Japan Non-Destructive Testing (NDT) Market

Japan Non-Destructive Testing (NDT) Market Size, Share, By Component (Equipment, Software, Services, Consumables), By Testing Method (Ultrasonic Testing, Radiographic Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Eddy Current Testing, Visual Testing, and Others), By Technique (Traditional/Conventional, AI-Enabled), By End-User Industry (Oil & Gas, Power Generation, Aerospace, Defense, Automotive & Transportation, Manufacturing & Heavy Engineering, Construction & Infrastructure, Chemical & Petrochemical, Marine & Shipbuilding, Electronics & Semiconductor, Mining, Medical Devices, and Others), Japan NDT Market Insights, Industry Trends, Forecasts to 2035

Report Overview

Table of Contents

Japan Non-Destructive Testing (NDT) Market Size Insights, Forecasts to 2035

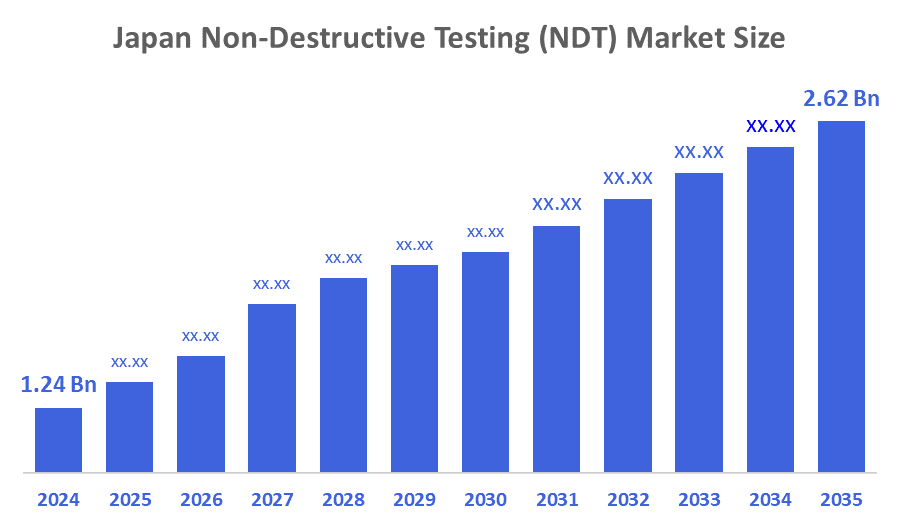

- Japan NDT Market Size 2024: USD 1.24 Billion

- Japan NDT Market Size 2035: USD 2.62 Billion

- Japan NDT Market CAGR (2025-2035): 7.04%

- Japan NDT Market Segments: Component, Testing Method, Technique, End-User Industry

The Japan Non-Destructive Testing (NDT) Market Size consists of inspection technologies and services used to evaluate the condition, safety, and performance of materials, components, and industrial assets without changing their usability. NDT is essential to Japan's high quality of manufacturing, operational safety, and regulatory compliance levels in asset, intensive industries. Japan has quality assurance frameworks and lifecycle asset management practices, in which the use of ultrasonic testing, radiographic testing, eddy, current inspection, and visual testing is standard.

NDT methods are employed extensively in aerospace maintenance, the automotive industry, power generation plants, oil and gas infrastructure, shipbuilding yards, electronics manufacturing, and semiconductor fabrication plants. The demand for NDT is mainly determined by Japan's aging industrial infrastructure, the high concentration of advanced manufacturing facilities, and the safety and quality regulations, which are strictly enforced under national industrial standards. The necessity for continuous inspections in aircraft maintenance hubs, nuclear and thermal power plants, and precision manufacturing environments, therefore, NDT utilization is at a steady level.

Technological innovation is the main factor that is opening the way for growth, as more and more automated inspection systems, digital radiography, phased, array ultrasonic testing, and AI, supported defect analysis are being adopted. Government, backed initiatives, such as smart factories, industrial digitalization, hydrogen energy development, and semiconductor manufacturing expansion, are indirectly strengthening the inspection demand. Looking forward, non-destructive testing could become the foundation for a support function through AI, enabled inspections, robotic testing, certification of materials for use with hydrogen, and advanced electronics manufacturing.

Market Dynamics of the Japan NDT Market:

The Japan NDT market is significantly influenced by the adherence to safety regulations, the aging of industrial infrastructure, and the extension of asset life in the manufacturing, energy, and transport sectors. The shift from periodic inspection to preventive and predictive maintenance is a trend across industries. There is a growing demand for ultra, precise defect detection and real, time monitoring. OEMs are focusing on quality assurance to prevent failures and recalls.

The market faces limitations due to a shortage of certified inspectors and a high training requirement. Advanced NDT instruments come with high capital and calibration costs. It is still difficult to integrate digital NDT systems with legacy infrastructure. The regulatory documentation and approval times also slow down the inspection cycles.

The market will be able to access various new opportunities in automated and robotic NDT solutions. Inspection accuracy will be improved through defect analysis using AI and digital data management. Remote inspection and inspection, as, a, service models are becoming more popular. The long, term asset integrity contracts will be the main driver of the market's sustained growth.

Market Segmentation

The Japan Non-Destructive Testing (NDT) Market share is classified into component, testing method, technique, and end-user industry.

By Component:

The Japan NDT market is divided by component into equipment, software, services, and consumables. Among these, the equipment segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The equipment segment leads the market as a consequence of the rising industrial inspections, the maintenance of the aging infrastructure, the adoption of advanced NDT systems, and the strict regulatory compliance requirements, which altogether propel continuous investments in ultrasonic, radiographic, and automated NDT equipment.

By Testing Method:

The Japan NDT market is divided by testing method into ultrasonic testing, radiographic testing, magnetic particle testing, liquid penetrant testing, eddy current testing, visual testing, and others. Among these, ultrasonic testing dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Ultrasonic testing is the leading method due to its high detection accuracy, versatility for different materials, portability, low operational risk, and a wide range of industries such as aerospace, power generation, and heavy manufacturing where it is increasingly being adopted.

By Technique:

The Japan NDT market is divided by technique into traditional/conventional and AI-enabled methods. Among these, the traditional/conventional segment dominated the share in 2024 and is anticipated to grow at a steady CAGR during the forecast period. The traditional segment is the largest one due to factors such as regulatory acceptance, the existing skilled workforce, lower implementation costs, and proven reliability for legacy industrial assets in critical inspection applications.

By End-User Industry:

The Japan NDT market is divided by end-user industry into oil & gas, power generation, aerospace, defense, automotive & transportation, manufacturing & heavy engineering, construction & infrastructure, chemical & petrochemical, marine & shipbuilding, electronics & semiconductor, mining, medical devices, and others. Among these, manufacturing & heavy engineering dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is the largest one due to factors such as stringent quality standards, export, oriented production, frequent maintenance inspections, and aging industrial infrastructure, which together result in the increased demand for high, volume NDT services.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan NDT market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in The Japan NDT market:

- Olympus Corporation

- Fujifilm Corporation

- Nikon Corporation

- Hitachi Power Solutions Co., Ltd.

- JFE Techno-Research Corporation

- Mitsui E and S Systems Research Inc.

- Eddyfi Technologies Japan K.K.

- Mistras Group K.K.

- SGS Japan Inc.

- Bureau Veritas Japan Co., Ltd.

- TÜV Rheinland Japan Ltd.

- KJTD Co., Ltd.

- Magnaflux Japan

- Sonatest Japan

- Zetec Japan Inc.

Recent Developments in The Japan NDT market:

In June 2024, The Ministry of Economy, Trade and Industry (METI) unveiled the creation and modification of several Japanese Industrial Standards (JIS) reflecting updated test methods for material quality and newly established assessment criteria. These revisions serve to standardize accredited inspection protocols and thus, increase the trustworthiness of non, destructive evaluation (NDE) methods used in the manufacturing and materials inspection industries. As a result, reliability has been enhanced, and market credibility has been progressed due to better consistency.

In October 2025, Nippon Steel Trading Corporation has secured an exclusive domestic sales agreement in Japan with Sky gauge Robotics. The companies plan to introduce non, destructive inspection drones equipped with an ultrasonic flaw detection method for high structures. The drones, as a service, enable safer, and more, efficient, infrastructure, and facility inspection, thus giving a solution to the issue of labor shortages in the sector and facilitating the spread of NDT automation in the energy, construction, and industrial sites domains.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Non-Destructive Testing (NDT) market based on the below-mentioned segments:

Japan NDT Market, By Component

- Equipment

- Software

- Services

- Consumables

Japan NDT Market, By Testing Method

- Ultrasonic Testing

- Radiographic Testing

- Magnetic Particle Testing

- Liquid Penetrant Testing

- Eddy Current Testing

- Visual Testing

- Others

Japan NDT Market, By Technique

- Traditional/Conventional

- AI-Enabled

Japan NDT Market, By End-User Industry

- Oil & Gas

- Power Generation

- Aerospace

- Defense

- Automotive & Transportation

- Manufacturing & Heavy Engineering

- Construction & Infrastructure

- Chemical & Petrochemical

- Marine & Shipbuilding

- Electronics & Semiconductor

- Mining

- Medical Devices

- Others

FAQ

Q: What is the Japan Non-Destructive Testing (NDT) market size?

A: The Japan NDT Market is expected to grow from USD 1.24 billion in 2024 to USD 2.62 billion by 2035, expanding at a CAGR of 7.04% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by aging industrial infrastructure requiring continuous inspections, the emergence of hydrogen energy and advanced electronics manufacturing, government initiatives for smart factories and industrial digitalization, and the increasing adoption of AI-based inspection systems and automated NDT solutions.

Q: What factors restrain the Japan NDT market?

A: The market is restrained by a shortage of certified inspectors, high capital and calibration costs for advanced NDT instruments, difficulties in integrating digital systems with legacy infrastructure, and lengthy regulatory approval processes that slow inspection cycles.

Q: What opportunities exist in the Japan NDT market?

A: Opportunities include automated and robotic NDT solutions, AI-driven defect analysis, digital data management, remote inspection services, and long-term asset integrity contracts supporting sustainable growth across multiple industries.

Q: How is the Japan NDT market segmented by component?

A: The market is divided into equipment, software, services, and consumables. Equipment dominates due to rising inspections, aging infrastructure maintenance, and adoption of advanced systems.

Q: How is the Japan NDT market segmented by testing method?

A: The market is divided into ultrasonic testing, radiographic testing, magnetic particle testing, liquid penetrant testing, eddy current testing, visual testing, and others. Ultrasonic testing dominates because of high detection accuracy, versatility, and industry adoption.

Q: How is the Japan NDT market segmented by technique?

A: The market is divided into traditional/conventional and AI-enabled methods. Traditional methods dominate due to regulatory acceptance, skilled workforce availability, and proven reliability in legacy industrial assets.

Q: How is the Japan NDT market segmented by end-user industry?

A: The market is divided into oil & gas, power generation, aerospace, defense, automotive & transportation, manufacturing & heavy engineering, construction & infrastructure, chemical & petrochemical, marine & shipbuilding, electronics & semiconductor, mining, medical devices, and others. Manufacturing & heavy engineering dominates due to quality standards, export-oriented production, frequent inspections, and aging infrastructure.

Q: Who are the key companies in the Japan NDT market?

A: Key companies include Olympus Corporation, Fujifilm Corporation, Nikon Corporation, Hitachi Power Solutions Co., Ltd., JFE Techno-Research Corporation, Mitsui E and S Systems Research Inc., Eddyfi Technologies Japan K.K., Mistras Group K.K., SGS Japan Inc., Bureau Veritas Japan Co., Ltd., TÜV Rheinland Japan Ltd., KJTD Co., Ltd., Magnaflux Japan, Sonatest Japan, and Zetec Japan Inc.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 178 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |