Japan Protein Supplements Market

Japan Protein Supplements Market Size, Share, By Type (Casein, Whey Protein, Egg Protein, Soy Protein, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Online Stores, Direct to Customers (DTC), and Others), Japan Protein Supplements Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

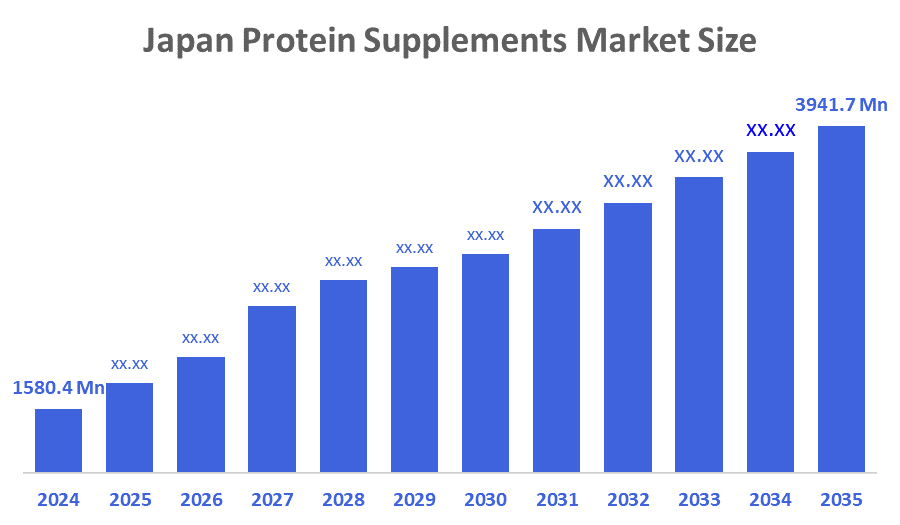

Japan Protein Supplements Market Insights Forecasts to 2035

- Japan Protein Supplements Market Size 2024: USD 1580.4 Mn

- Japan Protein Supplements Market Size 2035: USD 3941.7 Mn

- Japan Protein Supplements Market CAGR 2024: 8.66%

- Japan Protein Supplements Market Segments: Type and Distribution Channel

Japan protein supplements market size includes all aspects of producing protein supplements, such as the raw ingredients (whey, casein, etc.), manufacturing processes and facilities, retailing or bringing the product to market through wholesale/distributors, as well as end user consumption. Protein supplements are generally used by athletes and bodybuilders with a focus on muscle development, recovery, and weight loss, as well as overall health. The market for protein supplements in Japan is developing as a result of increased demand for handy protein products, growing fitness culture, aging populations' nutritional demands, and growing health consciousness.

The market for protein supplements in Japan is being supported by the nutrition policies that promote healthy diets for all stages of life. The government has made a commitment of more than ¥300 billion at the Nutrition for Growth Summit, and together with the Green Food System Strategy, is creating a situation in which the consumption of sustainable and plant-based proteins is encouraged, and the diet quality is improved. This indirectly leads to an increase in the adoption of protein supplements.The domestic firms are the driving force behind the development of Japan's protein supplements market through their introduction of plant-based and functional protein products, nutrient-fortified formulations, certified soy proteins, and protein-enriched foods. Besides, e-commerce expansion and the introduction of daily-nutrition protein drinks at reasonable prices for health-conscious consumers have also contributed to market growth.

Market Dynamics of the Japan Protein Supplements Market:

The Japan protein supplements market size is driven by the rising health and fitness awareness, participation in sports and gym activities, and growing demand for convenient nutrition among busy consumers. Besides, the aging population seeking muscle maintenance and recovery, expanding plant-based and clean-label protein offerings, and e-commerce being a strong factor also contribute to the market growth. The fact that athletes are endorsing the products, that flavors and formats are being innovated, and that the emphasis on preventive healthcare and functional nutrition is increasing are all factors that make the market more consumer-friendly through various segments.

The Japan protein supplements market size is restrained by the high product prices, strict food safety and labeling regulations, limited awareness among older consumers, taste and digestibility concerns, and strong preference for natural foods over supplements, which can all slow mass adoption down.Future opportunities for Japan's protein supplements market involve the development of plant-based and functional proteins, personalized nutrition, convenient formats, and the expansion of e-commerce as the main driver of growth. The cutting-edge innovations prioritize clean-label ingredients, better flavor and absorption, and the creation of products addressing the needs of older adults, fitness enthusiasts, and preventive healthcare.

Market Segmentation

The Japan Protein Supplements Market share is classified into type and distribution channel.

By Type:

The Japan protein supplements market size is divided by type into casein, whey protein, egg protein, soy protein, and others. Among these, the whey protein segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because of its high biological value, quick absorption, demonstrated advantages for muscle growth and recuperation, and widespread appeal among Japanese athletes, fitness enthusiasts, and health-conscious consumers.

By Distribution Channel:

The Japan protein supplements market size is divided by distribution channel into supermarkets and hypermarkets, online stores, direct to customers (DTC), and others. Among these, the supermarkets and hypermarkets segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Widespread product availability, a high level of customer confidence in physical retail, well-established distribution networks, and the opportunity to compare brands in-store, all of which make them the preferred channel for mass consumers to make purchases, are the main factors driving this dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan protein supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Protein Supplements Market:

- Meiji Holdings Co., Ltd.

- Morinaga Milk Industry Co., Ltd.

- Ajinomoto Co., Inc.

- FANCL Corporation

- DHC Corporation

- Nippon Protein Co., Ltd.

- Maruha Nichiro Corporation

- Otsuka Pharmaceutical Co., Ltd.

- Asahi Group Holdings, Ltd.

- Suntory Holdings Limited

- Others

Recent Developments in Japan Protein Supplements Market:

In August 2025, the aminoVITAL brand is enlarged by Ajinomoto, and the ami?katsu product is launched.

In July 2024, REDAS announced the release of Wellni Speed Whey Protein, which was exhibited at Sportec 2024.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan protein supplements market based on the below-mentioned segments:

Japan Protein Supplements Market, By Type

- Casein

- Whey Protein

- Egg Protein

- Soy Protein

- Others

Japan Protein Supplements Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |