Japan Neuromorphic Chip Market

Japan Neuromorphic Chip Market Size, Share, and COVID-19 Impact Analysis, By Offering Type (Hardware, and Software), By End User (Aerospace and Defense, IT and Telecom, Automotive, Medical, Industrial, Consumer Electronics, and Others), and Japan Neuromorphic Chip Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

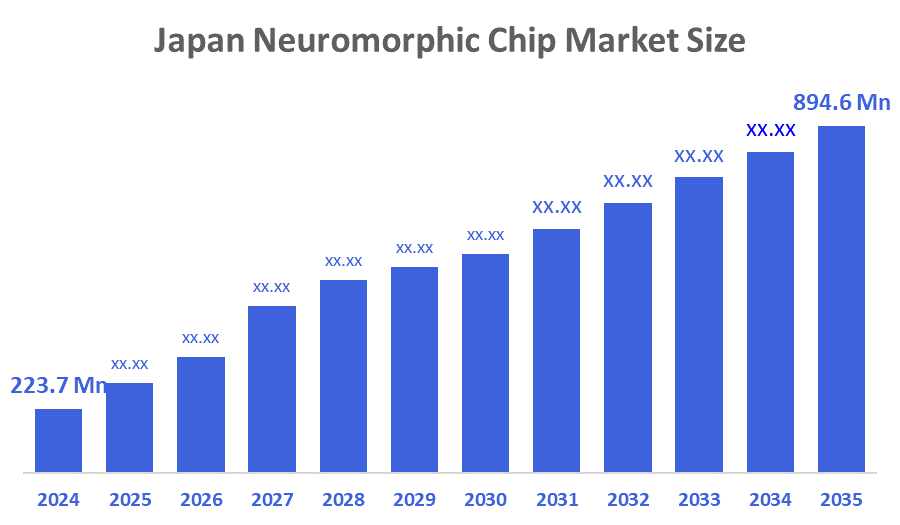

Japan Neuromorphic Chip Market Size Insights Forecasts to 2035

- The Japan Neuromorphic Chip Market Size Was Estimated at USD 223.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 13.43% from 2025 to 2035

- The Japan Neuromorphic Chip Market Size is Expected to Reach USD 894.6 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Neuromorphic Chip Market Size is anticipated to Reach USD 894.6 Million by 2035, Growing at a CAGR of 13.43% from 2025 to 2035. The neuromorphic chip market in Japan is driven by the quick uptake of edge AI, the increasing need for ultra-low-power processing in autonomous and embedded systems, and increased government and defense spending in advanced computing.

Market Overview

The neuromorphic chip market is the industry dedicated to creating and marketing processors that are structured and perform in a way that is representative of the way in which the human brain works. Japan's neuromorphic chip sector is rapidly growing as a result of increased demand for energy-efficient Artificial Intelligence (AI), edge computing, robotics, and real-time application processing. Government initiatives such as the US$65 billion semiconductor and artificial intelligence (AI) support program, along with the establishment of Rapidus and LSTC (Logistics Systems Technology Center), are supplying funds and subsidies to boost domestic research and development (R&D) and expand Japan's capacity to manufacture semiconductors. Many technology advancements are being generated through partnerships such as Fujitsu's partnership with NVIDIA to develop energy-efficient AI chips and other partnerships that are upgrading currently used supercomputing (HPC) systems, including the next-generation Fujitsu FugakuNEXT supercomputer. Areas where there is increasing opportunity for product development include edge AI, autonomous systems, industrial robotics, smart automotive, and medical applications, all of which are strongly supported by the semiconductor ecosystem in Japan. Additionally, recent activity in this market is signaling very large capital investments into next-generation supercomputing systems and government support projects, which support innovation in neuromorphic computing.

Report Coverage

This research report categorizes the market for the Japan neuromorphic chip market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan neuromorphic chip market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan neuromorphic chip market.

Driving Factors

The neuromorphic chip market in Japan is driven by the need for energy-efficient Artificial Intelligence (AI) and edge computing, and there is an increase in IoT's use of robotics and autonomous systems. Expansion of smart infrastructure, industrial automation, and real-time data processing (RTDP) applications increases the demand for neuromorphic chips. Also, government agencies have provided subsidies and research and development (R&D) funding, heard of initiatives such as Rapidus and LSTC, to promote local development of neuromorphic chips in Japan. Additionally, partnerships between companies, such as Fujitsu and NVIDIA, have developed and are fostering the enhancement of the performance of AI and high-performance computing (HPC) systems while creating new paths to deploy neuromorphic chips in various industries.

Restraining Factors

The neuromorphic chip market in Japan is mostly constrained by high R&D costs, complex hardware software integration (HSI), and an immature ecosystem. Additionally, there is limited commercial adoption of neuromorphic chips due to competition from established AI Chip vendors and a numerical standardization process that has not matured.

Market Segmentation

The Japan neuromorphic chip market share is classified into offering type and end user.

- The hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan neuromorphic chip market is segmented by offering type into hardware, and software. Among these, the hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The need for energy-efficient processors in edge AI, robotics, IoT, and real-time applications is driving the hardware segment's dominance in the Japanese neuromorphic chip industry. Since physical chips are necessary for neuromorphic computing to function, hardware makes the most money.

- The aerospace and defense segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan neuromorphic chip market is segmented by end user into aerospace and defense, it and telecom, automotive, medical, industrial, consumer electronics, and others. Among these, the aerospace and defense segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The desire for low-latency, energy-efficient AI in mission-critical applications like drones, defense robotics, and secure systems, bolstered by substantial government funding and technological requirements, drives the aerospace and defense segment's dominance of Japan's neuromorphic chip industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan neuromorphic chip market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NEC Corporation

- Fujitsu Limited

- Hitachi, Ltd.

- Renesas Electronics Corporation

- Panasonic Holdings Corporation

- Sony Corporation

- Toshiba Corporation

- Denso Corporation

- Mitsubishi Electric Corporation

- Socionext Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In August 2025, EdgeCortix recently announced that it has successfully closed the first round of its Series B financing, raising approximately ¥15 billion (around $100 million) in total (equity + government grants). This indicates the very high level of confidence that investors have in EdgeCortix's AI-chip roadmap.

- In May 2025, EdgeCortix secured a contract with the U.S. Defense Innovation Unit (DIU), making EdgeCortix the first semiconductor company in Japan to do so, thus demonstrating its increasingly important role in developing hardware for global defense-AI applications.

- In April 2025, NEDO approved Rapidus Corporation's FY2025 roadmap for R&D for 2nm generation semiconductors and chiplet/packaging technologies.

- In November 2024, EdgeCortix received a ¥4 billion grant from NEDO for the development of energy-efficient AI chiplets for next-generation communication systems beyond 5G.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan neuromorphic chip market based on the below-mentioned segments:

Japan Neuromorphic Chip Market, By Offering Type

- Hardware

- Software

Japan Neuromorphic Chip Market, By End User

- Aerospace and Defense

- IT and Telecom

- Automotive

- Medical

- Industrial

- Consumer Electronics

- Others

FAQ’s

Q: What is the Japan neuromorphic chip market size?

A: Japan neuromorphic chip market size is expected to grow from USD 223.7 million in 2024 to USD 894.6 million by 2035, growing at a CAGR of 13.43% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the need for energy-efficient Artificial Intelligence (AI) and edge computing, and there is an increase in IoT's use of robotics and autonomous systems. Expansion of smart infrastructure, industrial automation, and real-time data processing (RTDP) applications increases the demand for neuromorphic chips. Also, government agencies have provided subsidies and research and development (R&D) funding, heard of initiatives such as Rapidus and LSTC, to promote local development of neuromorphic chips in Japan.

Q: What factors restrain the Japan neuromorphic chip market?

A: Constraints include high R&D costs, complex hardware software integration (HSI), and an immature ecosystem. Additionally, there is limited commercial adoption of neuromorphic chips due to competition from established AI Chip vendors and a numerical standardization process that has not matured.

Q: How is the market segmented by end user?

A: The market is segmented into aerospace and defense, it and telecom, automotive, medical, industrial, consumer electronics, and others.

Q: Who are the key players in the Japan neuromorphic chip market?

A: Key companies include NEC Corporation, Fujitsu Limited, Hitachi, Ltd., Renesas Electronics Corporation, Panasonic Holdings Corporation, Sony Corporation, Toshiba Corporation, Denso Corporation, Mitsubishi Electric Corporation, Socionext Inc., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 147 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |