Japan Plastic Bottle Market

Japan Plastic Bottle Market Size, Share, and COVID-19 Impact Analysis, By Resin (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Other Resins), By End-User Industry (Food & Beverage, Pharmaceuticals, Personal Care & Toiletries, Industrial, Household Chemicals, Paints and Coatings, Other End-user Industries), and Japan Plastic Bottle Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Plastic Bottle Market Insights Forecasts to 2035

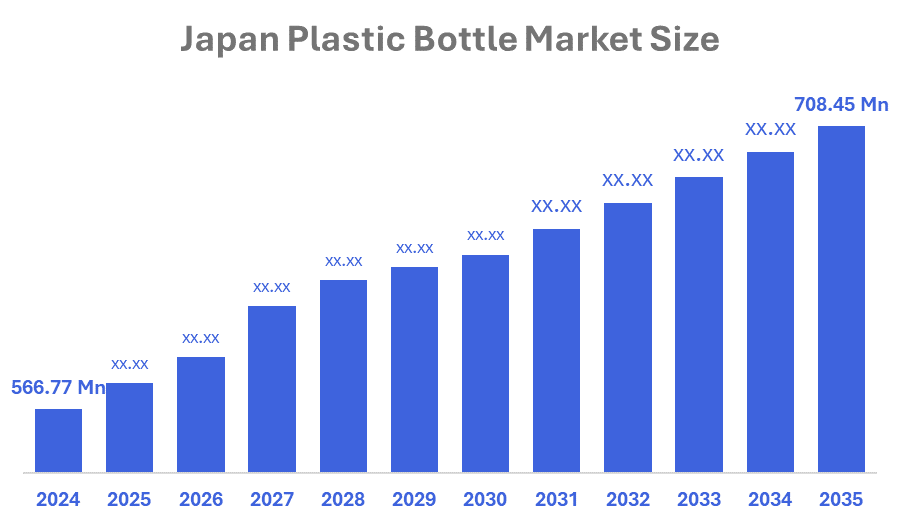

- The Japan Plastic Bottle Market Size Was Estimated at USD 566.77 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 2.05% from 2025 to 2035

- The Japan Plastic Bottle Market Size is Expected to Reach USD 708.45 Million by 2035

According to a research report published by Spherical Insights & Consulting, The Japan Plastic Bottle Market size is anticipated to reach USD 708.45 Million by 2035, growing at a CAGR of 2.05% from 2025 to 2035. The Japan plastic bottle market is driven by innovations in sustainable packaging, such as the use of recycled materials, lightweighting, and government incentives for recycling.

Market Overview

A plastic bottle is a container crafted from plastic, usually featuring a narrow neck, and is used to store liquids such as water, soft drinks, or shampoo. These bottles are commonly made from different kinds of plastic, like polyethylene terephthalate (PET), which is durable, lightweight, and resistant to breaking. The Japanese market for plastic bottles is led by several big players, with many small producers serving particular areas or needs. The main reasons for the growth of Japan’s plastic bottle market include the popularity of convenient beverage packaging, online shopping growth, and improvements in recycling. A major feature of the market is Japan strong culture of convenience, which drives high plastic consumption, yet there’s also rising interest in sustainable, reusable, and eco-friendly bottles. Materials such as PET and HDPE are widely used, and although mechanical recycling is practiced, much plastic waste is still disposed of through incineration.

The Japan Containers and Packaging Recycling Association (JCPRA) notes that recycling costs for plastic packaging averaged JPY 51 (USD 0.36) per kilogram in 2021 and could increase to JPY 62 (USD 0.44) by 2024. PET bottles are being adopted more widely across product lines because they are cost-effective, lightweight, and benefit from better recycling and printing technology, appealing especially to premium consumers. Japan imports PET bottles, with a notable number of shipments coming from China, Vietnam, and India, though China is the largest global exporter of PET bottles.

Report Coverage

This research report categorizes the market for the Japan plastic bottle market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan plastic bottle market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan plastic bottle market.

Driving Factor

The growth of Japan plastic bottle market is primarily driven by the material’s cost efficiency, light weight, and superior shatter resistance compared to traditional options such as glass. These advantages reduce production and transportation costs for manufacturers while improving convenience for consumers. The rapid expansion of the food and beverage sector, especially the increasing popularity of packaged water and single-serve drinks, has further fuelled market demand. Moreover, Japan’s extensive network of vending machines and convenience stores has enhanced product availability nationwide. Technological advancements, including heat-resistant and barrier-enhanced PET, have expanded application potential and improved product shelf life.

Restraining factor

The Japanese plastic bottle market faces limitations due to stringent government regulations and extended producer responsibility (EPR) fees, which raise production costs for manufacturers. The plastic bottle market is primarily restrained by increasing environmental concerns, stringent government regulations like single-use plastic bans, and the high costs associated with effective recycling and waste management infrastructure. Consumers are also shifting preferences toward eco-friendly alternatives like glass or metal, further limiting market growth.

Market Segmentation

The Japan plastic bottle market share is categorised by resin and end user.

By Resin

The Japan plastic bottle market is segmented by resin into polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP) and other resins. Among these, the polyethylene terephthalate (PET) pet dominates the Japanese plastic bottles market due to its lightweight, durable, and affordable, which reduces transportation expenses and makes handling more convenient for consumers. Its strong recyclability also supports government efforts to foster a circular economy and reduce plastic waste. In addition, PET’s ability to be moulded into diverse shapes and sizes makes it a highly versatile material suitable for various beverages and other products.

By End User

The Japan plastic bottle market is segmented by end user into food & beverage, pharmaceuticals, personal care & toiletries, industrial, household chemicals, paints and coatings and other end-user industries. Among these, the food and beverage industry dominates in Japan market due to convergence of robust consumer demand for convenience and health-focused products, the impact of a sizable and aging population, and ongoing innovation coupled with advanced technological adoption within the sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan plastic bottle market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takemoto

- Yohki Co Ltd

- Kodama Plastics Co Ltd

- TSUKASA PETCO Corporation

- Toyo Seikan Group Holdings Ltd

- Far Eastern Ishizuka Green PET Corporation

- Hosokawa Yoko Co. Ltd.

- Idemitsu Kosan Co. Ltd.

- Amcor Plc

- Kirin Holdings Company Ltd

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In July 2024: Takemoto Yohki Co. Ltd has added a new square shaped container to its collection of easy-refill “mother” bottles. The bottle features a slightly larger opening and a removable screw-on spout, making it simple to transfer contents from refill bottles. Its clean, square form with a built-in cap is versatile enough to accommodate a wide range of skincare products, suitable for use in cosmetics for both men and women.

In December 2023: Toyo Seikan Group Holdings Ltd and Idemitsu Kosan Co. Ltd have partnered to conduct a demonstration test aimed at recycling plastic scrap. In this trial, Idemitsu Kosan’s subsidiary, Chemical Recycle Japan Co. Ltd, will process plastic scrap collected from Toyo Seikan Group’s manufacturing facilities. Idemitsu plans to produce “renewable chemicals” and “renewable fuel oil” utilizing its current oil refining and petrochemical infrastructure.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Japan Plastic Bottle Market based on the below-mentioned segments:

Japan Plastic Bottle Market, By Resin

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Other Resins

Japan Plastic Bottle Market, By End User

- Food & Beverage

- Pharmaceuticals

- Personal Care & Toiletries

- Industrial

- Household Chemicals

- Paints and Coatings

- Other End-user Industries

Frequently Asked Questions (FAQs)

Q. How big is the Japan plastic bottle market?

A: Japan Plastic Bottle Market size is expected to grow from USD 566.77 million in 2024 to USD 708.45 billion by 2035, growing at a CAGR of 2.05% during the forecast period 2025-2035.

Q. Which Industries are the largest consumers of plastic bottle in Japan?

A: The largest consumers of plastic bottles in Japan are the beverage and food industries, driven by high consumption of bottled water and soft drinks. Other significant sectors include pharmaceuticals and personal care, which require secure and hygienic packaging solutions.

Q. What is the Japan Plastic Bottle Market in 2024?

A: In 2024, the Japan Plastic Bottles Market size is expected to reach USD 677.55 million.

Q. Who are the key players in Japan plastic bottle market?

A: Yohki Co Ltd, Kodama Plastics Co Ltd, TSUKASA PETCO Corporation, Toyo Seikan Group Holdings Ltd, Far Eastern Ishizuka Green PET Corporation, Hosokawa Yoko Co. Ltd., Idemitsu Kosan Co. Ltd., Amcor Plc, Kirin Holdings Company Ltd and Other.

Q: How is the Japan plastic bottle market segmented by resin type?

A: The Japan plastic market is segmented by end users into food, beverage, pharmaceuticals, personal care & toiletries, industrial, household chemicals, paints and coatings and other end-user industries.

Q. What is the expected CAGR of the Japan plastic bottle market

A: The Japan plastic market is expected to grow at a CAGR of around 2.05% from 2025 to 2035.

Q. Who are the kay audience in the Japan plastic market?

A: The target audience are market players, investors, end-users, government authorities, consulting and research firm, venture capitalists and value-added resellers (vars).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 167 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |