Japan Propylene Glycol Market

Japan Propylene Glycol Market Size, Share, and COVID-19 Impact Analysis, By Source Type (Petroleum-based, and Bio-based), By Application (Unsaturated Polyester Resins, Antifreeze and Functional Fluids, Food, Drug, and Cosmetics, Liquid Detergent, Paints and Coatings, and Others), and Japan Propylene Glycol Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Propylene Glycol Market Insights Forecasts to 2035

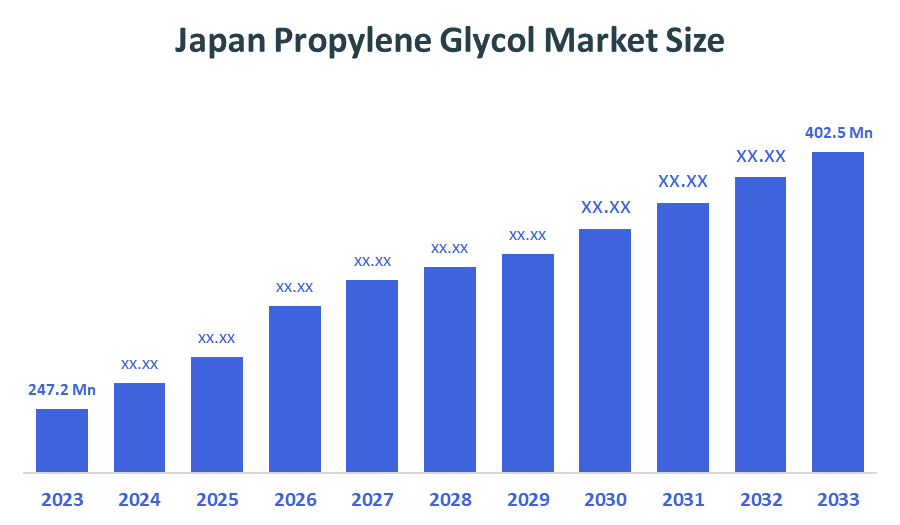

- The Japan Propylene Glycol Market Size Was Estimated at USD 247.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.53% from 2025 to 2035

- The Japan Propylene Glycol Market Size is Expected to Reach USD 402.5 Million by 2035

According to a Research Report Published by Decision Advisiors & Consulting, the Japan propylene glycol market size is anticipated to reach USD 402.5 million by 2035, growing at a CAGR of 4.53% from 2025 to 2035. The propylene glycol market in Japan is driven by increasing bio-based propylene glycol adoption due to sustainability initiatives, expanding pharmaceutical and personal care applications, and government decarbonization efforts under Japan’s Green Transformation strategy.

Market Overview

The propylene glycol (PG) market consists of the manufacturing, distribution, and sale of propylene glycol, a clear, odorless, hygroscopic liquid. The PG Market is reflected in the supply of raw materials, manufacturing processes, grades of product (USP, Industrial, and Cosmetic), and end markets, and reflects trends in demand for products, regulatory concerns, and new product development. The market for propylene glycol (PG) in Japan is growing as a result of increased demand in industrial, food, personal care, and pharmaceutical applications. Japan’s government supports chemical sector decarbonization through initiatives like the Green Transformation (GX) strategy and NEDO’s Green Innovation Fund, allocating ¥20?trillion over 10 years, with specific projects funded at ¥304.1?billion for industrial decarbonization and ¥176.7?billion for bio-manufacturing and CO?-based carbon recycling, indirectly benefiting propylene glycol production. Applications in cosmetics, injectables, and food-grade goods are supported by technological developments in high-purity and renewable PG manufacturing. PG can be used as a solvent and humectant in industrial resins, paints, and antifreeze. Increased use of bio-based PG and importation of specialty grades to satisfy domestic demand are recent trends. An aging population, environmental regulations, and regulatory compliance all contribute to Japan's steady market expansion.

Report Coverage

This research report categorizes the market for the Japan propylene glycol market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan propylene glycol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan propylene glycol market.

Driving Factors

The propylene glycol market in Japan is driven by increasing use of propylene glycol in pharmaceuticals, personal care, food, and industrial markets. This increase is supported by sustainable initiatives that promote the use of bio-based propylene glycol, as well as government initiatives to promote decarbonization through their Green Transformation initiative, and increased utilization of renewable feedstock for production. Advances in technology leading to higher purity and more environmentally sustainable productions of propylene glycol will open up new uses for propylene glycol products in cosmetics, injectables, and food-grade products. In addition, continued growth in the industrial sector using propylene glycol in the manufacture of resins, coatings, and antifreeze provides continued support for stable growth in the Japanese propylene glycol market.

Restraining Factors

The propylene glycol market in Japan is mostly constrained by high production costs for bio-based and high-purity grades, volatility in prices for raw materials, requirements for stringent regulatory compliance, and competition from alternative types of solvents or humectants that limit the ability to use these high-purity grades of propylene glycol on a wide scale for maximum profitability.

Market Segmentation

The Japan propylene glycol market share is classified into source type and application.

- The petroleum-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan propylene glycol market is segmented by source type into petroleum-based and bio-based. Among these, the petroleum-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the fact that petroleum-based PG continues to be the most accessible and economical source, supporting extensive industrial, medicinal, and personal care applications.

- The unsaturated polyester resins segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan propylene glycol market is segmented by application into unsaturated polyester resins, antifreeze and functional fluids, food, drug, and cosmetics, liquid detergent, paints and coatings, and others. Among these, the unsaturated polyester resins segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to PG's importance as a raw material in UPR manufacturing and its widespread use in industrial, automotive, and construction settings. Consistent PG usage is driven by the high need for robust, lightweight composite materials in industry and infrastructure, giving the UPR segment the most revenue share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan propylene glycol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsui Chemicals, Inc.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Toagosei Co., Ltd.

- ADEKA Corporation

- Nippon Nyukazai Co., Ltd.

- Tokuyama Corporation

- Resonac K.K.

- Kureha Corporation

- Fujifilm Wako Pure Chemical Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In May 2024, the Japanese National Parliament passed two game-changing pieces of legislation (the Hydrogen Society Promotion Act and the CCS Business Act) that created a multitude of new financial incentives for low-carbon hydrogen and Carbon Capture and Storage (CCS) technologies, creating a path toward new “green chemicals” and Resource Efficient Industries.

- In December 2023, the Government of Japan identified 14 priority sectors (including chemicals, heavy industry, energy, and materials) for long-term private and public investment as part of their GX long-term public-private investment and Structural Transformation initiatives.

- In July 2023, the Government of Japan's cabinet approved the "GX Promotion Act" and the much broader GX Structural Transition Strategy, which represents the official launch of Japan's commitments to decarbonizing all sectors of industry, including energy-intensive sectors like chemicals.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Japan propylene glycol market based on the below-mentioned segments:

Japan Propylene Glycol Market, By Source Type

- Petroleum-based

- Bio-based

Japan Propylene Glycol Market, By Application

- Unsaturated Polyester Resins

- Antifreeze and Functional Fluids

- Food, Drug, and Cosmetics

- Liquid Detergent

- Paints and Coatings

- Others

FAQ’s

Q: What is the Japan propylene glycol market size?

A: Japan propylene glycol market size is expected to grow from USD 247.2 million in 2024 to USD 402.5 million by 2035, growing at a CAGR of 4.53% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by increasing use of propylene glycol in pharmaceuticals, personal care, food, and industrial markets. This increase is supported by sustainable initiatives that promote the use of bio-based propylene glycol, as well as government initiatives to promote decarbonization through their Green Transformation initiative, and increased utilization of renewable feedstock for production. Advances in technology leading to higher purity and more environmentally sustainable productions of propylene glycol will open up new uses for propylene glycol products in cosmetics, injectables, and food-grade products.

Q: What factors restrain the Japan propylene glycol market?

A: Constraints include high production costs for bio-based and high-purity grades, volatility in prices for raw materials, requirements for stringent regulatory compliance, and competition from alternative types of solvents or humectants that limit the ability to use these high-purity grades of propylene glycol on a wide scale for maximum profitability.

Q: How is the market segmented by source type?

A: The market is segmented into petroleum-based and bio-based.

Q: Who are the key players in the Japan propylene glycol market?

A: Key companies include Mitsui Chemicals, Inc., Tokyo Chemical Industry Co., Ltd. (TCI), Toagosei Co., Ltd., ADEKA Corporation, Nippon Nyukazai Co., Ltd., Tokuyama Corporation, Resonac K.K., Kureha Corporation, Fujifilm Wako Pure Chemical Corporation, and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 157 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |