Japan Industrial Safety Gloves Market

Japan Industrial Safety Gloves Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Leather Gloves, Aluminized Gloves, Aramid Gloves, Disposable Gloves, Synthetic Gloves, Metal Mesh, Fabric Gloves, Coated Fabric Gloves, Chemical Protective Gloves, Rubber Insulating Gloves, and Others), By End User (Manufacturing and Construction, Oil and Gas, Transportation, Pharmaceuticals, Chemicals, Food, Mining, Agriculture, Defense and Maritime, and Others), and Japan Industrial Safety Gloves Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Industrial Safety Gloves Market Insights Forecasts to 2035

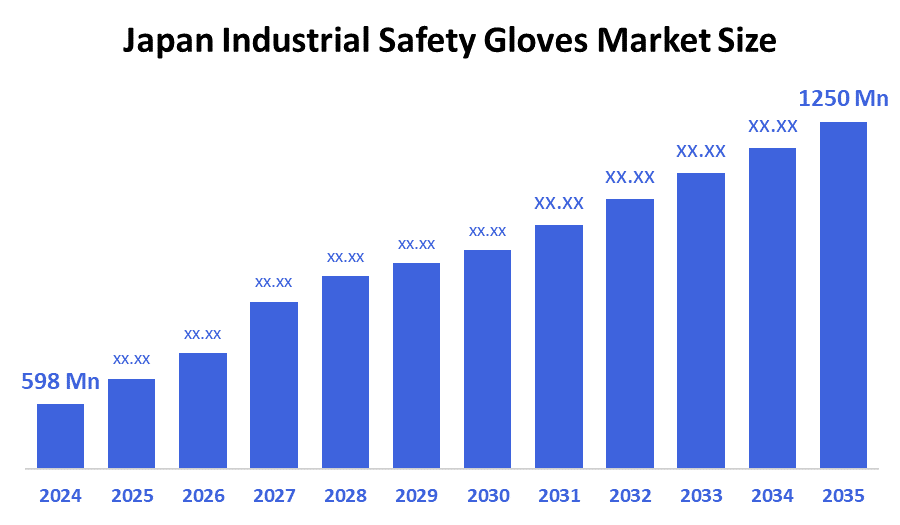

- The Japan Industrial Safety Gloves Market Size Was Estimated at USD 598 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.93% from 2025 to 2035

- The Japan Industrial Safety Gloves Market Size is Expected to Reach USD 1250 Million by 2035

According to a research report published by Spherical Insights & Consulting, the Japan Industrial Safety Gloves Market size is anticipated to reach USD 1250 million by 2035, growing at a CAGR of 6.93% from 2025 to 2035. The Japan industrial safety gloves market is driven by rising workplace safety regulations, growing manufacturing and construction activities, increasing awareness of occupational hazards, adoption of advanced protective materials, and a heightened focus on worker well-being and productivity across industries.

Market Overview

The Japan industrial safety gloves market refers to the industry focused on producing and supplying protective gloves designed to safeguard workers’ hands across various sectors. It emphasizes safety compliance, injury prevention, durability, and advanced materials to support growing industrial and occupational safety needs. The demand for industrial safety gloves in Japan is seeing notable growth within healthcare, biotechnology, and laboratory environments. These sectors require strict adherence to hygiene, contamination control, and personnel safety, driving the consistent use of disposable and chemical-resistant gloves. For instance, in October 2024, INTCO medical showcased its innovative medical consumables at medical Japan 2024 in tokyo, highlighting its focus on the Japan market. Notably, the disposable Synmax vinyl gloves drew attention for their superior durability compared to traditional gloves, marking a significant advancement in safety and comfort for medical professionals in Japan. Hospitals, diagnostic labs, pharmaceutical firms, and research institutions are increasingly relying on nitrile and latex gloves for procedures involving biological materials, hazardous substances, or sterile environments.

The COVID-19 pandemic further reinforced the importance of PPE in medical settings, creating long-term behavioral shifts and higher baseline demand. Additionally, Japan’s strong emphasis on public health and infection prevention has led to the institutionalization of glove use in both clinical and non-clinical settings. This rising adoption, supported by regulatory oversight and safety standards, is positioning healthcare and laboratory applications as a significant contributor to the country’s industrial safety gloves market growth.

Report Coverage

This research report categorizes the market for the Japan industrial safety gloves market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan industrial safety gloves market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan industrial safety gloves market.

Driving Factors

The industrial safety gloves markets in Japan are driven by increasingly advanced advancements in high-tech materials and specialised coatings that enhance protection and durability. Industries such as automotive, electronics, and chemicals require gloves with advanced properties, including high cut resistance, heat insulation, and chemical protection. Manufacturers are responding by introducing gloves made from aramid fibres, nitrile blends, and composite materials that combine strength with flexibility. Innovative coatings improve grip, tactile sensitivity, and resistance to oils and solvents, making gloves suitable for precision work in demanding environments.

For instance, in May 2023, Japan TOWA Corporation unveiled its new nano finish coating technology for industrial gloves at the London Safety & Health Expo. The innovation enhances grip and flexibility for dry applications. Currently offered on general-purpose gloves, the company aims to expand this technology to cut, thermal, and chemical-resistant gloves in the future.

Restraining Factors

The industrial safety gloves market in Japan is restrained by high product costs, limited awareness in smaller industries, availability of low-cost alternatives, fluctuating raw material prices, and slower adoption of advanced protective technologies in traditional sectors.

Market Segmentation

The Japan industrial safety gloves market share is categorized by product type and end user.

- The disposable gloves segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan industrial safety gloves market is segmented by product type leather gloves, aluminized gloves, aramid gloves, disposable gloves, synthetic gloves, metal mesh, fabric gloves, coated fabric gloves, chemical protective gloves, rubber insulating gloves, and others. Among these, the disposable gloves segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by developments high demand in healthcare, food processing, and electronics, driven by hygiene standards, infection control needs, convenience, and increasing use of single-use protective solutions across industries.

- The manufacturing and construction segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan industrial safety gloves market is segmented by end user into manufacturing and construction, oil and gas, transportation, pharmaceuticals, chemicals, food, mining, agriculture, defense and maritime, and others. Among these, the manufacturing and construction segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to strict safety regulations, high injury risks, expanding industrial activities, and growing investment in infrastructure, increasing the need for durable, high-performance gloves to protect workers in hazardous environments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan industrial safety gloves market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- MCR Safety

- Ergodyne

- Saf-T-Gard International, Inc

- Radians Inc.

- Protective Industrial Products, Inc

- Lakeland Industries, Inc.

- Honeywell International Inc

- Saurya

- Shamrock Manufacturing Company, Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2024, 3M announced the launch of a new line of cut-resistant gloves designed specifically for the automotive and manufacturing sectors. These gloves incorporate advanced materials that enhance grip and dexterity while providing superior protection against cuts and abrasions, addressing the growing demand for safety in high-risk environments.

- In November 2024, MCR Safety expanded its product range by introducing a new series of chemical-resistant gloves tailored for the oil and gas industry. This new line features enhanced chemical barrier properties and improved comfort for extended wear, responding to the increasing regulatory requirements in hazardous work environments.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Industrial Safety Gloves Market based on the below-mentioned segments:

Japan Industrial Safety Gloves Market, By Product Type

- Leather Gloves

- Aluminized Gloves

- Aramid Gloves

- Disposable Gloves

- Synthetic Gloves

- Metal Mesh

- Fabric Gloves

- Coated Fabric Gloves

- Chemical Protective Gloves

- Rubber Insulating Gloves

- Others

Japan Industrial Safety Gloves Market, By End User

- Manufacturing And Construction

- Oil And Gas

- Transportation

- Pharmaceuticals

- Chemicals

- Food

- Mining

- Agriculture

- Defense And Maritime

- Others

FAQ’s

Q: What is the market size of the Japan industrial safety gloves market in 2024?

A: The market size was estimated at USD 598 million in 2024.

Q: What is the expected market size by 2035?

A: The Japan industrial safety gloves market is projected to reach USD 1250 million by 2035.

Q: What is the CAGR of the market during 2025–2035?

A: The market is expected to grow at a CAGR of 6.93% from 2025 to 2035.

Q: Which product segment held the largest share in 2024?

A: The disposable gloves segment held the largest market share in 2024.

Q: Which end-user segment dominated the market in 2024?

A: The manufacturing and construction segment dominated the market in 2024.

A: What are the major factors driving market growth?

A: Key drivers include strict workplace safety regulations, rising industrial activities, advanced protective materials, and increasing awareness of occupational hazards.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 206 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |