Japan Mobile Phone Insurance Market

Japan Mobile Phone Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage Type (Physical Damage, Electronic Damage, Virus Protection, Data Protection, and Theft Protection), By Distribution Channel (Mobile Operators, Device OEMs, Retailers, Online, and Others), and Japan Mobile Phone Insurance Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Mobile Phone Insurance Market Size Insights Forecasts to 2035

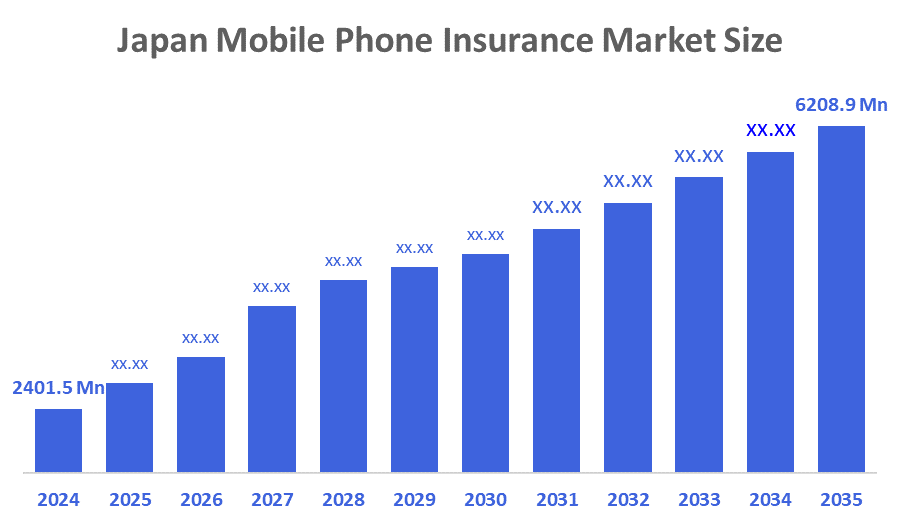

- The Japan Mobile Phone Insurance Market Size Was Estimated at USD 2401.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.02% from 2025 to 2035

- The Japan Mobile Phone Insurance Market Size is Expected to Reach USD 6208.9 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Mobile Phone Insurance Market Size is anticipated to Reach USD 6208.9 Million by 2035, Growing at a CAGR of 9.02% from 2025 to 2035. The mobile phone insurance market in Japan is driven by high smartphone penetration, rising purchases of premium devices, greater consumer focus on device protection, increasing reliance on mobile services across demographics, and the growth of digital, app-based insurance solutions with faster, personalized claims and support.

Market Overview

The mobile phone insurance market, companies offer consumers coverage for unexpected events (e.g., theft, loss, or accidental breakage), giving them peace of mind and financial security. Companies that provide coverage for mobile phones are often telecoms, insurers, manufacturers, and retailers, and their objective is to help consumers avoid spending money to repair or replace their mobile phones, allowing them to use their phones continuously. Japan's Mobile Phone Insurance market is poised for significant growth due to the rapid increase in smartphone ownership and the continued trend of purchasing premium flagship devices, which results in maximizing the appeal of mobile phone insurance to mitigate the risk of loss, theft, or damage. According to the National Police Agency, internet and phone scams in Japan increased by 8.3% in 2023, reaching 19,033 cases, the highest number in ten years. Finally, the two emerging technologies of insurers and carriers using digital technologies (e.g., Mobile apps for registration, claims processing, etc.) are providing consumers with an increase in the level of convenience to make it easier to purchase mobile phone insurance and consequently obtain higher volumes. Therefore, this convergence of high premium device values, consumer behaviour, and technology-driven insurance provision will lead to continued expansion opportunities for mobile phone insurance in Japan.

Report Coverage

This research report categorizes the market for the Japan mobile phone insurance market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan mobile phone insurance market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan mobile phone insurance market.

Driving Factors

The mobile phone insurance market in Japan is driven by the use of high-end smartphones is growing rapidly, creating an increased level of risk associated with damage and/or theft, which drives insurance adoption. Consumers becoming more aware of risk-related issues, such as theft and accidental damage, are driving consumer purchases of insurance to protect their devices. The availability of digital insurance issues, flexible plan options, and the ability to bundle insurance options with other products offered by carriers and retailers has created an easier environment for consumers to purchase insurance coverage.

Restraining Factors

The mobile phone insurance market in Japan is mostly constrained because most consumers are still not completely aware of the various benefits offered by mobile insurance and view premiums as an unnecessary expense. Mobile insurance policies typically have complicated and lengthy terms, do not cover gradual damages (e.g., no wear and tear, etc.), and/or have very complex and tedious claims processes, which result in a large number of consumers being discouraged from purchasing insurance.

Market Segmentation

The Japan mobile phone insurance market share is classified into coverage type and distribution channel.

- The physical damage segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan mobile phone insurance market is segmented by coverage type into physical damage, electronic damage, virus protection, data protection, and theft protection. Among these, the physical damage segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to accidental drops, screen cracks, and liquid damage account for the majority of claims in Japan's mobile phone insurance market, and because high-end gadget repairs and replacements are expensive, physical damage coverage is crucial.

- The mobile operators segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan mobile phone insurance market is segmented by distribution channel into mobile operators, device OEMs, retailers, online, and others. Among these, the mobile operators segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to they combine insurance with service contracts, make invoicing and renewals simple, and use their sizable subscriber base to encourage high adoption at the point of device purchase, mobile operators control the majority of the mobile phone insurance industry in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan mobile phone insurance market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NTT Docomo

- Asurion Japan Holdings G.K.

- Rakuten Mobile, Inc.

- Sompo Japan Insurance Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In March 2025, the nation's first embedded insurance solution within Buy Now, Pay Later (BNPL) platforms was introduced by Smartpay Corporation in collaboration with Chubb Insurance Japan. By incorporating digital, real-time, and customized insurance solutions into the payment process, this effort seeks to modernize Japan's traditional, paper-based insurance industry. Mobile phone insurance is one of the many industries that the embedded insurance model is intended to cover.

- In March 2024, Bolttech launched "Back Up," an integrated device protection service, in collaboration with the refurbished equipment marketplace Back Market. This product offers free data recovery services in addition to covering for mobile phone breakage, corrosion, and liquid damage. By lowering electronic waste, it promotes sustainability and increases the lifespan of reconditioned electronics.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan mobile phone insurance market based on the below-mentioned segments:

Japan Mobile Phone Insurance Market, By Coverage Type

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

Japan Mobile Phone Insurance Market, By Distribution Channel

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

FAQ’s

Q: What is the Japan mobile phone insurance market size?

A: Japan mobile phone insurance market size is expected to grow from USD 2401.5 million in 2024 to USD 6208.9 million by 2035, growing at a CAGR of 9.02% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the use of high-end smartphones is growing rapidly, creating an increased level of risk associated with damage and/or theft, which drives insurance adoption. Consumers becoming more aware of risk-related issues, such as theft and accidental damage, are driving consumer purchases of insurance to protect their devices.

Q: What factors restrain the Japan mobile phone insurance market?

A: Constraints include that most consumers are still not completely aware of the various benefits offered by mobile insurance and view premiums as an unnecessary expense.

Q: How is the market segmented by source type?

A: The market is segmented into physical damage, electronic damage, virus protection, data protection, and theft protection.

Q: Who are the key players in the Japan mobile phone insurance market?

A: Key companies include NTT Docomo, Asurion Japan Holdings G.K., Rakuten Mobile, Inc., Sompo Japan Insurance Inc., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 157 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |