Japan Pharmaceutical Excipients Market

Japan Pharmaceutical Excipients Market Size, Share, and COVID-19 Impact Analysis, By Type (Binders & Fillers, Disintegrants, Lubricants, Coatings, Others), By Drug Form (Oral, Injectable, Topical, Others), and Japan Pharmaceutical Excipients Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Pharmaceutical Excipients Market Insights Forecasts to 2035

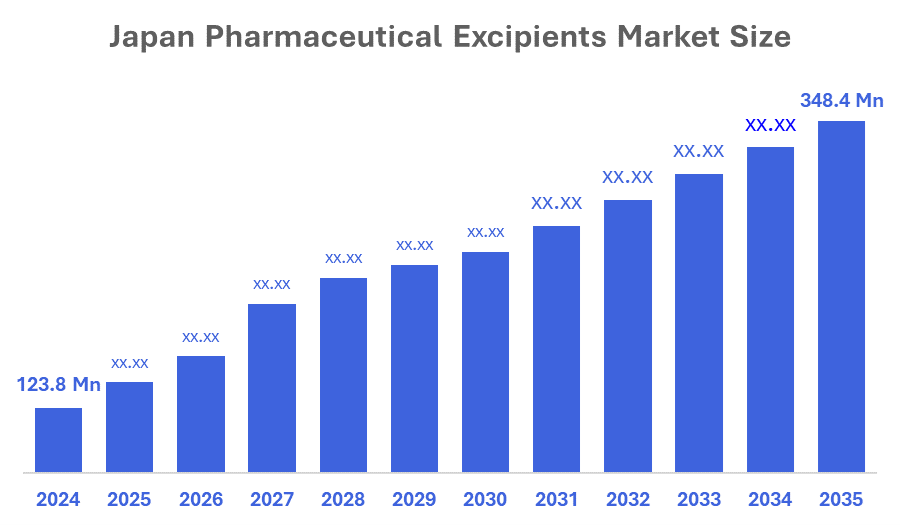

• The Japan Pharmaceutical Excipients Market Size Was Estimated at USD 123.8 Million in 2024

• The Market Size is Expected to Grow at a CAGR of Around 9.86% from 2025 to 2035

• The Japan Pharmaceutical Excipients Market Size is Expected to Reach USD 348.4 Million by 2035

According to a research report published By Decision Advisors & Consulting, the Japan Pharmaceutical Excipients Market size is anticipated to reach USD 348.4 Million by 2035, growing at a CAGR of 9.86% from 2025 to 2035. The Japanese pharmaceutical excipients market is driven by increasing demand for high-quality excipients in generic and branded drugs, growing chronic disease prevalence among an aging population, and regulatory emphasis on drug stability. Rising oral solid dosage manufacturing, biologics expansion, and R&D into modified-release formulations further fuel market growth.

Market Overview

The Japanese pharmaceutical excipients refer to substances formulated alongside the active pharmaceutical ingredient (API) to aid in drug delivery, stability, and efficacy. The Japanese market is characterized by increased adoption of multifunctional excipients, growing use of polymer-based coatings, and a shift toward high-purity excipients conforming to international pharmacopeia standards. Drivers include expansion of pharmaceutical production, higher demand for oral solid and injectable drugs, rising chronic disease burden, and regulatory focus on drug quality. The increasing aging population, advanced drug delivery demands (such as biologics and sustained-release), regulations surrounding quality standards, innovation, and creation of patient-friendly, natural, or vegan options are all contributing to the growth of the pharmaceutical excipients market within Japan. The primary trends within this category revolve around specialized functions of pharmaceutical excipients, such as enhancement of bioavailability, functional excipients, and the use of artificial intelligence for formulation creation. Key characteristics include strict quality control, demand for multifunctional excipients, growth in biopharma needs, and increasing focus on sustainable, plant-based options.

The Ministry of Health, Labour and Welfare (MHLW) oversees Japan’s health, labour, and pharmaceutical regulation, and in 2024, it focused on enabling real-world data for drug approvals, maintaining chemical and excipient safety via subcommittees, and ensuring compliance and global regulatory harmonization for pharmaceuticals and excipients.

Report Coverage

This research report categorizes the market for the Japan pharmaceutical excipients market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan pharmaceutical excipients market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan pharmaceutical excipients market.

Driving Factors

The Japanese pharmaceutical excipients market is driven by increasing pharmaceutical production, an aging population, increasing demand for medicines, the rise of generics and biologics, and the shift toward complex and advanced drug-delivery formulations. Stringent regulatory standards for quality and safety, increased R&D in formulation science, and demand for patient-centric dosage forms such as pediatric or geriatric-friendly medications further drive the market, boosting demand for high-purity, specialized excipients, rising demand for generic and branded medicines, and regulatory enforcement on drug safety and stability. Growth in oral solid dosage forms and injectable formulations fuels excipient demand, while ongoing R&D in advanced drug delivery systems enhances the usage of specialized excipients.

Restraining Factors

The Japanese pharmaceutical excipients market is restrained by stringent regulatory compliance, rising cost of high-purity excipients, and limited supplier diversity. Supply chain disruptions for specialty raw materials may also restrict smaller manufacturers’ market access. High regulatory compliance costs, limited availability of high-quality raw materials, supply chain disruptions, and intense competition among domestic and international excipient suppliers. Additionally, small and mid-sized manufacturers may struggle to invest in advanced excipient technologies or meet stringent quality and safety standards.

Market Segmentation

The Japan pharmaceutical excipients market share is categorized by type and drug form.

• The binders & fillers segment is accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period

The Japanese pharmaceutical excipients market is segmented by type into binders & fillers, disintegrants, lubricants, coatings, and others. Among these, the binders & fillers segment is accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Growth is driven by rising demand for oral solid dosage forms, including tablets and capsules, which dominate the Japanese pharmaceutical landscape. Polymer-based and multifunctional fillers further support enhanced compressibility and stability of drug formulations.

• The oral drug form segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period

The Japanese pharmaceutical excipients market is segmented by drug form into oral, injectable, topical, and others. Among these, the oral segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by high consumption of tablets and capsules for chronic diseases, over-the-counter medicines, and generics. The segment benefits from innovations in excipient coatings and formulations that improve bioavailability and patient compliance.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan pharmaceutical excipients market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Chemical Corporation

- Shin?Etsu Chemical Co., Ltd.

- Daito Kasei Co., Ltd.

- Asahi Kasei Corporation

- JSR Corporation

- Fujifilm Corporation

- Daicel Corporation

- Colorcon Japan, LLC

- IGUCHI Inc.

- Others

Key Target Audience

- Market Players

- Pharmaceutical Manufacturers

- Investors

- Regulatory Authorities

- Contract Manufacturing Organizations (CMOs)

- Research & Development Firms

- Value-Added Resellers (VARs)

Recent Developments

• In March 2024, Asahi Kasei Corporation launched a high-purity polymer-based coating excipient designed to improve stability and controlled release for oral solid formulations.

• In September 2023, Mitsubishi Chemical Corporation expanded its excipient manufacturing plant in Japan to meet rising domestic demand.

Market Segment

This study forecasts revenue at the Japan national level from 2020 to 2035. Decision Advisors has segmented the Japan Pharmaceutical Excipients Market based on the below-mentioned segments:

Japan Pharmaceutical Excipients Market, By Type

- Binders & Fillers

- Disintegrants

- Lubricants

- Coatings

- Others

Japan Pharmaceutical Excipients Market, By Drug Form

- Oral (Tablets, Capsules)

- Injectable

- Topical

- Others

Frequently Asked Questions (FAQ’s)

Q: What is the Japan pharmaceutical excipients market size?

A: Japan pharmaceutical excipients market size is expected to grow from USD 123.8 million in 2024 to USD 348.4 million by 2035, growing at a CAGR of 9.86% during the forecast period 2025–2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by rising pharmaceutical production, increasing demand for oral solid dosage forms, regulatory focus on drug safety, and growing use of high-quality excipients in generics and branded drugs.

Q: What factors restrain the market?

A: The market is restrained by stringent regulatory compliance requirements, rising costs of high-purity excipients, and supply chain constraints for specialty raw materials.

Q: How is the market segmented by type?

A: The market is segmented into Binders & Fillers, Disintegrants, Lubricants, Coatings, and Others.

Q: How is the market segmented by drug form?

A: The market is segmented into Oral, Injectable, Topical, and Others.

Q: Who are the key players in the Japan pharmaceutical excipients market?

A: Key companies include Mitsubishi Chemical Corporation, Shin?Etsu Chemical, Daito Kasei, Asahi Kasei, JSR, and Fujifilm (Pharma Division).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 168 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |