Japan Power Market

Japan Power Market Size, Share, By Power Source (Thermal, Nuclear, and Renewables), By End-User (Utilities, Commercial and Industrial, and Residential), Japan Power Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Power Market Size Insights Forecasts to 2035

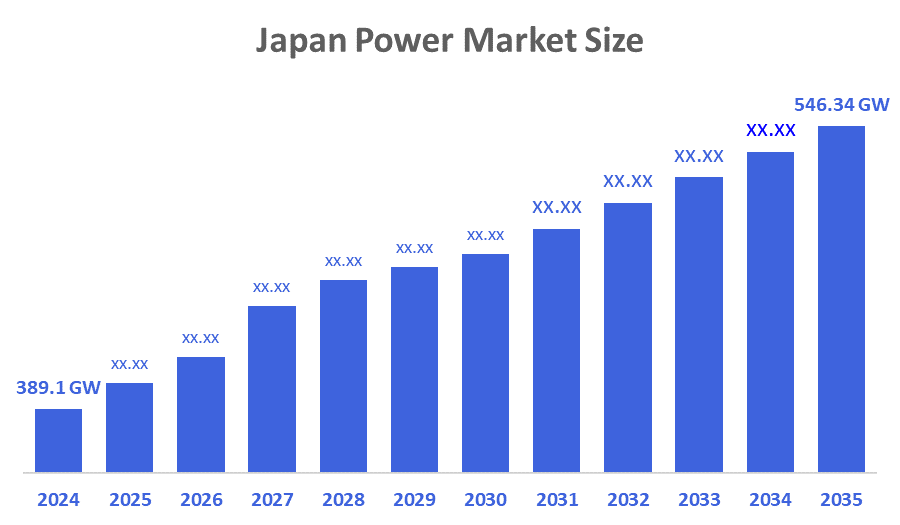

- Japan Power Market Size 2024: 389.01 GW

- Japan Power Market Size 2035: 546.34 GW

- Japan Power Market CAGR 2025-2035: 3.14%

- Japan Power Market Segments: Power Source and End-User

The Japan Power Market Size includes the entire cycle of electric power from generation to transmission and distribution and it relies on a mix of thermal, nuclear, and renewable energy sources to meet the country's energy demand. A stable power supply is a prerequisite for residential living, commercial activities, and industrial manufacturing. This further extends to the electrification of transport and the digital infrastructure that is spread across Japan. Electricity remains as the primary energy source in heavy industries, smart cities, railways, data centers, and electric mobility, among others. While thermal power is still the mainstay of the grid and keeps it stable, renewable energy and nuclear power are helping to meet Japan's decarbonization and energy security goals. In fiscal 2023, the share of power generated from thermal sources was almost 69%, that from renewable sources including hydro was close to 23%, and that from nuclear power was approximately 9%. Japan is still very much reliant on imported fuels such as LNG, coal, and oil because it has limited domestic resources and this is why power diversification has become a strategic priority.

Technological innovation is transforming the market with the help of smart grids, large, scale battery storage, offshore wind farms, and advanced grid forecasting systems. The Japanese government is backing the sector with its Green Transformation strategy and the Basic Energy Plan, which aims at 4050% renewable energy and around 20% nuclear power in the national electricity mix by 2040. The government is allocating subsidies worth more than JPY 200 billion for the promotion of clean power and the upgrading of the grid. The next, door opportunities in offshore wind, corporate PPAs, hydrogen, based power generation, and grid modernization will not only facilitate but also affirm the energy resilience and sustainability of the future.

Market Dynamics of the Japan power market:

The Japan power market is primarily fueled by the rising electricity demand that is largely influenced by the industrial automation, data centers, electric vehicles, and urban infrastructure expansion. Demand side factors such as these have been complemented by supply side developments in the power sector which include strong policy support for energy transition, renewable capacity growth, various grid modernization initiatives, and the gradual restart of nuclear reactors. Besides these, one cannot overlook the role of corporate renewable PPAs and large scale solar and offshore wind investments in accelerating market momentum further.

The market is restrained by the high dependence on imported fossil fuels coupled with the exposure to fuel price volatility, an aging transmission infrastructure, and lengthy approval processes for nuclear restarts and renewable projects. In addition to those, natural disaster risks, grid congestion, and high capital requirements for power generation and storage infrastructure not only hobble the industry but also exert cost and price pressures on utilities and developers alike.

The future outlook continues to be bright and optimistic mainly because of the unfolding opportunities related to various renewable energy technologies and innovations such as the expanding renewable energy installations, offshore wind development, hydrogen, based power generation, and battery energy storage deployment. The government led decarbonization targets, corporate sustainability commitments and digital grid technologies among others are additional enablers and facilitators which will help to further energize the sector through enhanced energy security, lower emissions and solidified long, term growth of the Japan power sector.

Market Segmentation

The Japan Power Market share is classified into power source and end-user.

By Power Source:

The Japan power market is divided by power source into thermal, nuclear, and renewables. Among these, the thermal segment dominated the share in 2024 and is anticipated to grow steadily during the forecast period. Thermal power is still very important as it delivers a stable and reliable energy supply, makes use of the current infrastructure, and shows that Japan is still relying on LNG and coal imports to keep the grid stable and ensure energy security.

By End-User:

The Japan power market is divided by end-user into utilities, commercial and industrial, and residential. Among these, the utilities segment dominated the share in 2024 and is expected to grow at a notable CAGR during the forecast period. Utilities are in the lead because they own large, scale generation assets, they manage the national grid, have integrated renewable energy, and the electricity demand is growing because of industrial electrification and the expansion of digital infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan power market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Power Market:

- Tokyo Electric Power Company Holdings (TEPCO)

- Kansai Electric Power Company

- Chubu Electric Power

- Hokkaido Electric Power

- Tohoku Electric Power

- Hokuriku Electric Power

- Chugoku Electric Power

- Shikoku Electric Power

- Kyushu Electric Power

- Okinawa Electric Power

- JERA Co., Inc.

- Electric Power Development Co.

- Japan Renewable Energy Corporation

- Hitachi Energy

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions

- Sumitomo Corporation

- Marubeni Corporation

- Mitsubishi Heavy Industries

- Orsted Japan K.K.

Recent Developments in Japan Power Market:

In June?2025, PPA Daigas Energy has delivered onsite a power purchase agreement of 549.5 kW at Kitagawa Iron Works, a facility powered a 100% by renewable energy for the next 20 years with a reduction of CO2 emissions estimated at 265 tons per year. This helps Japan meet its corporate decarbonization and renewable energy adoption targets.

In May?2025, Toyo Carbon and Tess Engineering signed the largest industrial onsite power purchase agreement (PPA) in Japan for a 20 MW solar project, which is expected to deliver 26.68 million kWh annually from 2027, contributing to Japan’s energy transition and the integration of industrial renewables.

In March?2025, Tokyo Electric Power Company Holdings plans to restart the Kashiwazaki-Kariwa nuclear reactor for F?Y?2025, approved by Japan's Nuclear Regulation Authority, reportedly potentially boosting its earnings by up to JPY 100?billion per year and offering a fillip to nuclear energy generation in the national grid.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts installed capacity at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan power market based on the below-mentioned segments:

Japan Power Market, By Power Source

- Thermal

- Nuclear

- Renewables

Japan Power Market, By End-User

- Utilities

- Commercial and Industrial

- Residential

FAQ

Q: What is the Japan power market size?

A: Japan Power Market is expected to grow from 389.01 GW in 2024 to 546.34 GW by 2035, at a CAGR of 3.14% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by rising electricity demand from industrial electrification, data centers, urban infrastructure, and electric vehicles. Supply-side factors include renewable capacity expansion, corporate PPAs, nuclear reactor restarts, and government-led energy transition policies.

Q: What factors restrain the Japan power market?

A: High reliance on imported fossil fuels, fuel price volatility, aging transmission infrastructure, long approval processes for nuclear and renewable projects, natural disaster risks, and high capital requirements are key restraints.

Q: How is the market segmented by power source?

A: The market is segmented into thermal, nuclear, and renewables.

Q: How is the market segmented by end-user?

A: The market is segmented into utilities, commercial and industrial, and residential.

Q: Who are the key companies in the Japan power market?

A: Key companies include TEPCO, Kansai Electric Power, Chubu Electric Power, Hokkaido Electric Power, Tohoku Electric Power, Hokuriku Electric Power, Chugoku Electric Power, Shikoku Electric Power, Kyushu Electric Power, Okinawa Electric Power, JERA Co., Inc., Electric Power Development Co., Japan Renewable Energy Corporation, Hitachi Energy, Mitsubishi Electric Corporation, Toshiba Energy Systems & Solutions, Sumitomo Corporation, Marubeni Corporation, Mitsubishi Heavy Industries, and Orsted Japan K.K.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 174 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |