Japan Medical Examination Lights Market

Japan Medical Examination Lights Market Size, Share, and COVID-19 Impact Analysis, By Product Type (LED Examination Lights and Halogen Examination Light), By Mounting Type (Wall-Mounted, Ceiling-Mounted, Mobile/Floor-Standing, Head Lights / Lamps / Clamp-On, and Combination), By Application (General Examination, Gynecological Examination, Dental Examination, ENT Examination, Dermatology, and Others), and Japan, Medical Examination Lights Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Medical Examination Lights Market Insights Forecasts to 2035

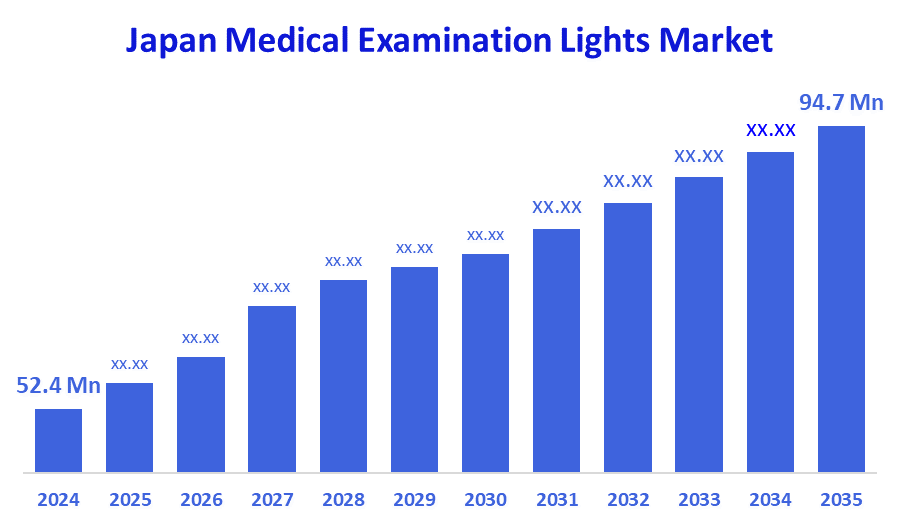

- The Japan Medical Examination Lights Market Size Was Estimated at USD 52.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.53% from 2025 to 2035

- The Japan Medical Examination Lights Market Size is Expected to Reach USD 94.7 Million by 2035

According to a research report published by Spherical Insights & Consulting, the Japan Medical Examination Lights Market Size is Anticipated to Reach USD 94.7 Million by 2035, growing at a CAGR of 5.53% from 2025 to 2035. The Japanese medical examination light market is expanding due to the aging population of Japan and higher needs for advanced diagnostic and surgical light, a focus on innovation in smart and energy-efficient LED lighting technology, a strong healthcare system with a focus on precision and safety, and government incentives for upgrading medical infrastructure.

Market Overview

The Japanese medical examination lights market refers to the manufacturing and supply of specialized lighting equipment utilized in medical facilities to produce intense, focused light in instances of medical examinations and operations. These lights improve visibility for proper diagnosis and treatment, usually utilized in clinics, hospitals, and diagnostic centers. The growth in the market is fueled by higher investments in healthcare infrastructure, rising demand for sophisticated medical equipment, and an aging population that needs frequent medical attention. Market strengths are Japan's developed health system, technological innovation in LED lighting, and a stringent focus on patient protection and hygiene. Market opportunities exist in the incorporation of smart lighting systems, energy-saving LED solutions, and the development of healthcare facilities in rural areas. In March 2024, Japan's METI unveiled the Medical Device Industry Vision 2024, which aimed at increasing the global presence of Japan's medical device industry through collaboration and innovation overseas, developing and promoting the use of advanced technologies such as medical examination lights.

Report Coverage

This research report categorizes the market for Japan medical examination lights market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan medical examination lights market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan medical examination lights market.

Driving Factors

The Japanese medical examination lights market is dominated by growing demand for energy-efficient LED lighting, government incentives for hospital modernization, expanding use of smart IoT-based lighting systems, and rising focus on improving patient care and infection prevention. Government reforms streamlining device approvals and continuous healthcare infrastructure investments also stimulate market growth.

Restraining Factors

The Japanese medical examination lights market is hindered by high up-front expenses of advanced lighting solutions, strict rules and regulations, low awareness in smaller hospitals, and compatibility issues with current hospital infrastructure.

Market Segmentation

The Japan medical examination lights market share is classified into product type, mounting type, and application.

- The LED examination lights segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan medical examination lights market is segmented by product type into LED examination lights and halogen examination light. Among these, the LED examination lights segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. LED lighting dominates due to energy efficiency, extended lifespan, less heat, and improved lighting quality, which improves medical examination accuracy. Their modifiable brightness, color temperature, and suitability for portable and intelligent healthcare systems boost demand in hospitals, outpatient facilities, and home care environments.

- The mobile/floor-standing segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan medical examination lights market is segmented by mounting type into wall-mounted, ceiling-mounted, mobile/floor-standing, head lights/lamps / clamp-on, and combination. Among these, the mobile/floor-standing segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their versatility, mobility, and affordability, perfect for hospitals, clinics, and emergency treatment. Their convenient repositioning eliminates fixed systems, while increased home healthcare, field missions, and disaster relief drive demand for portable, battery-powered, lightweight models.

- The general examination segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan medical examination lights market is segmented by application into general examination, gynecological examination, dental examination, ENT examination, dermatology, and others. Among these, the general examination segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This predominates with increased clinical evaluation in hospitals, clinics, and emergency centers. Their widespread application in diagnostics, affordability, simple installation, and low maintenance requirements render them indispensable for primary care, with demand increasing from preventive medicine and aging populations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan medical examination lights market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- STERIS

- Getinge

- Stryker

- FUJIFILM Corporation

- Burton Medical

- GE Healthcare

- Koninklijke Philips N.V.

- Hoya Corporation

- Nichia Corporation

- Yamada Shadowless Lamp Co., Ltd.

- Draeger

- Others

Recent Developments

- In September 2024, Stryker launched its 1788 Advanced Imaging Platform in India. This innovative system supports multiple specialties, offering enhanced imaging capabilities to improve surgical visualization and patient outcomes, reinforcing Stryker’s legacy in medical technology innovation.

- In January 2025, Grand Medical launched the GM300D LED examination lamp with adjustable brightness, beam angles, and color temperature, offering energy efficiency and advanced features to support diverse medical procedures and improve patient care.

- In November 2024, Stryker launched the Oculan Lighting Platform, offering consistent, high-quality illumination to enhance visibility in operating rooms, helping surgeons overcome visual challenges and maintain precision, accuracy, and efficiency during critical surgical procedures.

- In January 2024, Nichia, the leading LED manufacturer, commercialized the NFSWL11A-D6 chip-scale LED, offering horizontal light distribution and advancing high-brightness blue and white LED technology.

- In January 2024, Getinge launched the Maquet Ezea surgical light, designed for ease of use, durability, and alignment with evolving OR risk management standards, supporting the essential needs of surgical staff.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan medical examination lights market based on the below-mentioned segments:

Japan Medical Examination Lights Market, By Product Type

- LED Examination Lights

- Halogen Examination Light

Japan Medical Examination Lights Market, By Mounting Type

- Wall-Mounted

- Ceiling-Mounted

- Mobile/Floor-Standing

- Head Lights / Lamps / Clamp-On

- Combination

Japan Medical Examination Lights Market, By Application

- General Examination

- Gynecological Examination

- Dental Examination

- ENT Examination

- Dermatology

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |