Japan School Furniture Market

Japan School Furniture Market Size, Share, By Product Type (Desks, Tables, Chairs, Stools, Storage Units, and Lockers), By Material (Wood, Metal, and Plastic), Japan School Furniture Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan School Furniture Market Insights Forecasts to 2035

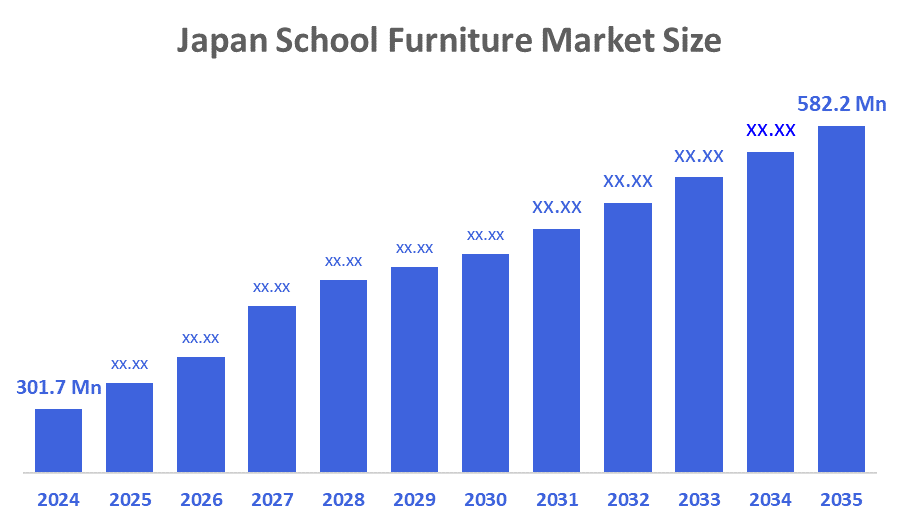

- Japan School Furniture Market Size 2024: USD 301.7 Mn

- Japan School Furniture Market Size 2035: USD 582.2 Mn

- Japan School Furniture Market Size CAGR 2024: 6.16%

- Japan School Furniture Market Size Segments: Product Type and Material

The Japan School Furniture Market Size includes desks, chairs, storage areas, laboratory tables, lockers, and ergonomic seating of various kinds intended for kindergartens, primary and secondary schools, and higher educational institutions. Safe and ergonomically designed goods for the users and the educational settings are the main features of the market. Other factors that contribute to the growth are government measures that improve the quality of learning, the enrollment of more and more students at the private sector, and the transition to versatile, cooperative teaching methods that require kids' furniture which is modern, adjustable, and suitable furniture for classrooms.

Japan had planned a lot of things to support the school furniture demand. One of them was the MEXT, which covered the biggest share of one-third of the costs incurred on public school construction or renovation. For 2023-2025, the fund for facility upgrades was ¥68.7 billion (USD 460 million). GIGA School Program allocated ¥231.8 billion (USD 1.6 billion) for ICT classrooms. Another way in which school governments helped private students and helped in the establishment of modern and ergonomic learning environments was through private school subsidies and grants for educational infrastructure.

Some of the major changes in Japan's furniture for schools market is Kotobuki Seating's refurbished showroom, Okamura's ergonomic designs winning awards, Kurogane Kks' multifunctional product "CoStair" introduction, Nishio Furniture's wellness endorsement, and Axona Aichi's products that save space. All of these developments indicate a trend toward the use of technology and the right materials in ergonomics, sustainability, flexibility, and modern classroom solutions.

Market Dynamics of the Japan School Furniture Market:

The Japan school furniture market size is driven by the government’s investment into educational infrastructure and both the increasing enrollment and modernisation of classrooms. Furthers in growth will continue as ergonomic and age-appropriate furniture is being used more frequently, the demand to integrate digital media tools into classrooms, and the need for adaptable and collaborative learning environments. Also, sustainability initiatives promote the use of eco-friendly and recycled products. Other factors impacting this market are the private education institutions and international school systems, both creating the demand for more upscale and innovative designs for their students. In addition, school programs funded by the government (GIGA) to support the use of technology demonstrate an avenue to upgrade furniture within educational institutions.

The Japan school furniture market size is restrained by the high costs of manufacturing and imports, strict safety regulations, limited budgets for public schools, slow acceptance of modern designs in certain areas, and low-cost imported furniture competition, which all serve to restrict rapid market growth.

Future opportunities in the Japan school furniture market are likely to consist of smart and modular classroom furniture, ergonomic designs, adjustable desks and chairs, collaborative learning spaces, and eco-friendly materials. The changes are aimed at creating flexible layouts, digital integration for ICT classrooms, space-saving solutions, and sustainable production methods that will help meet the ever-changing educational needs.

Market Segmentation

The Japan School Furniture Market share is classified into product type and material.

By Product Type:

The Japan school furniture market size is divided by product type into desks, tables, chairs, stools, storage units, and lockers. Among these, the desks segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Desks are the most profitable product category because of their crucial function in classrooms, frequent replacement, ergonomic and customizable designs for different age groups, and high demand in both public and private schools.

By Material:

The Japan school furniture market size is divided by material into wood, metal, and plastic. Among these, the wood segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Wood is the material of choice for desks, seats, and storage units in schools because of its durability, aesthetic appeal, ergonomic adaptability, and popularity in both classic and modern classrooms.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan school furniture market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan School Furniture Market:

- MASS SET Co., Ltd.

- Nihon Kyoiku Bihin Co., Ltd.

- Uchida Yoko Co., Ltd.

- Okamura Corporation

- Kokuyo Co., Ltd.

- Nitori Co., Ltd.

- Itoki Corporation

- HAYASHI KOGYO Co., Ltd.

- Takara Belmont Corporation

- Katori Co., Ltd.

- Others

Recent Developments in Japan School Furniture Market:

In November 2025, Kokuyo Co., Ltd. unearthed the forthcoming Puzzme table & stool set, aimed to be utilized in versatile learning environments, and is expected to be launched in March 2026 to cater to individualized classroom activities.

In March 2025, Nishio Furniture got certified as a Health & Productivity Management Excellent Corporation 2025, which highlights the corporation's dedication to the production of safe and quality educational furniture.

In August 2023, Kokuyo introduced the “Campus for SCHOOL” movable desk and chair set that can be arranged in different ways and is suitable for ICT friendly classrooms, thus aiding the GIGA School initiative.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan School Furniture market based on the below-mentioned segments:

Japan School Furniture Market, By Product Type

- Desks

- Tables

- Chairs

- Stools

- Storage Units

- Lockers

Japan School Furniture Market, By Material

- Wood

- Metal

- Plastic

FAQ

Q: What is the Japan school furniture market size?

A: Japan school furniture market is expected to grow from USD 301.7 million in 2024 to USD 582.2 million by 2035, growing at a CAGR of 6.16% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the government’s investment in educational infrastructure and the increasing enrollment and modernisation of classrooms. Furthers in growth will continue as ergonomic and age-appropriate furniture is being used more frequently, the demand to integrate digital media tools into classrooms, and the need for adaptable and collaborative learning environments. Also, sustainability initiatives promote the use of eco-friendly and recycled products. Other factors impacting this market are the private education institutions and international school systems, both creating the demand for more upscale and innovative designs for their students.

Q: What factors restrain the Japan school furniture market?

A: Constraints include the high costs of manufacturing and imports, strict safety regulations, limited budgets for public schools, slow acceptance of modern designs in certain areas, and low-cost imported furniture competition, which all serve to restrict rapid market growth.

Q: How is the market segmented by product type?

A: The market is segmented into desks, tables, chairs, stools, storage units, and lockers.

Q: Who are the key players in the Japan school furniture market?

A: Key companies include MASS?SET Co., Ltd., Nihon Kyoiku Bihin Co., Ltd., Uchida Yoko Co., Ltd., Okamura Corporation, Kokuyo Co., Ltd., Nitori Co., Ltd., Itoki Corporation, HAYASHI KOGYO Co., Ltd., Takara Belmont Corporation, Katori Co., Ltd., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |