Japan Printed Circuit Board Market

Japan Printed Circuit Board Market Size, Share, and COVID-19 Impact Analysis, By Type (Single-Sided, Double-Sided, Multi-Layer, and HDI), By End User (Industrial Electronics, Healthcare, Aerospace and Defense, Automotive, IT and Telecom, Consumer Electronics, and Others), and Japan Printed Circuit Board Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Printed Circuit Board Market Insights Forecasts to 2035

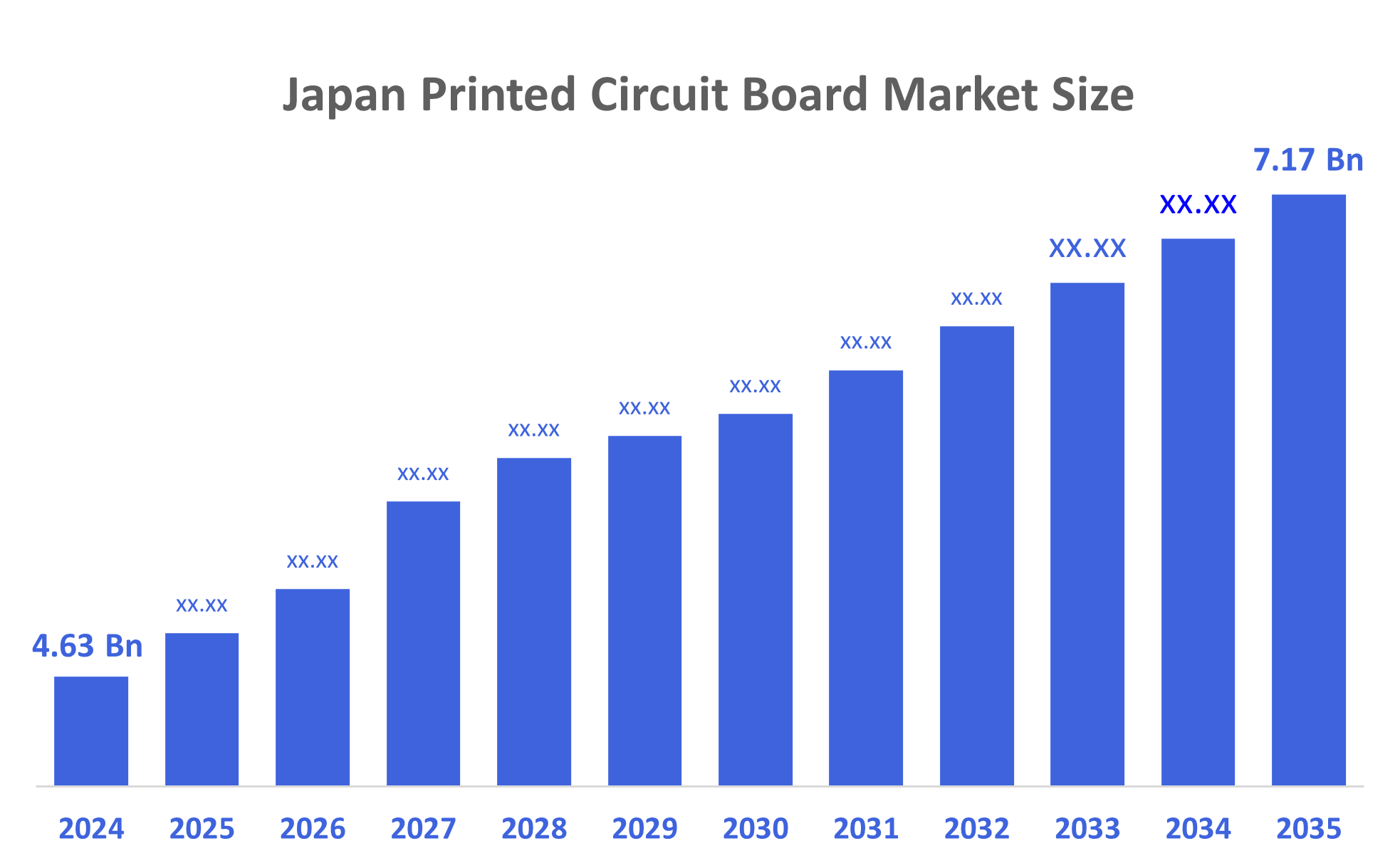

- The Japan Printed Circuit Board Market Size Was Estimated at USD 4.63 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.06% from 2025 to 2035

- The Japan Printed Circuit Board Market Size is Expected to Reach USD 7.17 Billion by 2035

According to a research report published by Decisions Advisors, The Japan Printed Circuit Board Market Size is Anticipated to Reach USD 7.17 Billion by 2035, Growing at a CAGR of 4.06% from 2025 to 2035. The printed circuit board market in Japan is driven by the rising integration of automotive electronics, the rapid rollout of 5G, the expansion of data center infrastructure, and increasing domestic semiconductor investments, all of which support advanced electronic manufacturing.

Market Overview

The Printed Circuit Board (PCB) market describes the sector involved in the design, production, and distribution of rigid or flexible boards that provide physical support and electrical connections for electronic devices through conductive pathways, tracks, or signal traces. The PCB market includes the materials, fabrication technologies, assembly services, and new PCB technologies that enhance the performance of these electronic devices and systems to achieve high density, high speed, and miniature performance. The Japan printed circuit board (PCB) market is set to achieve sustainable growth due to the increased electronic content in autos, 5G infrastructure rollout, and data center growth. Additionally, the Japanese government's support for the domestic semiconductor ecosystem, evidenced by METI revitalizing semiconductor support programs and significant subsidies for major projects such as TSMC and Rapidus, will contribute to a step increase in Japan's existing chip and advanced packaging capability and indirectly impact demand for high-performance PCBs. Innovation is directed at applications such as HDI, rigid flex, and high frequency for reduced size and high-speed capabilities. Opportunities will emerge around electric vehicle (EV)/advanced driver-assistance systems (ADAS) platforms and telecom equipment through locally sourced substrates. Recent developments around the announcement of a major semiconductor subsidy in 2024 reinforce Japan's long-term electronics manufacturing ecosystem.

Report Coverage

This research report categorizes the market for the Japan printed circuit board market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan printed circuit board market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan printed circuit board market.

Driving Factors

The printed circuit board market in Japan is driven by increasing demand for sophisticated automotive electronics, specifically EV and ADAS systems that need multilayer PCBs with high reliability. The quick rollout of 5G service and upgrades to telecom infrastructure are moving HDI and high-frequency board adoption forward significantly. The need for server and connection PCBs is driven by the construction of infrastructure, such as data centers. Local sourcing and purchasing are nevertheless encouraged by ongoing investments in domestic semiconductors and sophisticated packaging capabilities. Lastly, more rigid-flex and flexible PCBs are being employed as a result of ongoing downsizing developments in consumer electronics.

Restraining Factors

The printed circuit board market in Japan is mostly constrained by high production costs and a limited supply of raw materials. Aside from raw materials and substrate independence, manufacturers are faced with continuous global competition, quickening technology cycles, and an increasing need to comply with environmental legislation, all of which put manufacturers under pressure, specifically small and mid-sized companies.

Market Segmentation

The Japan printed circuit board market share is classified into type and end user.

- The multi-layer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan printed circuit board market is segmented by type into single-sided, double-sided, multi-layer, and HDI. Among these, the multi-layer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because they are necessary for high-density and high-performance electronics utilized in Japan's main demand sectors, automotive electronics (EV and ADAS systems), 5G telecom equipment, servers and data centers, industrial automation, and advanced consumer devices, multi-layer PCBs predominate.

- The automotive segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan printed circuit board market is segmented by end user into industrial electronics, healthcare, aerospace and defense, automotive, it and telecom, consumer electronics, and others. Among these, the automotive segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. High-reliability multilayer, rigid flex, and high-temperature PCBs are necessary for Japan's robust automotive industry, which is fueled by electrification, ADAS adoption, connected car systems, and EV production.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan printed circuit board market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBIDEN Co., Ltd.

- Meiko Electronics Co., Ltd.

- CMK Corporation

- Nippon Mektron Ltd.

- Shinko Electric Industries Co., Ltd.

- OKI Circuit Technology Co., Ltd.

- Sumitomo Electric Printed Circuits, Inc.

- Kyocera Corporation

- Murata Manufacturing Co., Ltd.

- Yamamoto Manufacturing Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, it was announced that OKI Circuit Technology Co., Ltd. developed high-precision simulation technology relating to high-frequency vias in 1.6 Tbps class high-speed transmission printed circuit boards (PCBs) for new generation AI data-centres.

- In September 2025, Meiko Electronics Co., Ltd. reported to the JPY stock market that it reached a combined corporate alliance with Allied Circuits Co., Ltd. and formed a joint venture in Vietnam for the production and sale of high-layer printed circuit boards (PCBs) geared towards the AI-server market.

- In August 2025, it was reported that the Japanese printed circuit board (PCB) manufacturer market was positioning to produce ultra-high layer class circular printed circuit boards (PCBs) as well as HDI board format boards to accommodate demand for miniaturization and higher-speed requirements.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan printed circuit board market based on the below-mentioned segments:

Japan Printed Circuit Board Market, By Type

- Single-Sided

- Double-Sided

- Multi-Layer

- HDI

Japan Printed Circuit Board Market, By End User

- Industrial Electronics

- Healthcare

- Aerospace and Defense

- Automotive

- IT and Telecom

- Consumer Electronics

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |