Japan Plastic Caps and Closure Market

Japan Plastic Caps and Closure Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Screw-On Caps, Dispensing Caps, and Others), By Raw Material (PET, PP, HDPE, LDPE, and Others), By Container Type (Plastic, Glass, and Others), By Technology (Injection Molding, Compression Molding, Post-Mold Tamper-Evident Band), By End Use (Beverages, Industrial Chemicals, Food, Cosmetics, Household Chemicals, Pharmaceuticals, and Others), and Japan Plastic Caps and Closure Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Plastic Caps and Closure Market Size Insights Forecasts to 2035

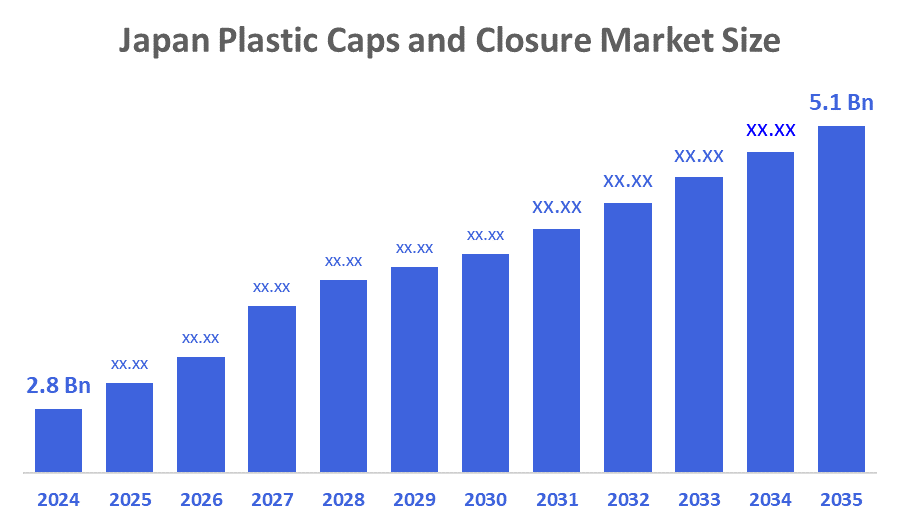

- The Japan Plastic Caps and Closure Market Size Was Estimated at USD 2.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.6% from 2025 to 2035

- The Japan Plastic Caps and Closure Market Size is Expected to Reach USD 5.1 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Plastic Caps and Closure Market Size is anticipated to Reach USD 5.1 Billion by 2035, Growing at a CAGR of 5.6% from 2025 to 2035. The Japan plastic caps and closure market is driven by rising demand for packaged beverages and food, growth in pharmaceutical packaging, increasing convenience-oriented products, advancements in lightweight closure designs, and expanding consumer goods manufacturing.

Market Overview

The Japan Plastic Caps and Closures Market is the sector of the Japanese packaging industry focused on the design, production, and sale of plastic components used to seal bottles, jars, and other containers. This market includes various product types like screw caps, dispensing caps, and tamper-evident closures, and is segmented by the plastic resin used (such as PE, PET, and PP) and end-use industries like food, beverages, and personal care. The market is characterized by high standards for quality, innovation, and user-friendly, safe, and sustainable packaging solutions. Japan's government investment in the plastic caps and closures sector is evidenced by clear policy targets, regulatory frameworks, and market statistics. The ministry of the environment has set a goal to reduce single-use plastics by 25% by 2030, directly impacting the plastic caps and closures industry through policies promoting recyclable and biodegradable materials. Additionally, the government supports R&D for sustainable packaging solutions, which has led to increased adoption of eco-friendly caps and closures in the market.

Report Coverage

This research report categorizes the market for the Japan plastic caps and closure market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan plastic caps and closure market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan plastic caps and closure market.

Driving Factors

The plastic caps and closure markets in Japan are driven by growing transition toward mono-material packaging, largely driven by the demand for improved recycling processes and compliance with sustainability targets. Traditional multi-material closures often complicate sorting and recycling, prompting manufacturers to explore designs that streamline the material recovery chain. Mono-material caps, especially those made entirely from PET, enable easier post-consumer recycling, reduce processing time, and limit the amount of non-recyclable waste generated. These caps also support the development of single-material containers, which are increasingly being favoured in both domestic and export packaging standards.

Restraining Factors

The plastic caps and closure market in Japan is restrained by increasing environmental concerns, strict regulations on plastic use, rising demand for sustainable alternatives, fluctuating raw material prices, and growing pressure to reduce single-use plastic consumption.

Market Segmentation

The Japan plastic caps and closure market share is categorized by product type, raw material, container type, technology and end use.

- The screw-on caps segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan plastic caps and closure market is segmented by product type into screw-on caps, dispensing caps, and others. Among these, the screw-on caps segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by high demand in beverages and household products, ease of use, strong sealing performance, compatibility with diverse containers, cost-effective production, and increasing adoption in food, pharmaceutical, and personal care packaging.

- The PP segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan plastic caps and closure market is segmented by raw material into PET, PP, HDPE, LDPE, and others. Among these, the PP segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to polypropylene durability, chemical resistance, lightweight properties, cost-effectiveness, recyclability, and its widespread use across beverage, food, pharmaceutical, and personal care packaging, driving strong industry adoption.

- The plastic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan plastic caps and closure market is segmented by container type into plastic, glass, and others. Among these, the plastic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by rising demand for lightweight packaging, cost-effective production, high compatibility of caps with plastic bottles, expanding beverage and personal care markets, and increasing adoption of durable, flexible plastic containers across industries.

- The injection molding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan plastic caps and closure market is segmented by technology into injection molding, compression molding, post-mold tamper-evident band. Among these, the injection molding segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to injection molding’s high production efficiency, precise shaping capability, lower defect rates, suitability for mass manufacturing, material versatility, and rising demand for durable, lightweight, and customized plastic closures across industries.

- The beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan plastic caps and closure market is segmented by end use into beverages, industrial chemicals, food, cosmetics, household chemicals, pharmaceuticals, and others. Among these, the beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by rising consumption of bottled water and ready-to-drink beverages, increasing demand for secure and tamper-evident closures, lightweight packaging trends, and expanding use of PET bottles across the beverage industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan plastic caps and closure market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Closures Co., Ltd.

- Toyo Seikan Group Holdings Ltd.

- Aptar Group Inc.

- Amcor Group GmbH

- Tetra Laval International S.A.

- Berry Global Japan

- Silgan Closures Japan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2025: Kewpie and partners launched Japan’s first pilot to chemically recycle salad dressing caps using supercritical water. The initiative advanced the plastic caps and closures market by promoting closed-loop systems, improving recycling efficiency, and encouraging local collaboration for sustainable packaging innovations.

- In January 2025: Japan’s Nissha invested in Sweden-based Blue Ocean Closures to co-develop plastic-free, fiber-based bottle caps. This move supported the Japanese plastic caps and closures market by promoting sustainable alternatives, reducing ocean plastic pollution, and advancing eco-friendly packaging through scalable vacuum press forming technology.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Plastic Caps and Closure Market based on the below-mentioned segments:

Japan Plastic Caps and Closure Market, By Product Type

- Screw-On Caps

- Dispensing Caps

- Others

Japan Plastic Caps and Closure Market, By Raw Material

- PET

- PP

- HDPE

- LDPE

- Others

Japan Plastic Caps and Closure Market, By Container Type

- Plastic

- Glass

- Others

Japan Plastic Caps and Closure Market, By Technology

- Injection Molding

- Compression Molding

- Post-Mold Tamper-Evident Band

Japan Plastic Caps and Closure Market, By End Use

- Beverages

- Industrial Chemicals

- Food

- Cosmetics

- Household Chemicals

- Pharmaceuticals

- Others

FAQ’s

Q: What is the size of the Japan plastic caps and closure market?

A: The market was valued at USD 2.8 billion in 2024 and is expected to reach USD 5.1 billion by 2035, growing at a CAGR of 5.6%.

Q: What factors are driving market growth in Japan?

A: Growth is driven by increasing packaged beverage consumption, rising demand for convenience packaging, advancements in lightweight closures, and expanding food, pharmaceutical, and personal care industries.

Q: Which product type holds the largest market share?

A: Screw-on caps dominated the market in 2024 due to their strong sealing performance, cost-effectiveness, and wide compatibility with beverage, food, and household containers.

Q: Which raw material segment leads the market?

A: Polypropylene (PP) is the leading raw material because of its durability, chemical resistance, lightweight nature, and recyclability.

Q: Which end-use industry drives the highest demand?

A: The beverages segment accounted for the largest share in 2024, supported by growing consumption of bottled water and ready-to-drink beverages.

Q: What trends are shaping the market’s future?

A: Key trends include adoption of mono-material caps, development of sustainable and recyclable closure designs, plastic reduction initiatives, and increased investment in advanced molding technologies.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 167 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |