Japan Online On-Demand Home Services Market

Japan Online On-Demand Home Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Home Cleaning, Repairs and Maintenance), By Platform (Web, Mobile), and Japan Online On-Demand Home Services Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Online On-Demand Home Services Market Insights Forecasts to 2035

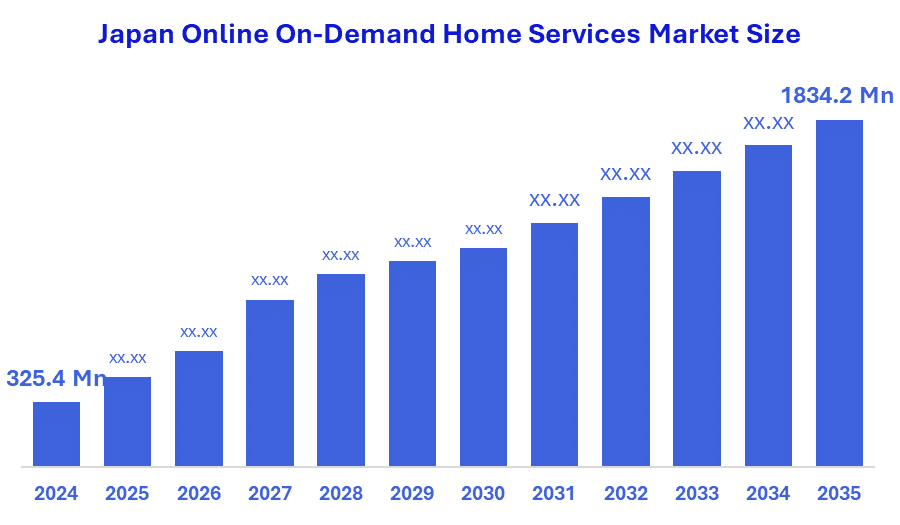

- The Japan Online On-Demand Home Services Market Size Was Estimated at USD 325.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 17.02% from 2025 to 2035

- The Japan Online On-Demand Home Services Market Size is Expected to Reach USD 1834.2 Million by 2035

According to a research report published by Spherical Insights & Consulting, The Japan Online On-Demand Home Services Market size is anticipated to reach USD 1834.2 Million by 2035, Growing at a CAGR of 17.02% from 2025 to 2035. The Japan online on-demand home services market is driven by increasing urbanization, the widespread use of smartphones and the internet, and a growing demand for convenience among consumers.

Market Overview

Online On-Demand Home Services are digital platforms, usually mobile apps or websites, that quickly link customers with nearby independent professionals who can handle a wide range of household tasks. In simple terms, they offer a fast and convenient way for users to schedule services such as cleaning, plumbing, painting, or pet care with just a few taps or clicks on their devices. In Japan, the online on-demand home services market is driven by mobile app dominance, an aging population’s need for in-home and wellness support, rising integration of IoT and AI technologies, and growing urban demand for convenience and efficiency. The growth of Japan online on-demand home services market is fueled by an aging demographic, expanding smartphone penetration, rising consumer demand for convenience amid urban lifestyles, and rapid technological innovations such as AI and IoT integration.

The Ministry of Economy, Trade and Industry (METI) conducts annual surveys on Japan’s e-commerce market, revealing overall trends in online transactions. In 2021, the B2C e-commerce segment for “household goods, furniture, and interior” recorded a high digital conversion rate of 32.58%, reflecting increasing consumer confidence in making home-related purchases online.

Report Coverage

This research report categorizes the market for the Japan online on-demand home services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan online on-demand home services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan online on-demand home services market.

Driving Factor

The driving factors for Japan's online on-demand home services market include high internet and smartphone penetration, the growing urban population with busy lifestyles, and technological advancements. At the same time, Japan’s aging society is intensifying the need for user-friendly assistive technologies and outsourced household support, such as cleaning and maintenance services.

Restraining Factor

The Japanese online on-demand home services market faces several challenges, such as workforce shortages, elevated operating costs, difficulties in establishing consumer trust due to cultural preferences for long-term relationships, and worries about the consistency, quality, and security of services.

Market Segmentation

The Japan online on demand home service market shares is categorized by type and platform.

By Type

The Japan online on demand home service market is segmented by type into home cleaning, repairs and maintenance. Among these, the home cleaning segment was the dominant segment in the online on-demand home service market in 2024 is due to strong demand arising from busy urban lifestyles, widespread adoption among diverse demographic groups such as working professionals and older adults, and the convenience of online service booking. The market continues to expand. This dominance is further reinforced by the consistent need for routine and deep cleaning, supported by professional service quality and the customer trust that digital platforms cultivate.

By Platform

The Japan online on demand home service market is segmented by platform into web and mobile. Among these, the mobile platform was dominant in Japan's online on-demand home services market in 2024 due to the widespread use of smartphones and high internet access, along with growing comfort with digital payments and online convenience. Mobile apps have become the leading and fastest-growing platform, allowing users to easily book and manage services like cleaning and home repairs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan online on demand home service market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

The Key Companies

- Rakuten

- Amazon Japan

- Mercari

- Yahoo Shopping Japan

- DMM

- Zozotown

- au PAY Market

- Muji

- i-PRO

- Panasonic

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2025: Rakuten expanded its autonomous delivery service in the Harumi, Tsukishima, and Kachidoki areas of Tokyo, marking a significant step forward in automated logistics and last-mile delivery innovation.

- In March 2024: Rakuten introduced the RMS AI Assistant on its e-commerce platform, Rakuten Ichiba, to help merchants streamline store management. The company has set ambitious plans to double the profit generated by AI by 2025.

- In August 2024: Rakuten rebranded its online grocery delivery service, previously known as Rakuten Seiyu Netsuper, to the new name "Rakuten Mart," reflecting a fresh identity and renewed focus on customer convenience.

- In March 2024: Mercari Hallo is an on-demand work-matching platform that connects individuals with short-term, hourly jobs. This initiative marks a notable expansion beyond Mercari’s core consumer-to-consumer (C2C) marketplace business.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Japan online on demand home service market based on the below-mentioned segments:

Japan Online On Demand Home Service Market, By Type

- Home Cleaning

- Repairs

- Maintenance

Japan Online On Demand Home Service Market, By Platform

- Web

- Mobile

Frequently Asked Questions (FAQs)

Q: What is the Japan online on demand home service market size?

A: Japan Online On-Demand Home Services Market size is expected to grow from USD 325.4 million in 2024 to USD 1834.2 million by 2035, growing at a CAGR of 17.02% during the forecast period 2025-2035.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Q: Who are the key players in the Japan online on demand home service market?

A: Key companies include Rakuten, Amazon Japan, Mercari, Yahoo Shopping Japan, DMM, Zozotown, au PAY Market, Muji, i-PRO, Panasonic, and Other.

Q: What factors restrain the Japan online on demand home service market?

A: The Japanese online on-demand home services market faces several challenges, such as workforce shortages, elevated operating costs, difficulties in establishing consumer trust due to cultural preferences for long-term relationships, and worries about the consistency, quality, and security of services.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |