Japan Rolling Stock Market

Japan Rolling Stock Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Diesel Locomotive, Electric Locomotive, and Others), By Locomotive Technology (Conventional Locomotive, Turbocharge Locomotive, Maglev), By Application (Passenger Coach, Freight Wagon), and Japan Rolling Stock Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Rolling Stock Market Insights Forecasts to 2035

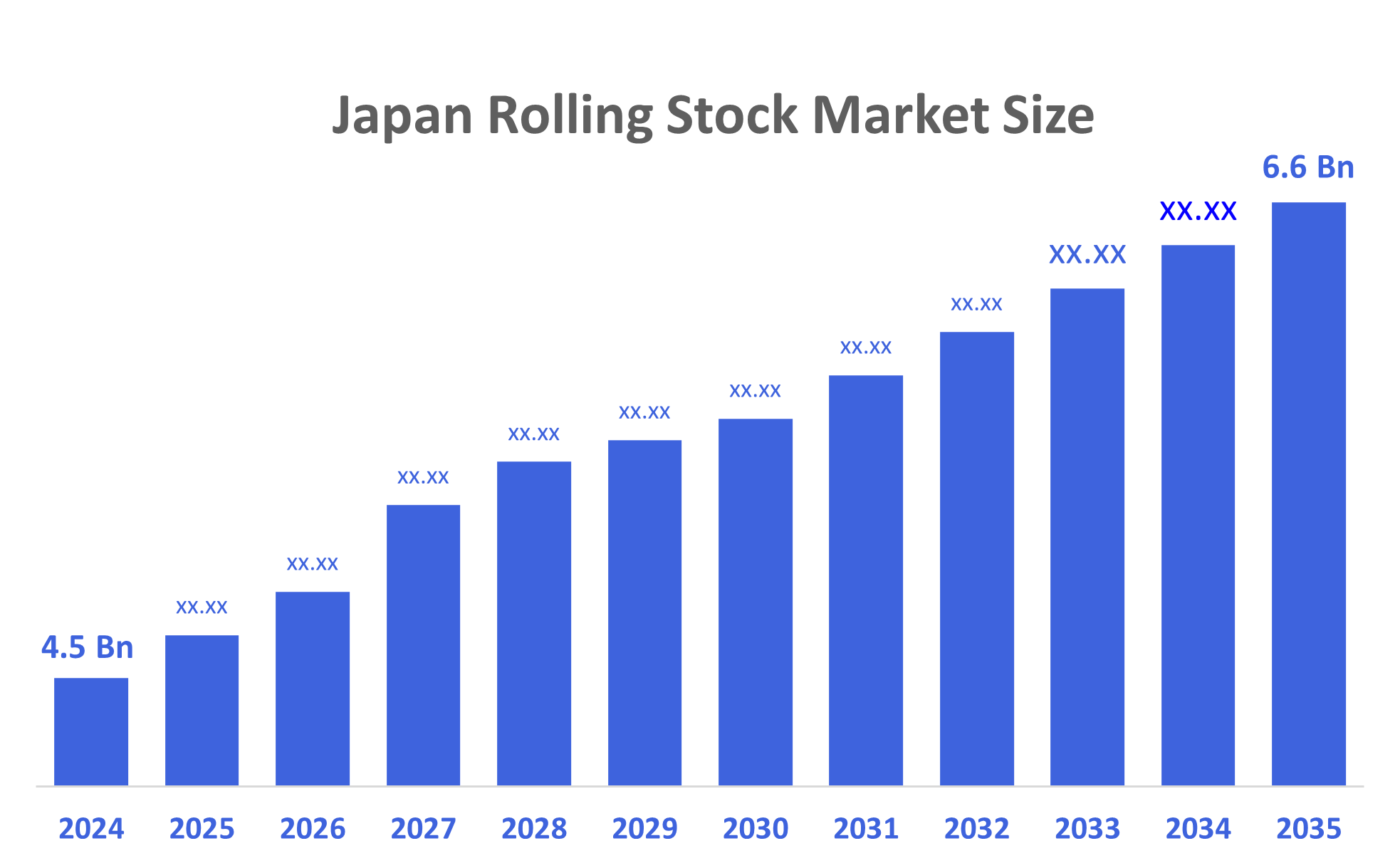

- The Japan Rolling Stock Market Size Was Estimated at USD 4.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.54% from 2025 to 2035

- The Japan Rolling Stock Market Size is Expected to Reach USD 6.6 Billion by 2035

According to a research report published by Decisions Advisors, The Japan Rolling Stock Market Size is Anticipated to Reach USD 6.6 Billion by 2035, growing at a CAGR of 3.54% from 2025 to 2035. The Japan rolling stock market is driven by urban transit expansion, aging fleet replacements, smart-rail technologies, sustainability policies, high-speed rail investments, safety upgrades, and growing demand for efficient, low-emission passenger and freight transportation solutions

Market Overview

The Japan rolling stock market refers to the industry involved in the design, manufacturing, maintenance, and modernisation of trains, including high-speed, commuter, and freight rail vehicles. It encompasses technological innovations, safety upgrades, and sustainable solutions to meet domestic transit needs, replace aging fleets, and support Japan’s advanced rail infrastructure, while also addressing global export opportunities. The magnifying implementation of smart technologies in rail systems is an essential trend in Japan's rolling stock landscape. With the rapid incorporation of big data, IoT, and AI, Japan is gravitating towards a completely digitalised rail system. Such technologies are currently being deployed to improve passenger experiences, manage train schedules, and enhance predictive maintenance via automated systems and real-time tracking.

Moreover, the active strive for enhanced safety measures and better operational efficacy is accelerating investments in smart rail infrastructure. In addition, as urbanisation proliferates and transportation demands transform, smart rail solutions are anticipated to play a crucial role in expanding the Japan rolling stock market share. For instance, as per industry reports, 93.1% of the total population in Japan, i.e., 114.65 million people, is urban in 2025.

Growing environmental concerns and Japan's commitment to sustainability are driving the demand for eco-friendly rolling stock solutions. For instance, as per industry reports, transportation sector accounts for 18.5% of total carbon emissions in Japan. In line with this, reducing rail usage or shutting rail lines will significantly prompt commuters to use buses or cars, resulting in elevating carbon levels. As part of its effort to reduce carbon emissions and meet climate goals, Japan is increasingly prioritizing electrification in its rail systems, transitioning away from diesel-powered locomotives.

Report Coverage

This research report categorizes the market for the Japan rolling stock market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan rolling stock market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan rolling stock market.

Driving Factors

The rolling stock markets in Japan are driven by substantial government investment pertaining to rail infrastructure. Japan's government has been constantly allocating significant funds to proliferate as well as modernise its rail network, with a strong focus on improving regional connectivity and high-speed rail systems. This target for infrastructure development fosters the burgeoning requirement for innovative rolling stock, encompassing locomotives, passenger coaches, and freight wagons.

For instance, as per industry reports, in October 2024, East Japan Railway Co. announced consideration of plans to develop a Shinkansen car (Japanese bullet train) particularly for freight purposes. It also plans to commercialise high-volume, high-speed transportation of freight in 2025. In addition, with steady investments in the expansion of Shinkansen lines, urban transit systems, and rail electrification, the government exhibits a critical role in fueling technological advancements as well as Japan rolling stock market growth.

Restraining Factors

The rolling stock market in Japan is restrained by high production and maintenance costs, limited domestic demand, stringent regulatory standards, aging infrastructure challenges, slow adoption of new technologies, and strong competition from global manufacturers.

Market Segmentation

The Japan rolling stock market share is categorized by product type, locomotive technology and application.

- The electric locomotive segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan rolling stock market is segmented by product type into diesel locomotive, electric locomotive, and others. Among these, the electric locomotive segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by rising demand for energy-efficient transportation, government initiatives promoting electrification, expansion of urban rail networks, modernization of aging fleets, and increasing focus on reducing carbon emissions.

- The conventional locomotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan rolling stock market is segmented by locomotive technology into conventional locomotive, turbocharge locomotive, maglev. Among these, the conventional locomotive segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to widespread existing infrastructure compatibility, lower operational costs, proven reliability, ongoing fleet replacements, and steady demand for commuter and freight rail services across Japan.

- The passenger coach segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan rolling stock market is segmented by application into passenger coach, freight wagon. Among these, the passenger coach segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to increasing urbanisation, rising demand for efficient public transportation, expansion of high-speed rail networks, government investments in passenger mobility, and modernisation of the ageing commuter train fleet.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan rolling stock market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Sharyo

- Kawasaki Heavy Industries

- Kinki Sharyo Co., Ltd

- Japan Transport Engineering Company

- Hitachi, Ltd

- Mitsubishi Heavy Industries

- Niigata Transys Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, Hybari, Japan's first hydrogen fuel cell-based hybrid train showcased on the JR Tsurumi Line for the media. This innovative train is collaboratively developed by Hitachi and Toyota Motor Corp.

- In September 2024, Hitachi Rail announced strategic partnership with DB ESG, Innovate UK, and the University of Birmingham to develop more efficient and smaller battery pack for trains in order to improve rail efficiency. The compact battery design will also facilitate train weight reduction, along with simplifying maintenance and advancing operational efficacy.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Rolling Stock Market based on the below-mentioned segments:

Japan Rolling Stock Market, By Product Type

- Diesel Locomotive

- Electric Locomotive

- Others

Japan Rolling Stock Market, By Locomotive Technology

- Conventional Locomotive

- Turbocharge Locomotive

- Maglev

Japan Rolling Stock Market, By Application

- Passenger Coach

- Freight Wagon

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |