Japan Over-The-Counter Healthcare Market

Japan Over-The-Counter Healthcare Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Analgesics and Pain Relievers, Cough, Cold, and Allergy Medications, Gastrointestinal Products, Vitamins, Minerals, and Supplements, Dermatology Products, Oral Care, and Others), By Distribution Channel (Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Retail and E-pharmacies, and Others), and Japan Over-The-Counter Healthcare Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Over-The-Counter Healthcare Market Insights Forecasts to 2035

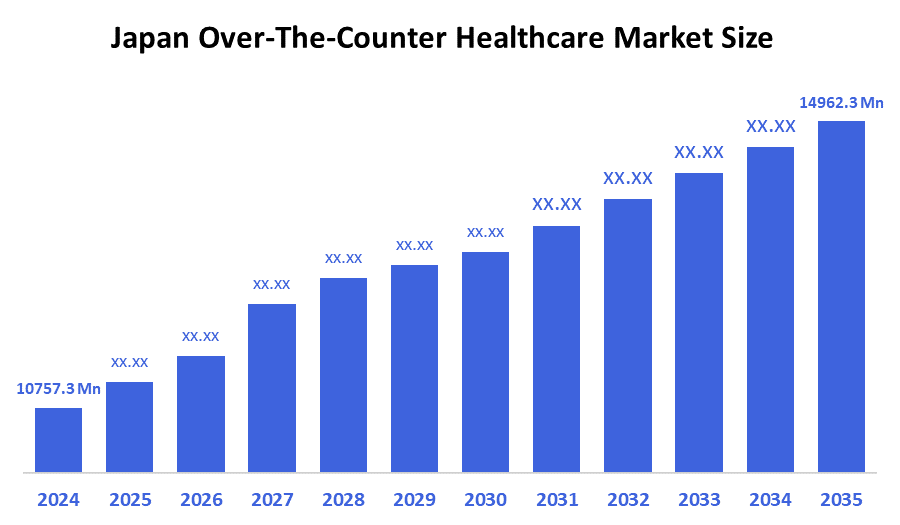

- The Japan Over-The-Counter Healthcare Market Size Was Estimated at USD 10757.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.04% from 2025 to 2035

- The Japan Over-The-Counter Healthcare Market Size is Expected to Reach USD 14962.3 Million by 2035

According to a research report published by Spherical Insights & Consulting, the Japan over-the-counter healthcare market size is anticipated to reach USD 14962.3 million by 2035, growing at a CAGR of 3.04% from 2025 to 2035. The over-the-counter (OTC) healthcare market in Japan is driven by an aging population, expanding self-medication practices, and supportive government reforms that enable wider OTC distribution through convenience stores and online pharmacist consultations, thereby boosting market adoption and accessibility.

Market Overview

The over-the-counter (OTC) healthcare market refers to healthcare products that are available to individual consumers and can be purchased without a prescription from a healthcare professional. This category includes medications, vitamins, supplements, medical devices, and personal health products that are considered safe for self-medication and used for the prevention, management, or treatment of minor health conditions. The OTC healthcare market in Japan is experiencing growth, as broad demographic trends toward an increasingly aging society and an increased preference for self-care drive demand for non-prescription medicines, supplements, and consumer healthcare devices. The market is already sizable and is expected to grow significantly in the coming years. Regulatory reform to facilitate consumer self-medication and the government facilitation of self-medication, as demonstrated by forthcoming policies for 2024-2025, will broaden access for consumers and allow for more access (e.g., expanded self-care designations for appropriate self-medication, convenience-store sale availability, and enhanced online pharmacy access). Technological advancements and product innovation, such as formulation for specific conditions, nutraceuticals, and digital health integration, will further promote consumer engagement. The growth of electronic pharmacies will add options for consumer self-medication, and retail deregulation will create commercial opportunities for manufacturers/retailers in several areas.

Report Coverage

This research report categorizes the market for the Japan over-the-counter healthcare market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan over-the-counter healthcare market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan over-the-counter healthcare market.

Driving Factors

The over-the-counter healthcare market in Japan is driven by the rapidly aging population, which perpetually fuels demand for self-care, pain relief, digestive health, and nutritional supplements. Increased healthcare costs and growing consumer preference for convenient and affordable treatment options also accelerate the consumer shift from a prescription to an over-the-counter treatment regimen. Governments are introducing supportive policies for self-medication practices; the expanded use of e-pharmacies; and more flexible regulations allowing OTC drug sales through convenience stores and online channels also support market penetration. Additionally, lifestyle-related disorders continue to drive sustained consumption of OTC products.

Restraining Factors

The over-the-counter healthcare market in Japan is mostly constrained by strict regulatory approvals, safety concerns over self-medication, and misuse risks. Limited awareness among elderly consumers regarding proper dosage and side effects, along with competition from prescription drugs, also hinders market expansion.

Market Segmentation

The Japan over-the-counter healthcare market share is classified into product type and distribution channel.

- The vitamins, minerals, and supplements segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan over-the-counter healthcare market is segmented by product type into analgesics and pain relievers, cough, cold, and allergy medications, gastrointestinal products, vitamins, minerals, and supplements, dermatology products, oral care, and others. Among these, the vitamins, minerals, and supplements segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of Japan's rapidly aging population and growing emphasis on immunity development, preventative healthcare, and nutritional supplementation, the VMS category is leading. Demand is further strengthened by growing consumer interest in convenience-based self-care, lifestyle-related disease prevention, and healthy aging.

- The pharmacies and drug stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan over-the-counter healthcare market is segmented by distribution channel into pharmacies and drug stores, supermarkets and hypermarkets, online retail and e-pharmacies, and others. Among these, the pharmacies and drug stores segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to consumers' demand for expert advice from pharmacists, particularly among senior folks, pharmacies and drug stores continue to be the major and most reliable places to make purchases. OTC dispensing through authorized pharmacies is supported by Japan's regulatory system, which promotes self-medication while guaranteeing compliance and safety.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan over-the-counter healthcare market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Taisho Pharmaceutical Co., Ltd.

- Rohto Pharmaceutical Co., Ltd.

- Hisamitsu Pharmaceutical Co., Ltd.

- Sato Pharmaceutical Co., Ltd.

- Taiho Pharmaceutical Co., Ltd.

- shiseido-ph.co.jp

- Ryukakusan Co., Ltd.

- Mochida Pharmaceutical Co., Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Daiichi Sankyo Company, Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2025, Amendments to the PMD Act in 2025 included new provisions permitting external dispensing and remote OTC drug sales in pharmacies that do not have a pharmacist on site.

- In February 2025, A PMD Act amendment was passed that would allow OTC sales at locations like convenience stores, as long as consumers could conduct an online pharmacist consultation.

- In December 2024, the Health, Labour and Welfare Ministry announced plans to draft a revision of the regulations to allow the sale of OTC drugs to be sold at convenience stores without an on-site pharmacist.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan over-the-counter healthcare market based on the below-mentioned segments:

Japan Over-The-Counter Healthcare Market, By Product Type

- Analgesics and Pain Relievers

- Cough, Cold, and Allergy Medications

- Gastrointestinal Products

- Vitamins, Minerals, and Supplements

- Dermatology Products

- Oral Care

- Others

Japan Over-The-Counter Healthcare Market, By Distribution Channel

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retail

- E-pharmacies

- Others

FAQ’s

Q: What is the Japan over-the-counter healthcare market size?

A: Japan over-the-counter healthcare market size is expected to grow from USD 10757.3 million in 2024 to USD 14962.3 million by 2035, growing at a CAGR of 3.04% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the rapidly aging population, which perpetually fuels demand for self-care, pain relief, digestive health, and nutritional supplements. Increased healthcare costs and growing consumer preference for convenient and affordable treatment options also accelerate the consumer shift from a prescription to an over-the-counter treatment regimen. Governments are introducing supportive policies for self-medication practices; the expanded use of e-pharmacies; and more flexible regulations allowing OTC drug sales through convenience stores and online channels also support market penetration.

Q: What factors restrain the Japan over-the-counter healthcare market?

A: Constraints include strict regulatory approvals, safety concerns over self-medication, and misuse risks. Limited awareness among elderly consumers regarding proper dosage and side effects, along with competition from prescription drugs, also hinders market expansion.

Q: How is the market segmented by product type?

A: The market is segmented into analgesics and pain relievers, cough, cold, and allergy medications, gastrointestinal products, vitamins, minerals, and supplements, dermatology products, oral care, and others.

Q: Who are the key players in the Japan over-the-counter healthcare market?

A: Key companies include Taisho Pharmaceutical Co., Ltd., Rohto Pharmaceutical Co., Ltd., Hisamitsu Pharmaceutical Co., Ltd., Sato Pharmaceutical Co., Ltd., Taiho Pharmaceutical Co., Ltd., shiseido-ph.co.jp, Ryukakusan Co., Ltd., Mochida Pharmaceutical Co., Ltd., Otsuka Pharmaceutical Co., Ltd., and Daiichi Sankyo Company, Limited.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 205 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |