Japan Saline Solution Market

Japan Saline Solution Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Normal Saline, Ringer's Lactate Solution, Dextrose, and Others), By End Use (Hospitals, Clinics, Ambulatory Surgery Center, Home Care Center, and Others), and Japan Gelatin Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Saline Solution Market Insights Forecasts to 2035

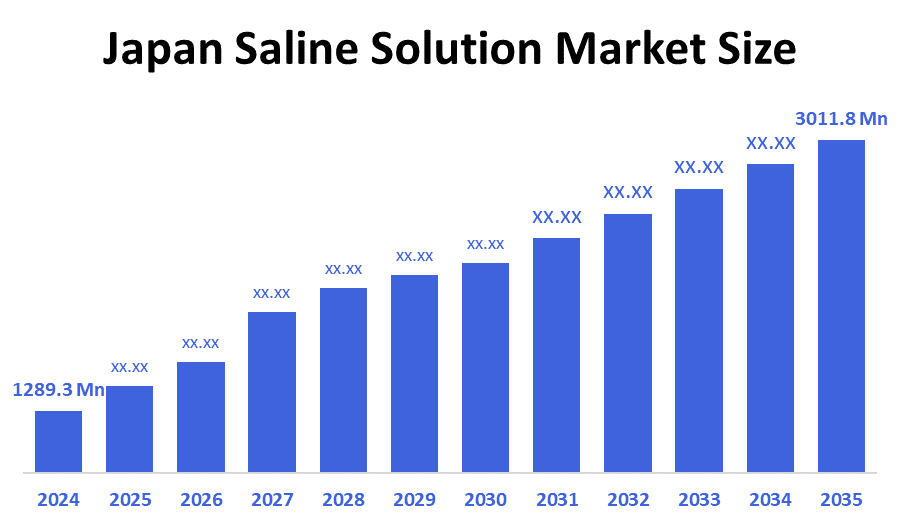

- The Japan Saline Solution Market Size Was Estimated at USD 1289.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.02% from 2025 to 2035

- The Japan Saline Solution Market Size is Expected to Reach USD 3011.8 Million by 2035

According to a research report published by decision advisor & Consulting, the Japan saline solution market size is anticipated to reach USD 3011.8 million by 2035, growing at a CAGR of 8.02% from 2025 to 2035. The saline solution market in Japan is driven by a rapidly aging population, rising demand for essential medical treatments, improved healthcare infrastructure, and government initiatives to strengthen the reliability and accessibility of the pharmaceutical supply chain.

Market Overview

The saline solution industry represents the economic sector that produces, distributes, and sells sterile saltwater solutions for medical uses. Saline solutions are most commonly 0.9% sodium chloride and are frequently utilized to provide hydration, balance electrolytes, wash and clean wounds, mix medications, and as intravenous fluids in various healthcare environments, including hospitals, clinics, and home healthcare. Japan's saline solution market is growing as medical needs driven by the rapidly aging population and rising chronic disease rates, increase demand for IV fluids, wound irrigation, and drug dilution solutions. The Japanese government has taken an active role in dealing with the stable supply of medically essential drugs and infusion products, such as saline solutions, which are relevant to the Japanese market. Most recently, regulatory changes, including an amendment to the Pharmaceutical and Medical Devices (PMD) Act in May 2025, require manufacturers to appoint a stable supply management officer in their organization and notify the Ministry of Health, Labour and Welfare (MHLW) of any risks to supply stability.

Additionally, the FY2023 supplementary budget included financial resources to bolster funding for pharmaceutical manufacturing and support drug stability. Developments are supporting technological advances in sterile filling, automated packaging and distribution, and healthcare's digital transformation, improving safety and distribution. Promise exists in domestic production, home care infusion product markets, and value-added saline products.

Report Coverage

This research report categorizes the market for the Japan saline solution market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan saline solution market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Japan saline solution market.

Driving Factors

The saline solution market in Japan is driven by a rapidly aging Japanese population, contributing to increases in demand for IV therapy, hydration, and wound care indications. The rising burden of chronic disease, an increasing number of surgical procedures, and increasing home care services also increase usage. The government's ongoing efforts to bolster healthcare infrastructure, ensure resilient pharmaceutical supply chains, and foster domestic production also play a significant current role. Continued enhancements in sterile manufacturing and automated packaging will also improve product availability and safety while providing continuous contributions to growth in the country.

Restraining Factors

The saline solution market in Japan is mostly constrained by regulatory burden, elevated production and quality-control costs, and reliance on imported raw materials. Further, inconsistent availability and slow market growth are impeded by supply chain hurdles, labor shortages, and low domestic manufacturing capacity.

Market Segmentation

The Japan saline solution market share is classified into product type and end use.

- The normal saline segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan saline solution market is segmented by product type into normal saline, ringer's lactate solution, dextrose, and others. Among these, the normal saline segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to 0.9% sodium chloride (normal saline) being the most commonly used IV fluid in hospitals, emergency room care, surgery, dehydration management, drug diluent, etc., making it applicable to numerous clinical scenarios, its low cost, common use in older or chronically ill patients, and its essential-medicine status in Japan's MHLW hierarchy leading to it being the highest volume and highest revenue segment.

- The hospitals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan saline solution market is segmented by end use into hospitals, clinics, ambulatory surgery center, home care center, and others. Among these, the hospitals segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Hospitals play a leading role because of their high patient volume and heavy use of IV fluids for surgery, emergency room trauma care, inpatient treatments, and chronic disease management. In addition, hospitals carry large, continuous inventories to satisfy regulatory requirements and prevent disruption of care in a medical emergency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan saline solution market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nipro Corporation

- Fuso Pharmaceutical Industries

- Otsuka Pharmaceutical

- Hikari Pharmaceutical

- Terumo Corporation

- Alfresa Pharma

- Viatris Japan

- Nichiyaku

- Takeda Pharmaceutical

- Nisshin Pharmaceutical

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, the latest Pharmaceutical Law became enforced (Drug, Quality, Safety Act), adding a stable supply mechanism for key essential drugs.

- In August 2025, the MHLW announced its 6th “Stable Supply Support” fund, which prescribes key drugs to support domestic manufacturing of key APIs.

- In May 2025, the amendment to the PMD Act was approved, which states that MAHs will need to add a “Supply System Manager” as a member of their organization while also reporting to the MHLW any supply chain vulnerabilities to ensure a stable supply of a drug to the market.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. decision advisor has segmented the Japan saline solution market based on the below-mentioned segments:

Japan Saline Solution Market, By Product Type

- Normal Saline

- Ringer's Lactate Solution

- Dextrose

- Others

Japan Saline Solution Market, By End Use

- Hospitals

- Clinics

- Ambulatory Surgery Center

- Home Care Center

- Others

FAQ’s

Q: What is the Japan saline solution market size?

A: Japan saline solution market size is expected to grow from USD 1289.3 million in 2024 to USD 3011.8 million by 2035, growing at a CAGR of 8.02% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by a rapidly aging Japanese population, contributing to increases in demand for IV therapy, hydration, and wound care indications. The rising burden of chronic disease, an increasing number of surgical procedures, and increasing home care services also increase usage. The government's ongoing efforts to bolster healthcare infrastructure, ensure resilient pharmaceutical supply chains, and foster domestic production also play a significant current role.

Q: What factors restrain the Japan saline solution market?

A: Constraints include regulatory burden, elevated production and quality-control costs, and reliance on imported raw materials. Further, inconsistent availability and slow market growth are impeded by supply chain hurdles, labor shortages, and low domestic manufacturing capacity.

Q: How is the market segmented by product type?

A: The market is segmented into normal saline, ringer's lactate solution, dextrose, and others.

Q: Who are the key players in the Japan saline solution market?

A: Key companies include Nipro Corporation, Fuso Pharmaceutical Industries, Otsuka Pharmaceutical, Hikari Pharmaceutical, Terumo Corporation, Alfresa Pharma, Viatris Japan, Nichiyaku, Takeda Pharmaceutical, and Nisshin Pharmaceutical.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 204 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |