Japan Industrial Heaters Market

Japan Industrial Heaters Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Pipe Heaters, Immersion Heaters, Duct Heaters, Cartridge Heaters, and Circulation Heaters), By End User (Chemical, Oil and Gas, Plastic, and Food and Beverages), Japan Industrial Heaters Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Industrial Heaters Market Insights Forecasts to 2035

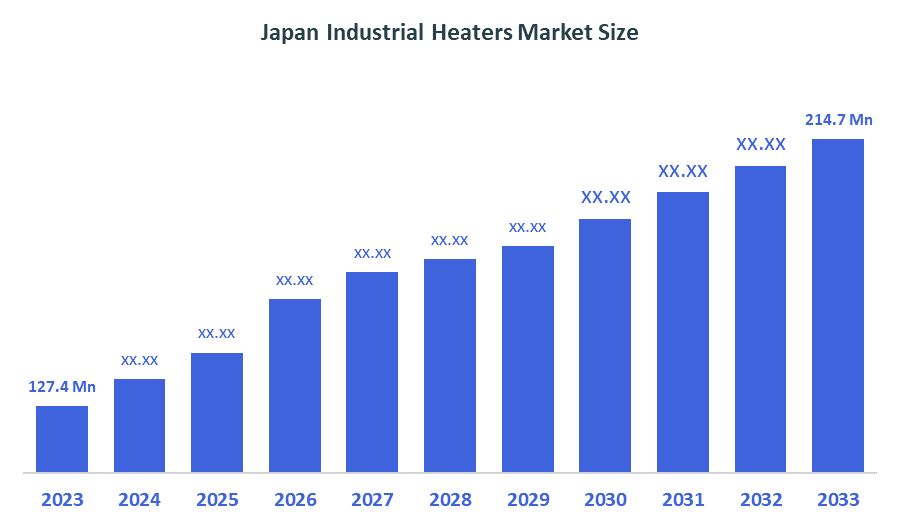

- The Japan Industrial Heaters Market Size Was Estimated at USD 127.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.86% from 2025 to 2035

- The Japan Industrial Heaters Market Size is Expected to Reach USD 214.7 Million by 2035

According to a Research Report Published by Decision Advisiors & Consulting, the Japan industrial heaters market size is anticipated to reach USD 214.7 million by 2035, growing at a CAGR of 4.86% from 2025 to 2035. The industrial heaters market in Japan is driven by Rising automation, expansion in the production of semiconductors and electronics, growing need for energy-efficient heating, stringent quality standards, and continuous improvements in industrial processes and temperature-control systems.

Market Overview

The industrial heaters market is defined as a market that produces and provides heating devices that are used for Industrial processes to regulate temperatures, support production, enhance Efficiency, and maintain the quality of the finished product across various industries, including chemical, electronic, manufacturing, food processing, and energy. Steady growth in Japan's industrial heater market is being fueled by a growing demand for automation throughout the manufacturing, semiconductor, and electronic industries, which require precise control of temperature to produce high-performance products. Japan supports the industrial heaters market through strong funding and policy incentives. METI’s Energy Conservation Subsidy provides up to JPY 10 million for adopting efficient heating systems, while NEDO’s ¥30.41 billion Green Innovation Fund backs low-carbon thermal technologies. The national ¥20 trillion GX strategy further accelerates investment in advanced, energy-efficient industrial heating solutions. Combined with these incentives are advancements in technologies such as smart heaters, IoT-enabled remote monitoring systems, and high-efficiency electric and infrared heater systems. The market is witnessing emerging trends around renewable energy, integration of heating systems into the production of electric vehicles (EVs), and semiconductor manufacturing. Examples of recent activity include increased investment into environmentally friendly industrial heating products, upgrades to existing facilities to improve energy efficiency, and joint ventures between manufacturers based in Japan and global providers of thermal technology.

Report Coverage

This research report categorizes the market for the Japan industrial heaters market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan industrial heaters market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan industrial heaters market.

Driving Factors

The industrial heaters market in Japan is driven by an increasing need for more efficient heaters. The growth of semiconductor & electronics manufacturing is leading to an increase in requirements for accurate temperature control through thermal regulation. Automation solutions are also becoming more popular due to labour shortages. The increased adoption of industrial heaters within these growing sectors will help maintain consistent product quality. Moreover, the continuous implementation of high-quality, low-emission technologies via government initiatives like Green Transformation (GX) and energy-saving incentives is anticipated to create additional growth prospects for the industrial heater market in Japan

Restraining Factors

The industrial heaters market in Japan is mostly constrained by high initial installation costs, stringent safety and emissions regulations, and escalating electricity prices. Short supply of qualified technicians trained in advanced heating technologies, along with long replacement cycles, continues to limit the adoption of industrial heater systems among smaller to medium-sized businesses.

Market Segmentation

The Japan industrial heaters market share is classified into product type and end user.

- The immersion heaters segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan industrial heaters market is segmented by product type into pipe heaters, immersion heaters, duct heaters, cartridge heaters, and circulation heaters. Among these, the immersion heaters segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Immersion heaters are crucial to Japan's chemical, food processing, pharmaceutical, and electronics sectors because they provide great thermal efficiency, quick heating, and accurate temperature control. Their greater market share is driven by their capacity to heat liquids directly with little energy loss and the growing use of automated process heating systems.

- The chemical segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan industrial heaters market is segmented by end user into chemical, oil and gas, plastic, and food and beverages. Among these, the chemical segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the fact that reactions, distillation, drying, and material treatment all require exact and constant temperature control during chemical processing. Japan has the biggest market share for dependable, energy-efficient industrial heaters due to its robust chemical manufacturing base, growing expenditures in specialty chemicals, and stringent quality and safety regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan industrial heaters market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Heater Co., Ltd.

- RYOYU Industrial Corp.

- YAC Denko Co., Ltd.

- ThreeHigh Co., Ltd.

- Inductotherm Group Japan Co., Ltd.

- Taikisha Global Ltd.

- Sanden Corporation

- Furukawa Electric Co., Ltd.

- Panasonic Electric Works Co., Ltd.

- Morito Electric Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April 2025, the Japanese Government announced their renewal of the Energy Conservation and Non-Fossil Energy Transition public call for applications. These grants will support manufacturing companies that invest in energy-efficient heating systems, process electrification, or the conversion away from fossil fuels. The subsidy will support up to 2/3 of expenses for Small and Medium-sized Enterprises (SMEs) or up to 1/2 of the expenses for large companies, and the total price limit is ¥1.5B per year, per project.

- In May 2024, the Ministry of Economy, Trade and Industry (METI), and Agency for Natural Resources and Energy (ANRE), and the New Energy and Industrial Technology Development Organization (NEDO) released a new Technology Strategy for Energy Efficiency and Transition to Non-Fossil Energy 2024, which will provide guidelines for promoting new energy-efficient and non-fossil energy through the promotion of energy efficiency and transition away from non-fossil energy.

- In December 2023, MHI Thermal Systems won the Energy Conservation Center, Japan (Awarded through METI) for converting their old steam boiler into an industrial heat pump and received recognition by the Government and Institutions for the conversion of old steam heating systems to more efficient, new industrial heating systems.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Japan industrial heaters market based on the below-mentioned segments:

Japan Industrial Heaters Market, By Product Type

- Pipe Heaters

- Immersion Heaters

- Duct Heaters

- Cartridge Heaters

- Circulation Heaters

Japan Industrial Heaters Market, By End User

- Chemical

- Oil and Gas

- Plastic

- Food and Beverages

FAQ’s

Q: What is the Japan industrial heaters market size?

A: Japan Industrial Heaters market size is expected to grow from USD 127.4 million in 2024 to USD 214.7 million by 2035, growing at a CAGR of 4.86% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by an increasing need for more efficient heaters. The growth of semiconductor & electronics manufacturing is leading to an increase in requirements for accurate temperature control through thermal regulation. Automation solutions are also becoming more popular due to labour shortages. The increased adoption of industrial heaters within these growing sectors will help maintain consistent product quality.

Q: What factors restrain the Japan industrial heaters market?

A: Constraints include high initial installation costs, stringent safety and emissions regulations, and escalating electricity prices.

Q: How is the market segmented by product type?

A: The market is segmented into pipe heaters, immersion heaters, duct heaters, cartridge heaters, and circulation heaters.

Q: Who are the key players in the Japan industrial heaters market?

A: Key companies include Nippon Heater Co., Ltd., RYOYU Industrial Corp., YAC Denko Co., Ltd., ThreeHigh Co., Ltd., Inductotherm Group Japan Co., Ltd., Taikisha Global Ltd., Sanden Corporation, Furukawa Electric Co., Ltd., Panasonic Electric Works Co., Ltd., Morito Electric Co., Ltd., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 140 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |