Japan Remote Patient Monitoring Market

Japan Remote Patient Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Blood Pressure Monitor, Glucose Monitor, Heart Rate Monitor, Pulse Oximeters, Respiratory Monitor, and Others), By End Use (Hospitals and Clinics, Homecare Settings, and Others), and Japan Remote Patient Monitoring Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Remote Patient Monitoring Market Insights Forecasts to 2035

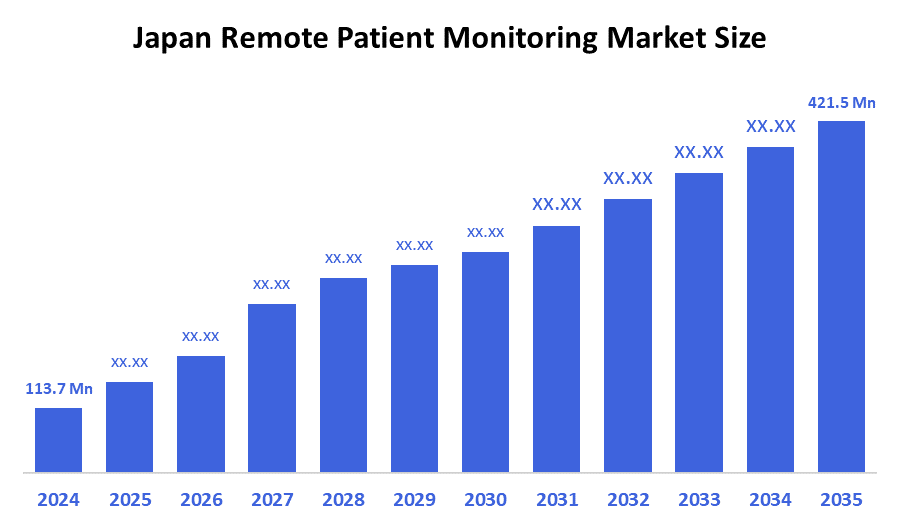

- The Japan Remote Patient Monitoring Market Size Was Estimated at USD 113.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 12.65% from 2025 to 2035

- The Japan Remote Patient Monitoring Market Size is Expected to Reach USD 421.5 Million by 2035

According to a research report published by decision advisor & Consulting, the Japan remote patient monitoring market size is anticipated to reach USD 421.5 million by 2035, growing at a CAGR of 12.65% from 2025 to 2035. The remote patient monitoring market in Japan is driven by Japan's elderly population, high rate of chronic illness, robust government digital health programs, and the growth of the My Number Card infrastructure.

Market Overview

The remote patient monitoring (RPM) market consists of technologies, devices, software platforms, and services that facilitate healthcare providers to observe, assess, and manage patients' health data outside of traditional settings of clinical care. RPM encompasses products such as wearable devices, sensors, mobile health applications, and connected medical devices that can collect and transmit recordings of patient vital signs, such as heart rate, blood pressure, glucose levels, or oxygen saturation, to clinicians in real-time. Japan's remote patient monitoring market is growing quickly in response to the country's aging population, increasing rates of chronic conditions, and heightened interest in receiving care at home. Support from the government is crucial, with several initiatives active under the Ministry of Health, Labour and Welfare to support digital-health initiatives and the nationwide launch of a My Number Card healthcare infrastructure, which allows for improved population health data integration and increases the use of RPM.

In addition, innovative technologies like AI-enabled diagnostics, smart wearables, and interoperable platforms continue to enhance remote care. In addition, there will be more opportunities for RPM in the areas of elderly care, chronic disease management, and partnerships between hospitals, insurers, and device manufacturers. RPM includes the recent announcement of the expansion of digital-health policies, increased subsidies for the digitization of nursing care, and major Japanese medical device companies recently introducing new forms of AI-enabled monitoring devices.

Report Coverage

This research report categorizes the market for the Japan remote patient monitoring market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan remote patient monitoring market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Japan remote patient monitoring market.

Driving Factors

The remote patient monitoring market in Japan is driven by a rapidly aging population, increases in the incidence of chronic diseases, such as diabetes and cardiovascular diseases, and the growing imperative to reduce hospital burden through home-based solutions. Several government-led digital health initiatives to enhance the My Number Card healthcare infrastructure and to support telehealth adoption by MHLW have significantly impacted the growth of the industry. In addition, innovations in AI-enabled diagnostics, wearable sensors, and interoperable health-data platforms have improved monitoring efficiency and effectiveness, leading to increasing demand among healthcare providers and insurers.

Restraining Factors

The remote patient monitoring market in Japan is mostly constrained by strict data privacy regulations, interoperability among legacy hospital systems, and the slow adoption of elderly patients not well-versed in the digital space. Additionally, the large cost of the devices with little or no reimbursements also reduces the ability to deploy at the level necessary to have an impact across healthcare providers.

Market Segmentation

The Japan remote patient monitoring market share is classified into device type and end use.

- The blood pressure monitor segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan remote patient monitoring market is segmented by device type into blood pressure monitor, glucose monitor, heart rate monitor, pulse oximeters, respiratory monitor, and others. Among these, the blood pressure monitor segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Continuous blood pressure monitoring is crucial for controlling cardiovascular risk because hypertension is very common in Japan's elderly population. Healthcare professionals and insurers strongly encourage the widespread use of blood pressure monitors in home health services.

- The hospitals and clinics segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan remote patient monitoring market is segmented by end use into hospitals and clinics, home care settings, and others. Among these, the hospitals and clinics segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to their large patient numbers, well-established reimbursement processes, and significant demand for managing chronic diseases, hospitals and clinics are the main users of RPM technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan remote patient monitoring market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nihon Kohden Corporation

- Omron (Omron Healthcare Co.)

- Fukuda Denshi Co., Ltd.

- Terumo Corporation

- Panasonic Healthcare Co., Ltd.

- Sharp Corporation (Healthcare Devices Division)

- Medirom Healthcare Technologies Inc.

- A&D Company, Limited

- HealthNode

- Medical Edge Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, in response to public need, the mobile version of the My Number Health Insurance Card will be released for use in belonging to an app on a smartphone and for use when accessing care in clinics to facilitate access and verification.

- In August 2025, reports have noted Japan's accelerated interest in expanding digital-health apps, developing standards for EMRs, and evaluating a nationwide data-sharing infrastructure.

- In December 2024, Japan officially phases out traditional health-insurance cards, and all patients are expected to begin using the My Number Card.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. decision advisor has segmented the Japan remote patient monitoring market based on the below-mentioned segments:

Japan Remote Patient Monitoring Market, By Device Type

- Blood Pressure Monitor

- Glucose Monitor

- Heart Rate Monitor

- Pulse Oximeters

- Respiratory Monitor

- Others

Japan Remote Patient Monitoring Market, By End Use

- Hospitals and Clinics

- Homecare Settings

- Others

FAQ’s

Q: What is the Japan remote patient monitoring market size?

A: Japan remote patient monitoring market size is expected to grow from USD 113.7 million in 2024 to USD 421.5 million by 2035, growing at a CAGR of 12.65% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by a rapidly aging population, increases in the incidence of chronic diseases, such as diabetes and cardiovascular diseases, and the growing imperative to reduce hospital burden through home-based solutions. Several government-led digital health initiatives to enhance the My Number Card healthcare infrastructure and to support telehealth adoption by MHLW have significantly impacted the growth of the industry.

Q: What factors restrain the Japan remote patient monitoring market?

A: Constraints include strict data privacy regulations, interoperability among legacy hospital systems, and the slow adoption of elderly patients not well-versed in the digital space.

Q: How is the market segmented by device type?

A: The market is segmented into blood pressure monitor, glucose monitor, heart rate monitor, pulse oximeters, respiratory monitor, and others.

Q: Who are the key players in the Japan remote patient monitoring market?

A: Key companies include Nihon Kohden Corporation, Omron (Omron Healthcare Co.), Fukuda Denshi Co., Ltd., Terumo Corporation, Panasonic Healthcare Co., Ltd., Sharp Corporation (Healthcare Devices Division), Medirom Healthcare Technologies Inc., A&D Company, Limited, HealthNode, and Medical Edge Co., Ltd.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 166 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |