Japan Rare Earth Elements Market

Japan Rare Earth Elements Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Neodymium, Praseodymium, Cerium, Dysprosium, Lanthanum, and Others), By Application (Magnets, NiMH Batteries, Auto Catalysts, Diesel Engines, Fluid Cracking Catalyst, Phosphers, Glass, Polishing Powders, and Others), and Japan Rare Earth Elements Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Rare Earth Elements Market Size Insights Forecasts to 2035

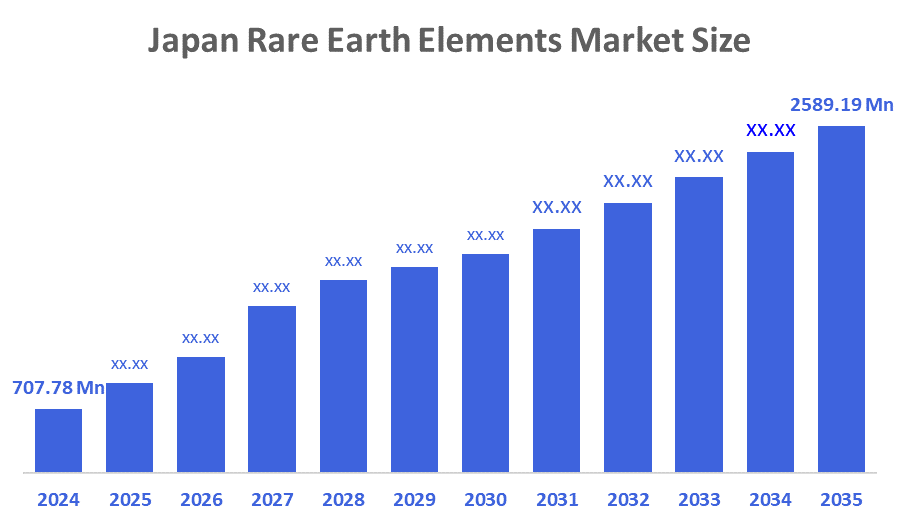

- The Japan Rare Earth Elements Market Size Was Estimated at USD 702.78 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 12.59% from 2025 to 2035

- The Japan Rare Earth Elements Market Size is Expected to Reach USD 2589.19 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Rare Earth Elements Market Size is anticipated to Reach USD 2589.19 Million by 2035, Growing at a CAGR of 12.59% from 2025 to 2035. The Japan rare earth elements market is driven by growing demand for electric vehicles, renewable energy technologies, advanced electronics, government support for strategic materials, supply chain diversification, and increasing investment in high-tech manufacturing.

Market Overview

The Japan rare earth elements (REE) market refers to the domestic industry involved in the supply, demand, and utilization of rare earth elements—17 metallic elements critical for high-tech manufacturing, including electronics, automotive (especially electric vehicles), renewable energy, and precision machinery. Japan is a major consumer and producer of REEs, particularly for magnets and advanced technologies, and the market is shaped by both industrial needs and government efforts to secure stable, diversified supplies amid global supply chain risks. One of the main drivers of Japan's rare earth elements market is its heavy dependence on these elements in high-tech manufacturing industries. Japan is a world leader in electronics, robotics, renewable energy, and precision machinery all of which need specific REEs for performance and functionality.

The Japan government has made significant investments to secure and diversify its rare earth elements (REE) supply chain, reducing reliance on China. This includes a $120 million investment in a French rare earth refining project to access heavy rare earths like dysprosium and terbium, essential for advanced technologies and electric vehicles. Japan also established a comprehensive package of measures, such as funding recycling technologies, supporting alternative materials, stockpiling, and investing in overseas mining projects. Additionally, Japan collaborates with the US on joint financing, project development, and regulatory reforms to boost domestic and international rare earth production and processing. These initiatives are part of broader efforts to enhance supply security and industrial resilience in high-tech sectors.

Report Coverage

This research report categorizes the market for the Japan rare earth elements market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan rare earth elements market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan rare earth elements market.

Driving Factors

The rare earth elements markets in Japan are driven by the rare earth elements (REE) market in Japan is primarily driven by strong demand from high-tech industries, especially electric vehicles, renewable energy, robotics, and advanced electronics, which rely heavily on REEs for magnets and specialized components. Recent news highlights Japan's strategic efforts to diversify supply chains, including increased investment in recycling, domestic refining, and international partnerships to reduce reliance on amid export restrictions and supply disruptions. The market is also expanding due to government-backed resource security initiatives, rising EV production, and technological innovation, with projections showing robust growth in both value and volume through 2033.

Restraining Factors

The rare earth elements market in Japan is restrained by heavy reliance on Chinese imports, limited domestic processing capacity, high costs of alternative sources, and technical challenges in scaling up deep-sea mining and recycling technologies. Geopolitical risks and competition for non-Chinese supply also pose significant barriers to market growth.

Market Segmentation

The Japan rare earth elements market share is categorized by product type and application.

- The neodymium segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan rare earth elements market is segmented by product type into neodymium, praseodymium, cerium, dysprosium, lanthanum, and others. Among these, the neodymium segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by its extensive use in high-performance magnets for electric vehicles, electronics, and renewable energy technologies, which are experiencing rapid growth and technological advancement.

- The magnets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan rare earth elements market is segmented by application into magnets, nimh batteries, auto catalysts, diesel engines, fluid cracking catalyst, phosphers, glass, polishing powders, and others. Among these, the magnets segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to strong demand from electric vehicles, electronics, and renewable energy technologies. If you meant magnets, the growth is driven by Japan leadership in advanced manufacturing and its push toward electrification and clean energy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan rare earth elements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shin-Etsu Chemical Co. Ltd.

- Hitachi Metals

- Sojitz Corporation

- Sumitomo Corporation

- Lynas Rare Earths Ltd.

- MP Materials

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs

Recent Developments

- In November 2024, Japanese researchers discovered approximately 230 million tons of manganese nodules rich in cobalt and nickel on the seabed near Minamitori Island. This deposit can potentially fulfill Japan's cobalt needs for 75 years and nickel needs for 11 years, significantly reducing reliance on imports. The discovery is expected to bolster Japan's rare earth elements market by enhancing domestic supply for high-tech industries and strengthening economic security.

- In July 2024, Japan expanded its continental shelf eastward, incorporating approximately 120,000 square kilometers of the Ogasawara Plateau into its jurisdiction. This move allows Japan to exercise sovereign rights over the exploration and development of natural resources, including cobalt-rich crusts containing rare metals essential for electric vehicle batteries. The expansion aims to enhance Japan's resource security and reduce reliance on imports, particularly from dominant suppliers like China.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Rare Earth Elements Market based on the below-mentioned segments:

Japan Rare Earth Elements Market, By Product Type

- Neodymium

- Praseodymium

- Cerium

- Dysprosium

- Lanthanum

- Others

Japan Rare Earth Elements Market, By Application

- Magnets

- NiMH Batteries

- Auto Catalysts

- Diesel Engines

- Fluid Cracking Catalyst

- Phosphers

- Glass

- Polishing Powders

- Others

FAQ’s

Q: What was the size of the Japan rare earth elements market in 2024?

A: The market was estimated at USD 702.78 million in 2024.

Q: What is the expected CAGR from 2025 to 2035?

A: The market is expected to grow at a CAGR of 12.59% during 2025–2035.

Q: Which product type dominated the market in 2024?

A: Neodymium accounted for the largest revenue share due to its use in high-performance magnets for EVs and electronics.

Q: Which application segment leads the market?

A: Magnets dominated in 2024, driven by demand from electric vehicles, electronics, and renewable energy technologies.

Q: What are the key drivers of the Japan rare earth elements market?

A: Growth is driven by EV adoption, renewable energy, advanced electronics, government support, supply chain diversification, and investments in high-tech manufacturing.

Q: Who are the key companies in the Japan rare earth elements market?

A: Key players include Shin-Etsu Chemical, Hitachi Metals, Sojitz Corporation, Sumitomo Corporation, Lynas Rare Earths, and MP Materials.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 189 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |