Japan Road Freight Transport Market

Japan Road Freight Transport Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Liquid Goods, Solid Goods, and Others), By Destination (Domestic, International), By End User (Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Japan Road Freight Transport Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Road Freight Transport Market Insights Forecasts to 2035

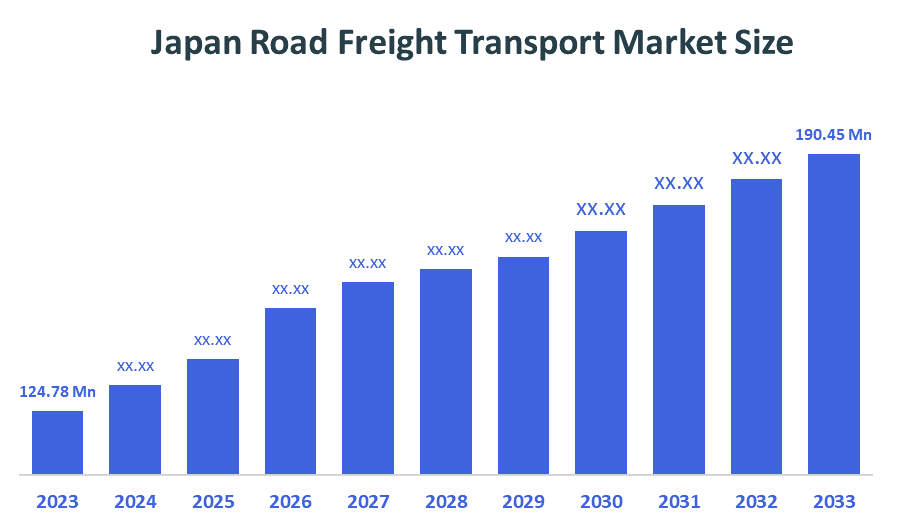

- The Japan Road Freight Transport Market Size Was Estimated at USD 124.78 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.32% from 2025 to 2035

- The Japan Road Freight Transport Market Size is Expected to Reach USD 190.45 Million by 2035

According to a Research Report Published by Decision Advisiors & Consulting, the Japan Road Freight Transport Market size is anticipated to reach USD 190.45 Million by 2035, growing at a CAGR of 4.32% from 2025 to 2035. The Japan road freight transport market is driven by e-commerce expansion, just-in-time logistics demand, urban distribution needs, infrastructure improvements, rising consumer expectations, and technological advancements enhancing efficiency, tracking precision, and reliability.

Market Overview

The Japan road freight transportation market is indeed growing due to several factors, such as rising demand for last-mile delivery services, driven by customers' preference for speedy delivery options. The well-developed infrastructures of Japan, its extensive network of highways, as well as advanced logistics centres, ensure smooth flow from one corner of the nation to another. The country's focus on technological advancement, such as the integration of IoT and telematics in freight operations, has increased efficiency and reduced operational costs, further fueling growth. Government initiatives to modernise the transport sector and reduce carbon emissions have also spurred investments in eco-friendly vehicles, which have contributed to the market's expansion.

In November 2024, Japan plans to create an automated cargo transport corridor known as the conveyor belt road between Tokyo and Osaka to address a truck driver shortage and reduce emissions. This innovative system, set to begin trials in 2027, automates cargo transport, improving efficiency and safety while decreasing reliance on human drivers. Streamlining logistics and integrating with other transport modes will mitigate workforce challenges, enhance operational efficiency, and support sustainable growth, ultimately driving expansion in Japan road freight transportation market.

Report Coverage

This research report categorizes the market for the Japan road freight transport market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan road freight transport market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan road freight transport market.

Driving Factors

Japan road freight transportation market is rapidly experiencing growth due largely in part to increasing demand for last mile delivery services, mainly due to consumers wanting their products delivered as quickly as possible. Additionally, Japan has a well-established infrastructure with a vast amount of highway systems and sophisticated logistics centers that allow for an easy transfer of goods across the nation. Japan's commitment to technological innovation, including the use of Internet of Things (IoT) to enhance the use of telematics in freight operations, has improved operational efficiencies while reducing costs and increasing productivity, thereby contributing toward continued growth in this sector. Besides technology advances, governmental authorities at the local and national levels are providing funding for programmes that seek to change the freight transportation industry by investing in clean equipment and systems. All the new technologies also align with the goals and objectives of the government of Japan to reduce carbon emissions produced by the freight transportation sector.

In November of 2024 the development of this corridor is an attempt to combat the truck driver shortage and reduce the ecological footprint associated with freight transport in Japan by automating the transport of goods between these two metropolitan areas. In order to meet the objective of developing this automated highway, a test programme has already been developed and is planned for implementation in the spring of 2027 to test the effectiveness of automating the transportation of cargo between these couriers, reducing reliance on human truck drivers, thereby improving both safety and efficiency of freight transport operations.

Restraining Factors

The road freight transport market in Japan is restrained by the driver shortages, aging workforce, high operating costs, strict regulations, limited parking, urban congestion, and rising sustainability pressures that challenge efficiency and long-term operational growth.

Market Segmentation

The Japan road freight transport market share is categorized by product type, destination and end user.

- The solid goods segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan road freight transport market is segmented by product type into liquid goods, solid goods, and others. Among these, the solid goods segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by rising manufacturing output, expanding e-commerce volumes, robust retail distribution networks, improved logistics infrastructure, and increasing demand for timely delivery of consumer goods across domestic supply chains, driving segment growth forward.

- The domestic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan road freight transport market is segmented by destination into domestic, international. Among these, the domestic segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to strong nationwide distribution demand, expanding e-commerce activity, efficient domestic logistics networks, frequent short-haul deliveries, increased consumer goods movement, and enhanced infrastructure supporting faster, reliable road-based transportation across Japan.

- The manufacturing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Japan road freight transport market is segmented by end user into agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others. Among these, the manufacturing segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by rising industrial production, increased movement of raw materials and finished goods, growth in automotive and electronics sectors, just-in-time supply chain needs, and expanding domestic distribution requirements across manufacturing hubs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan road freight transport market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Express Co., Ltd

- Yamato Transport Co. Ltd

- Sagawa Express Co. Ltd

- Seino Holdings Co. Ltd

- Hitachi Transport System Ltd

- Mitsui-Soko Holdings Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Mitsui & Co. Ltd in partnership with Shopify Japan, launched Plus Shipping to support the digital transformation of delivery operations for e-commerce merchants in Japan. This service integrates with Japan's major delivery companies, offering a streamlined one-stop solution for delivery orders and payments, reducing operational workloads by up to 93%. Plus, Shipping handles a wide range of delivery needs, from small to large packages, including temperature-controlled transport. This initiative addresses the driver shortage and rising logistics costs, enhancing efficiency and competitiveness in the Japanese e-commerce and road freight transportation markets.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the Japan Road Freight Transport Market based on the below-mentioned segments:

Japan Road Freight Transport Market, By Product Type

- Liquid Goods

- Solid Goods

- Others

Japan Road Freight Transport Market, By Destination

- Domestic

- International

Japan Road Freight Transport Market, By End User

- Agriculture

- Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas

- Mining and Quarrying

- Wholesale and Retail Trade

- Others

FAQ’s

Q: What was the size of the Japan road freight transport market in 2024?

A: The market was valued at USD 124.78 million in 2024.

Q: What is the expected market size by 2035?

A: It is projected to reach USD 190.45 million by 2035.

Q: What is the forecasted CAGR for 2025–2035?

A: The market is expected to grow at a CAGR of 4.32%.

Q: What factors are driving market growth?

A: Growth is driven by e-commerce expansion, just-in-time logistics, infrastructure upgrades, and advanced technologies like IoT and telematics.

Q: Which segment dominated the market in 2024?

A: The solid goods and domestic segments held the largest shares, with manufacturing leading among end users.

Q: What challenges does the market face?

A: Key challenges include driver shortages, aging workforce, high operating costs, congestion, and strict regulatory requirements.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 159 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |