Japan Hydrochloric Acid Market

Japan Hydrochloric Acid Market Size, Share, and COVID-19 Impact Analysis, By Grade Type (Synthetic Grade, and By-product Grade), By End User (Food and Beverages, Pharmaceuticals, Textile, Steel, Oil and Gas, Chemical Industry, and Others), and Japan Hydrochloric Acid Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Hydrochloric Acid Market Size Insights Forecasts to 2035

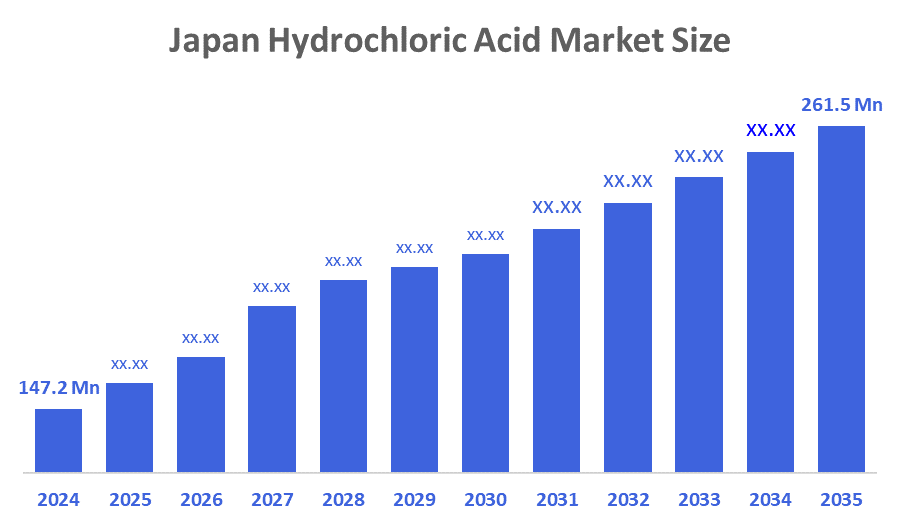

- The Japan Hydrochloric Acid Market Size Was Estimated at USD 147.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.36% from 2025 to 2035

- The Japan Hydrochloric Acid Market Size is Expected to Reach USD 261.5 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Hydrochloric Acid Market Size is anticipated to Reach USD 261.5 Million by 2035, Growing at a CAGR of 5.36% from 2025 to 2035. The hydrochloric acid market in Japan is driven by rising demand in water treatment, pharmaceuticals, and manufacturing, supported by stricter environmental regulations, technological advancements, and growing adoption of sustainable production methods across industrial applications.

Market Overview

The hydrochloric acid market encompasses the manufacture, distribution, and application of hydrochloric acid (HCl), a powerful inorganic acid that is frequently utilized in industrial processes. Water treatment, chemical production, pharmaceuticals, food processing, steel pickling, and numerous refining operations are all included in this market. In 2024, Japan’s elderly population reached 36.25 million, nearly one-third of the total. Rising healthcare demand, driven by aging demographics and advancements in medical technology, is increasing hydrochloric acid use in pharmaceuticals, including injectable formulations and medical equipment production, making HCl essential for high-quality healthcare products. The government of Japan provides financing for water infrastructure improvements, subsidies for pollution control equipment, and restrictions on industrial wastewater treatment to assist the hydrochloric acid business.

For instance, funds given to manufacturing facilities to construct neutralization and pH control systems increase the amount of HCl used in treatment procedures, indirectly increasing the demand for hydrochloric acid across the country. Many technological innovations now exist that increase efficiency and reduce waste, including high-purity electronic-grade HCl and acid recovery systems. Opportunities for growth exist within pharmaceutical production, semiconductor fabrication, and in the corrosion protection of metals (i.e., pickled metals). Finally, an increasing number of chemical facilities in Japan are implementing recycling-based HCl systems to reduce their waste and carbon footprint.

Report Coverage

This research report categorizes the market for the Japan hydrochloric acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan hydrochloric acid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan hydrochloric acid market.

Driving Factors

The hydrochloric acid market in Japan is driven by industrial wastewater treatment needs. HCl is primarily used in industrial wastewater treatment processes to control pH levels and neutralise pollutants. Increased HCl usage is being driven by increased growth in chemical processing, metals treatment, and the electronics industry, as well as government regulations promoting stricter compliance with environmental regulations and investment in water infrastructure improvements, leading to continued demand for HCl. The new emerging uses for HCl will create long-term growth in this industry, including increased usage of HCl in pharmaceuticals, food processing, and the production of resins.

Restraining Factors

The hydrochloric acid market in Japan is mostly constrained by regulations related to the safe handling and storage of chemical products, high prices associated with specialized corrosion-resistant equipment, and competitor products that are safer or less hazardous than HCl. The continued downturn in specific heavy industries continues to result in declining levels of large-scale HCl consumption.

Market Segmentation

The Japan hydrochloric acid market share is classified into grade type and end user.

- The synthetic grade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hydrochloric acid market is segmented by grade type into synthetic grade and by-product grade. Among these, the synthetic grade segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because Japan's main industries, pharmaceuticals, electronics, food processing, and the production of high-precision chemicals, need high-purity HCl, which is only available in synthetic grade. Compared to by-product grade, which is mostly utilized for lower purity industrial operations, its constant quality, controlled production, and appropriateness for regulated applications create stronger demand.

- The chemical industry segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hydrochloric acid market is segmented by end user into food and beverages, pharmaceuticals, textile, steel, oil and gas, chemical industry, and others. Among these, the chemical industry segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that HCl is frequently utilized in the development of resin, PVC, pH control procedures, and numerous organic and inorganic chemical reactions. Large, steady volumes of hydrochloric acid are needed due to Japan's robust chemical processing base, which gives this segment the largest revenue share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan hydrochloric acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shin?Etsu Chemical Co., Ltd.

- Tosoh Corporation

- Sumitomo Chemical Co., Ltd.

- Mitsui Chemicals, Inc.

- Nankai Chemical Co., Ltd.

- AIR WATER INC.

- Mitsubishi Gas Chemical Company, Inc.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Kishida Chemical Co., Ltd.

- Toagosei Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In January 2025, Toagosei raised its HCl selling prices (varied by packaging: factory, stock-point, poly-can) effective February 1, 2025, citing tighter supply due to manufacturing restructuring and higher raw materials, logistics, labor, and fixed costs.

- In December 2024, Tokuyama Corporation announced a price increase of 15 yen/kg for hydrochloric acid (effective Jan. 1, 2025), citing higher feedstock and logistics costs.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan hydrochloric acid market based on the below-mentioned segments:

Japan Hydrochloric Acid Market, By Grade Type

- Synthetic Grade

- By-product Grade

Japan Hydrochloric Acid Market, By End User

- Food and Beverages

- Pharmaceuticals

- Textile

- Steel

- Oil and Gas

- Chemical Industry

- Others

FAQ’s

Q: What is the Japan hydrochloric acid market size?

A: Japan hydrochloric acid market size is expected to grow from USD 147.2 million in 2024 to USD 261.5 million by 2035, growing at a CAGR of 5.36% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by industrial wastewater treatment needs. HCl is primarily used in industrial wastewater treatment processes to control pH levels and neutralise pollutants. Increased HCl usage is being driven by increased growth in chemical processing, metals treatment, and the electronics industry, as well as government regulations promoting stricter compliance with environmental regulations and investment in water infrastructure improvements, leading to continued demand for HCl.

Q: What factors restrain the Japan hydrochloric acid market?

A: Constraints include the regulations related to the safe handling and storage of chemical products, high prices associated with specialized corrosion-resistant equipment, and competitor products that are safer or less hazardous than HCl.

Q: How is the market segmented by end user?

A: The market is segmented into food and beverages, pharmaceuticals, textile, steel, oil and gas, the chemical industry, and others.

Q: Who are the key players in the Japan hydrochloric acid market?

A: Key companies include Shin?Etsu Chemical Co., Ltd., Tosoh Corporation, Sumitomo Chemical Co., Ltd., Mitsui Chemicals, Inc., Nankai Chemical Co., Ltd., AIR WATER INC., Mitsubishi Gas Chemical Company, Inc., Tokyo Chemical Industry Co., Ltd. (TCI), Kishida Chemical Co., Ltd., Toagosei Co., Ltd., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 195 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |