Japan Self-Monitoring Blood Glucose Device Market

Japan Self-Monitoring Blood Glucose Device Market Size, Share, and COVID-19 Impact Analysis, By Components (Glucometer Devices, Test Strips, and Lancets, Others), By Application (Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Others), and Japan Self-Monitoring Blood Glucose Device Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

Japan Self-Monitoring Blood Glucose Device Market Insights Forecasts to 2035

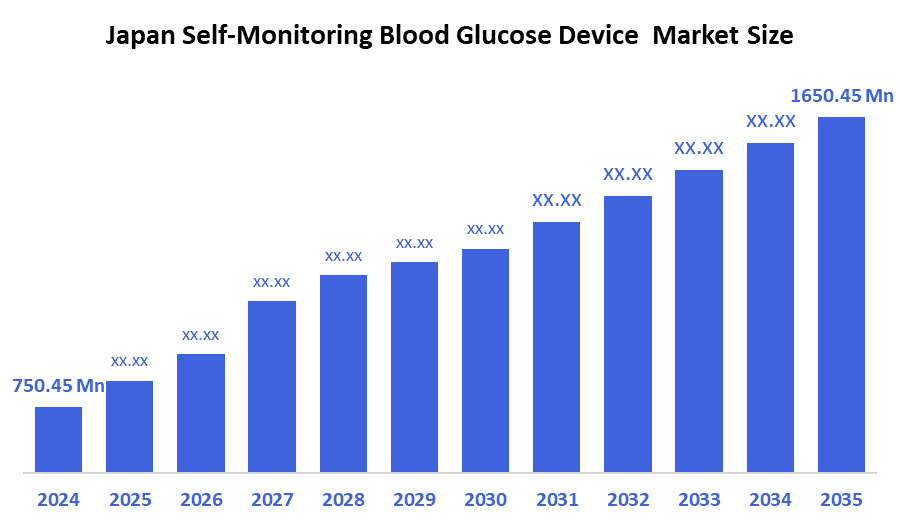

- The Japan Self-Monitoring Blood Glucose Device Market Size Was Estimated at USD 750.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.43% from 2025 to 2035

- The Japan Self-Monitoring Blood Glucose Device Market Size is Expected to Reach USD 1,650.45 Million by 2035

According to a research report published by decision advisor & Consulting, the Japan Self-Monitoring Blood Glucose Device Market size is anticipated to reach USD 1,650.45 Million by 2035, growing at a CAGR of 7.43% from 2025 to 2035. The Japan self-monitoring blood glucose device market is driven by the rising prevalence of diabetes and growing awareness of early disease management, the increasing adoption of digital health tools and user-friendly glucose monitoring technologies and supportive government initiatives promoting better chronic disease care and home-based monitoring.

Market Overview

The Japan self-monitoring blood glucose devices market is one of the highly critical segments in the health sector focused on servicing patients with diabetes and helping them control their blood glucose levels. A SMBG device can be described as a portable self-monitoring tool whose application is by a patient to measure his or her blood glucose levels at home; this helps provide them with critical information necessary for them to make informed decisions regarding their insulin dosage, diet, and exercise. These usually consist of finger-pricking, but a small sample of blood will be taken, and through direct analysis in the device, a glucose reading is given. The results are usually shown on a digital screen and can be stored and further tracked, and shared with healthcare providers.

SMBG devices have become very indispensable in diabetes care, enabling patients to adopt steps for the control of their own health and preventing all these complications associated with such uncontrolled blood sugar levels. Japan is experiencing a high demand for SMBG, resulting from diabetes prevalence, advancement in the technology of devices, and high patient awareness of the need for self-monitoring. In addition, there is the high adoption rate of digital health solutions in the Japan market, offering lots of space for innovative SMBG devices with wireless connectivity, integration with smartphones, and CGM.

Report Coverage

This research report categorizes the market for the Japan self-monitoring blood glucose device market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan self-monitoring blood glucose device market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan self-monitoring blood glucose device market.

Driving Factors

The self-monitoring blood glucose device markets in Japan are driven by the increasing prevalence of diabetes, coupled with a growing awareness of proactive health management, which is fuelling demand. Continuous glucose monitoring systems are gaining rapid traction, offering users the convenience of real-time glucose data without the need for frequent finger-prick testing.

This shift is further accelerated by technological advancements, including the integration of artificial intelligence and machine learning algorithms to enhance accuracy, provide predictive analytics, and personalise treatment plans. The market is also witnessing a growing demand for integrated digital health solutions, with devices seamlessly connecting to mobile apps and electronic health records for improved data management and remote patient monitoring capabilities. This trend aligns perfectly with the increasing emphasis on personalised healthcare in Japan.

Restraining Factors

The self-monitoring blood glucose device market in Japan is restrained by growing preference for continuous glucose monitoring systems that reduce the need for traditional SMBG devices, the high ongoing cost of test strips and device maintenance and limited reimbursement policies that reduce patient affordability and frequent usage.

Market Segmentation

The Japan self-monitoring blood glucose devices market share is categorized by components and application.

- The test strips segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan self-monitoring blood glucose devices market is segmented by components into glucometer devices, test strips, lancets, and others. Among these, the test strips segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the high frequency of daily glucose testing among diabetic patients, the continual demand for consumables that provide stable recurring revenue, and ongoing improvements in strip accuracy, convenience, and compatibility with modern glucose meters that support consistent market expansion.

- The type 2 diabetes segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan self-monitoring blood glucose devices market is segmented by application into type 1 diabetes, type 2 diabetes, gestational diabetes, and others. Among these, the type 2 diabetes segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the rising prevalence of lifestyle-related diabetes in Japan, increasing adoption of home-based glucose monitoring for long-term disease management, and expanding awareness initiatives that encourage regular testing to prevent complications and improve glycaemic control across a growing patient population.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan self-monitoring blood glucose devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roche Diabetes Care

- Abbott Diabetes Care

- Terumo

- LifeScan

- Menarini

- Nipro

- Arkray Inc

- Ascensia Diabetes Care

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Astellas Pharma partners with Roche Diabetes Care Japan for the development and commercialization of Accu-Chek Guide Me blood glucose monitoring system with advanced accuracy as a combined medical product with BlueStar.

- In March 2022, Quantum Operation Inc.a Tokyo-based healthcare IoT startup, presented the world's first non-invasive glucose monitor capable of continuous measurement. It measures the blood sugar from the wrist without any pricks.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. decision adviosr has segmented the Japan Self-Monitoring Blood Glucose Devices Market based on the below-mentioned segments:

Japan Self-Monitoring Blood Glucose Devices Market, By Components

- Glucometer Devices

- Test Strips

- Lancets

- Others

Japan Self-Monitoring Blood Glucose Devices Market, By Application

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

- Others

FAQ’s

Q: What was the size of the Japan SMBG device market in 2024?

A: The market size was estimated at USD 750.45 million in 2024.

Q: What is the expected market size by 2035?

A: The market is projected to reach USD 1,650.45 million by 2035.

Q: What is the CAGR expected during 2025–2035?

A: The Japan SMBG market is expected to grow at a CAGR of 7.43%.

Q: Which component segment held the largest share in 2024?

A: The test strips segment accounted for the largest revenue share in 2024.

Q: What drives the growth of the test strips segment?

A: High testing frequency, recurring consumable demand, and improved accuracy drive this segment.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 202 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |