Japan Laser Processing Equipment Market

Japan Laser Processing Equipment Market Size, Share, and COVID-19 Impact Analysis, By Technology (Fiber Lasers, CO2, Solid State, and Others), By End User (Automotive, Metal and Fabrication, Electronics, Energy and Power, and Others), and Japan Laser Processing Equipment Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Laser Processing Equipment Market Insights Forecasts to 2035

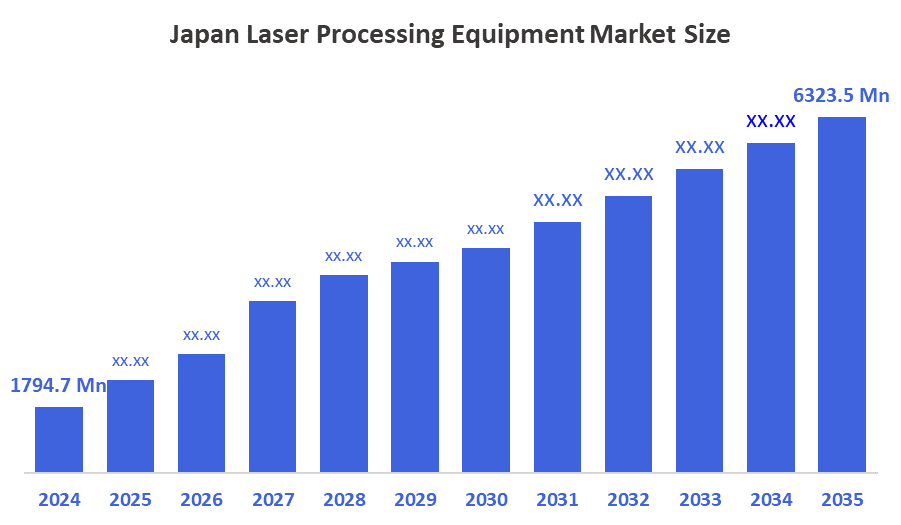

- The Japan Laser Processing Equipment Market Size Was Estimated at USD 1794.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 12.13% from 2025 to 2035

- The Japan Laser Processing Equipment Market Size is Expected to Reach USD 6323.5 Million by 2035

According to a research report published by Decision Advisors, the Japan Laser Processing Equipment Market Size is Anticipated to Reach USD 6323.5 Million by 2035, growing at a CAGR of 12.13% from 2025 to 2035. The laser processing equipment market in Japan is driven by EV-driven battery welding needs, semiconductor precision machining demand, Industry 4.0 automation, and strong manufacturing investments in advanced, high-performance laser technologies across key industries.

Market Overview

The laser processing equipment market represents the sector that produces and sells equipment and systems to cut, weld, drill, engrave, mark, or alter materials with precision using a laser. This equipment includes laser cutters, welders, engravers, and micromachining tools, in addition to automated laser workstations, utilized in the automotive, electronics and electrical, aerospace, medical, and manufacturing industries. The Japan Laser Processing Equipment Market has experienced significant growth driven by Japan's advanced manufacturing base and the increasing demand for laser equipment from the automotive, electronics, and semiconductor industries. The push towards electric vehicles is rapidly increasing investment in high-precision laser welding for batteries and light-weight components, while chip and PCB manufacturers are looking for ultrafast, high-accuracy micromachining systems. The increase in laser equipment adoption is further supported by government agencies, such as METI, NEDO, SME capital-investment subsidies, and productivity-enhancement programs. Government support includes METI and NEDO funding via the Green Innovation Fund (totaling ¥2.7564 trillion). There are also new opportunities emerging, such as a greater EV supply chain, improved semiconductor manufacturing, and modernization of SME fabrication plants across Japan.

Report Coverage

This research report categorizes the market for the Japan laser processing equipment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan laser processing equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Japan laser processing equipment market.

Driving Factors

The laser processing equipment market in Japan is driven by the rapid growth of electric vehicle production, which employs ultra-precise laser welding for battery modules and lightweight components. The semiconductor and electronics industries continue to propel the market's growth, driven by firm demand for ultrafast, high-precision micromachining capabilities. Additionally, Japan has a strong manufacturing sector that has undergone Industry 4.0 integration, which increases overall spending on automated laser systems with artificial intelligence (AI)-enabled quality monitoring. The Japanese government vigorously supports the creation of digitalization, energy efficiency, and advanced production technologies in automotive, electronics, and precision engineering industries as a culmination of investments made to accelerate the development and deployment process for laser equipment systems.

Restraining Factors

The laser processing equipment market in Japan is mostly constrained by the high capital investment required for laser systems, which limits adoption rates for small and medium-sized enterprises (SMEs). A limited workforce of skilled operators, potential complications with integrating laser technology into existing production lines, and uncertainty surrounding maintenance costs also contribute to the slow deployment of advanced laser systems. Furthermore, the semiconductor demand has cycles that can slow investment into equipment for a time.

Market Segmentation

The Japan laser processing equipment market share is classified into technology and end user.

The fiber lasers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan laser processing equipment market is segmented by technology into fiber lasers, CO2, solid state, and others. Among these, the fiber lasers segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. They are perfect for high-precision applications in semiconductors, electronics, metal fabrication, and automotive EV components because of their exceptional beam quality, long operating life, low maintenance needs, and excellent energy economy.

- The automotive segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan laser processing equipment market is segmented by end user into automotive, metal and fabrication, electronics, energy and power, and others. Among these, the automotive segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rapid transition to electric vehicles (EVs), which necessitate high-precision laser welding for battery packs, motor components, and lightweight aluminum parts, and Japan's robust automotive manufacturing base are the main drivers of this leadership. In order to achieve stringent quality, safety, and efficiency criteria, automakers now significantly rely on laser cutting, drilling, and labeling.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan laser processing equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amada Co., Ltd.

- Yamazaki Mazak Corporation

- Sumitomo Heavy Industries, Ltd.

- Laser Systems, Inc.

- Disco Corporation

- Lasertec Corporation

- Japan Laser Corporation

- LaserX Co., Ltd.

- Konica Minolta, Inc.

- Hamamatsu Photonics K.K.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April 2025, researchers at Tokyo University employed a deep UV laser to drill sub-10 µm high aspect ratio holes in glass substrates for next-generation semiconductors, all in the effort to significantly reduce the chemical waste associated with drilling.

- In April 2024, AMADA Co., Ltd. officially merged operations with AMADA Weld Tech to consolidate and expand the company's laser welding operations.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Japan laser processing equipment market based on the below-mentioned segments:

Japan Laser Processing Equipment Market, By Technology

- Fiber Lasers

- CO2

- Solid State

- Others

Japan Laser Processing Equipment Market, By End User

- Automotive

- Metal and Fabrication

- Electronics

- Energy and Power

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |