital bed market is segmented by product type into electric beds, semi-electric beds, and manual beds. Among these, the electric beds segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Electric beds reduce manual labor for nurses, allow for adjustable positioning, and help prevent pressure ulcers and falls. As a result of incentives to care facilities to implement new healthcare and assistive medical equipment, electric beds are being installed at increasing frequencies.

- The acute care segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hospital bed market is segmented by application into acute care, long-term care, psychiatric care, maternity care, and home care. Among these, the acute care segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Acute Care category is essential because it provides care for patients requiring it right away, highlighting the need for adaptable, high-tech beds that facilitate quick recovery and effective treatment plans.

- The hospitals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hospital bed market is segmented by end users into hospitals, clinics, and ambulatory. Among these, the hospitals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The main end consumers of specialized and sophisticated beds are hospitals. Strong demand is driven by Japan's extensive network of public and private hospitals, high rates of patient admission, and ongoing investments in the upgrading and replacement of medical infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan hospital bed market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Paramount Bed Co., Ltd.

- France Bed Co., Ltd.

- Nippon Steel Corporation

- Stryker Corporation

- Seahonence, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, for better supply chain resilience and quicker delivery to healthcare facilities across the globe, Stryker Corporation made a large investment in increasing its hospital bed production capacity to meet growing global demand, especially in critical care facilities.

- In October 2024, to speed up recovery, minimize issues from extended bed rest, and enable early patient motion following surgery, Paramount Bed Holdings unveiled its next-generation hospital bed with mobility aid features.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Hospital Bed market based on the below-mentioned segments:

Japan Hospital Bed Market, By Product Type

- Electric Beds

- Semi-Electric Beds

- Manual Beds

Japan Hospital Bed Market, By Application

- Acute Care

- Long-Term Care

- Psychiatric Care

- Maternity Care

- Home Care

Japan Hospital Bed Market, By End Users

- Hospital

- Clinics

- Ambulatory

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 251 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |