Japan Insulin Drugs and Delivery Devices Market

Japan Insulin Drugs and Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Drugs Type (Basal or Long-Acting Insulin, Bolus or Fast-Acting Insulin, Traditional Human Insulin, Combination Insulin, Biosimilar Insulin, and Others), By Devices (Insulin Pens, Insulin Pumps, Insulin Syringes, Jet Injectors, and Others), and Japan Insulin Drugs and Delivery Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Insulin Drugs and Delivery Devices Market Insights Forecasts to 2035

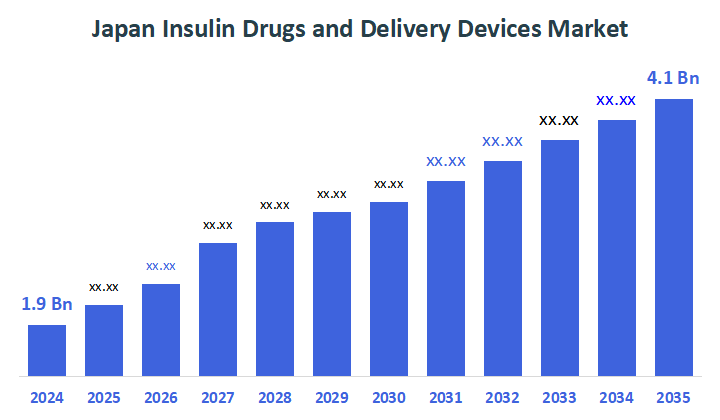

- The Japan Insulin Drugs and Delivery Devices Market Size Was Estimated at USD 1.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.24% from 2025 to 2035

- The Japan Insulin Drugs and Delivery Devices Market Size is Expected to Reach USD 4.1 Billion by 2035

According to a research report published by Decisions Advisors, the Japan Insulin Drugs and Delivery Devices Market size is anticipated to reach USD 4.1 Billion by 2035, growing at a CAGR of 7.24% from 2025 to 2035. The Japan insulin drugs and delivery devices market is driven by the growing prevalence of diabetes, the increase in age of the population, the advancements in technology and the uptake of modern insulin delivery systems has caused the rate of diabetes to increase.

Market Overview

Japan drug and therapy market for diabetes includes the sale of human insulin and other injectable medications. devices that facilitate the delivery of drugs such as pens, pumps, syringes, pen narrows with which to inject patients with medication As this market continues to grow due to an increasing aged diabetic demographic along with greater government investment into precision medicine both for the treatment of diabetes and in other critical areas there will be an even greater demand for newer methods of delivery as well as for many existing products.

The government's price regulation of pharmaceuticals takes place through a system called the National Health Insurance (NHI). A study published in 2021 by the OECD revealed that during the time of this report the mean cost of a vial of analogue insulin was $10.24 per standard unit (SU), and this amount was lower compared to those who do not have a similar type of health care coverage or government regulated prices for analogue insulin.

Self-monitoring blood glucose (SMBG) strips were given a specific MSRP (Manufacturer's Suggested Retail Price) established by the MHLW such as Yay 4000 for the first 20 uses (minimum) and Yay 5800 for the subsequent 40 (minimum). This indicates a very clear and defined dollar amount that would be used to help develop Target Pricing Agreements between manufacturers and healthcare providers.

Report Coverage

This research report categorizes the market for the Japan insulin drugs and delivery devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan insulin drugs and delivery devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan insulin drugs and delivery devices market.

Driving Factors

The insulin drugs and delivery devices markets in Japan are driven by the increasing number of people diagnosed each year with diabetes plays a major role in market growth for insulin delivery devices. In addition, a better understanding by patients and healthcare professionals alike about how diabetes is best managed through timely administration of insulin has also contributed positively towards the growing insulin delivery device market.

Also contributing to the growth of the insulin delivery device market is the growth in technological advancements by manufacturers of these devices, particularly the development of smart/electronic (connected) insulin pens and wearable insulin pumps, which enhance patient convenience and increase compliance with prescribed treatment regimens. The expected increase in diabetes patients due to an increasing aging population will continue to drive the insulin delivery device market. Lastly, based upon the rapid increase in Japan of overweight and/or obese people who lead sedentary lifestyles, type 2 diabetes is being diagnosed at an increasing rate, thereby enhancing market demand for insulin delivery devices.

Restraining Factors

The insulin drugs and delivery devices market in Japan is restrained by influencing insulin delivery device sales include the high cost of diabetes care, numerous regulatory challenges, limited reimbursement, and a preference for non-invasive.

Market Segmentation

The Japan insulin drugs and delivery devices market share is categorized by drugs type and devices.

- The basal or long-acting Insulin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan insulin drugs and delivery devices market is segmented by drugs type into basal or long-acting Insulin, bolus or fast-acting Insulin, traditional human Insulin, combination Insulin, biosimilar Insulin, and others. Among these, the basal or long-acting Insulin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by stable glucose control requirements, an increasing diabetic population, and the increasing use of convenient once daily insulin therapies.

- The insulin pens segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan insulin drugs and delivery devices market is segmented by devices into insulin pens, insulin pumps, insulin syringes, jet injectors, and others. Among these, the insulin pens segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to ease of use, accuracy of dose, portability, growing patient preference, and increasing acceptance for diabetes management.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan insulin drugs and delivery devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk

- Sanofi

- Eli Lill

- Medtronics

- Roche

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, ealth2Sync and Sanofi partnered to digitize insulin management in Japan. Both companies still have plans to extend their partnership in bringing digital therapeutic solutions to patients and healthcare professionals in Japan and other markets.

- In November 2021, Terumo Corporation, based in Japan, and the French company Diabeloop, have signed an agreement for a comprehensive strategic partnership. With this agreement, in addition to the current joint development of the AID system for Japan, they will work closely to bring Automated Insulin Delivery (AID) solutions to Europe with potential. further global expansion.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Insulin Drugs and Delivery Devices Market based on the below-mentioned segments:

Japan Insulin Drugs and Delivery Devices Market, By Drugs Type

- Basal or Long-Acting Insulin

- Bolus or Fast-Acting Insulin

- Traditional Human Insulin

- Combination Insulin

- Biosimilar Insulin

- Others

Japan Insulin Drugs and Delivery Devices Market, By Devices

- Insulin Pens

- Insulin Pumps

- Insulin Syringes

- Jet Injectors

- Others

FAQ’s

Q: What was the size of the Japan insulin drugs and delivery devices market in 2024?

A: The market was estimated at USD 1.9 billion in 2024, reflecting strong demand driven by the growing diabetic population and increasing adoption of modern insulin delivery systems.

Q: What is the expected market size by 2035?

A: The market is projected to reach USD 4.1 billion by 2035, growing at a CAGR of 7.24% from 2025 to 2035, driven by technological advancements and an aging population.

Q: Which insulin drug segment held the largest revenue share in 2024?

A: The basal or long-acting insulin segment held the largest share in 2024. Growth in this segment is due to stable glucose control requirements, the increasing diabetic population, and convenience of once-daily dosing.

Q: Which insulin delivery device dominated the market in 2024?

A: The insulin pens segment dominated the market in 2024. The growth is attributed to ease of use, dosing accuracy, portability, and increasing patient preference for pen devices over traditional syringes.

Q: What factors are driving the growth of the Japan insulin drugs and delivery devices market?

A: Key drivers include rising diabetes prevalence, aging population, increased awareness of disease management, technological advancements in insulin delivery devices, and government support for precision medicine and healthcare infrastructure.

Q: What factors are restraining the growth of the Japan insulin drugs and delivery devices market?

A: The market is restrained by high cost of diabetes care, stringent regulatory requirements, limited reimbursement coverage, and patient preference for non-invasive therapies over injectable insulin.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |