Japan Hydroelectric Power Market

Japan Hydroelectric Power Market Size, Share, and COVID-19 Impact Analysis, By Type of Hydroelectric Plant (Large Hydroelectric Plants, Small Hydroelectric Plants, and Micro Hydroelectric Plants), By Component (Turbines, Generators, Transformers, and Control Systems), and Japan Hydroelectric Power Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Hydroelectric Power Market Insights Forecasts to 2035

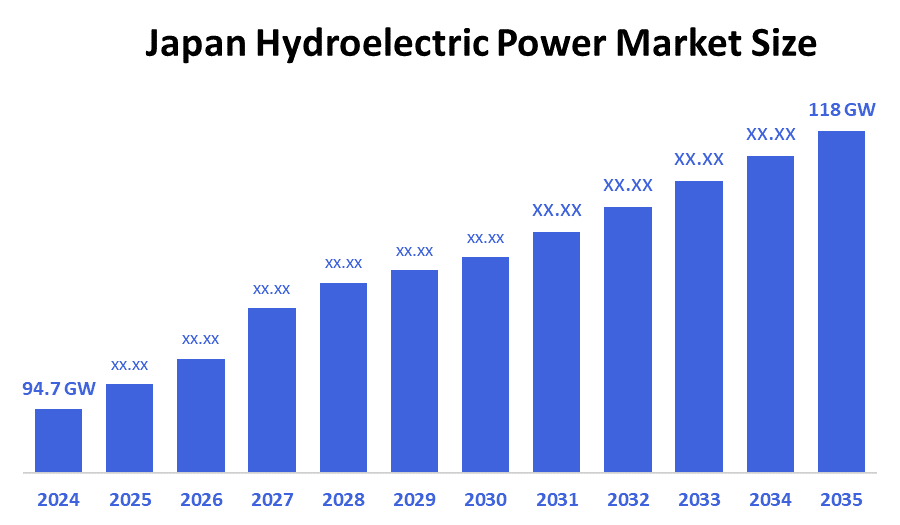

- The Japan Hydroelectric Power Market Size Was Estimated at 94.7 GW in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.04% from 2025 to 2035

- The Japan Hydroelectric Power Market Size is Expected to Reach 118.3 GW by 2035

According to a research report published by decision advisor & Consulting, the Japan Hydroelectric Power market size is anticipated to reach 118.3 GW by 2035, growing at a CAGR of 2.04% from 2025 to 2035. The hydroelectric power market in Japan is driven by strong renewable energy policies, energy security needs, environmental pressures, and technological upgrades, alongside national goals to cut fossil fuel dependence.

Market Overview

The hydroelectric power industry is a field that generates electricity from the potential and kinetic energy of water that flows or falls continuously, utilizing water turbines and generators. The sector encompasses the building, functioning, and upkeep of hydropower installations, which involve initiatives concerning large dams, small hydro systems, and pumped storage. The market also includes relevant technology provision, equipment supply, grid integration solutions, and services to provide consistent and non-emission electricity to consumers in a renewable energy market. Japan's hydroelectric market benefits from strong renewable energy policies, energy security efforts, and carbon-neutral goals for 2050. The government supports hydropower through NEDO-funded projects that help improve plant flexibility and upgrade aging plants, and incentives under the Feed-in Tariff program for small to medium hydro projects. Performance improvements are also driven through technology, including high-efficiency turbines, digital monitoring, and repowering of old plants. Interest in pumped storage expansion, run-of-river micro hydro, and repower projects is increasing. Recent events include Japan's desire to update hydro assets and new government R&D calls seeking to improve hydropower's ability to balance the grid.

Report Coverage

This research report categorizes the market for the Japan hydroelectric power market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan hydroelectric power market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan hydroelectric power market.

Driving Factors

The hydroelectric power market in Japan is driven by a comprehensive commitment from the national government to decarbonize the energy system and improve energy security. The national policy encourages investment in renewables, including hydropower, and modernization of existing generation resources, including hydropower resources. The national policy aims to meet the country's future energy demands by optimizing resources in Japan, providing greater grid stability, and providing more flexible generation to be paired with intermittent renewable energy sources. Technological improvements such as high-efficiency turbines, digital monitoring, and repowering of existing resources improve performance and operational efficiency. Further, with Japan's continuing commitment to low-carbon energy resources, hydroelectric generation remains an important part of Japan's long-term commitment to an energy transition.

Restraining Factors

The hydroelectric power market in Japan is mostly constrained by the limited availability of new suitable dam sites, expensive construction and upgrade costs, and lengthy environmental approvals. In addition, aging infrastructure, complex maintenance practices, and public concern over ecosystem effects slow the development of projects.

Market Segmentation

The Japan hydroelectric power market share is classified into type of hydroelectric plant and components.

- The large hydroelectric plants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hydroelectric power market is segmented by type of hydroelectric plants into large hydroelectric plants, small hydroelectric plants, and micro hydroelectric plants. Among these, the large hydroelectric plants segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because Japan has a well-established fleet of sizable hydroelectric facilities that contribute the largest percentage of installed capacity and energy generation, this segment dominates. Additionally, large plants have excellent grid balancing capabilities, lower generation costs per unit, and higher efficiency, all of which are crucial for integrating expanding solar and wind output.

- The turbines segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan hydroelectric power market is segmented by components into turbines, generators, transformers, and control systems. Among these, the turbines segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because they are the primary component that transforms water flow into mechanical energy, turbines are the most valuable and frequently upgraded component of hydro plants, accounting for the largest revenue share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan hydroelectric power market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- J-POWER / Electric Power Development Co., Ltd.

- Tokyo Electric Power Company (TEPCO)

- Chubu Electric Power Co., Inc.

- Tohoku Electric Power Co., Inc.

- Hokuriku Electric Power Company

- Hokkaido Electric Power Co., Inc.

- Japan Hydro-power Development, Inc.

- JNC Corporation

- Mori to Mizu no Chikara Co., Ltd.

- Hitachi-Mitsubishi Hydro Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2025, Renewable Matsukawa, Japan's first self-developed 965 kW run-of-river plant, is scheduled to go into commercial operation under FIT in September 2025.

- In February 2025, Unit 2 of Tohoku Electric Power's nearly 100-year-old Miyanohara plant was repowered, increasing generation by about 8%.

- In February 2024, using upgraded equipment to maximize efficiency, Hokkaido Electric Power and Mitsubishi Corporation started the Ainuma-uchi hydropower plant in Yakumo, Hokkaido, for commercial operation.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. decision advisor has segmented the Japan hydroelectric power market based on the below-mentioned segments:

Japan Hydroelectric Power Market, By Type of Hydroelectric Plant

- Large Hydroelectric Plants

- Small Hydroelectric Plants

- Micro Hydroelectric Plants

Japan Hydroelectric Power Market, By Component

- Turbines

- Generators

- Transformers

- Control Systems

FAQ’s

Q: What is the Japan hydroelectric power market size?

A: Japan hydroelectric power market size is expected to grow from 94.7 GW in 2024 to 118.3 GW by 2035, growing at a CAGR of 2.04% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by a comprehensive commitment from the national government to decarbonize the energy system and improve energy security. The national policy encourages investment in renewables, including hydropower, and modernization of existing generation resources, including hydropower resources. The national policy aims to meet the country's future energy demands by optimizing resources in Japan, providing greater grid stability, and providing more flexible generation to be paired with intermittent renewable energy sources.

Q: What factors restrain the Japan hydroelectric power market?

A: Constraints include the limited availability of new suitable dam sites, expensive construction and upgrade costs, and lengthy environmental approvals.

Q: How is the market segmented by component type?

A: The market is segmented into turbines, generators, transformers, and control systems.

Q: Who are the key players in the Japan hydroelectric power market?

A: Key companies include J-POWER / Electric Power Development Co., Ltd., Tokyo Electric Power Company (TEPCO), Chubu Electric Power Co., Inc., Tohoku Electric Power Co., Inc., Hokuriku Electric Power Company, Hokkaido Electric Power Co., Inc., Japan Hydro-power Development, Inc., JNC Corporation, Mori to Mizu no Chikara Co., Ltd., and Hitachi-Mitsubishi Hydro Corporation.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 188 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |