Japan Self-Monitoring Blood Glucose Devices Market

Japan Self-Monitoring Blood Glucose Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Glucometer Devices, Testing Strips, Lancets, and Others), By End User (Hospitals, Specialty Facilities, Home Care, and Others), and Japan Self-Monitoring Blood Glucose Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Self-Monitoring Blood Glucose Devices Market Insights Forecasts to 2035

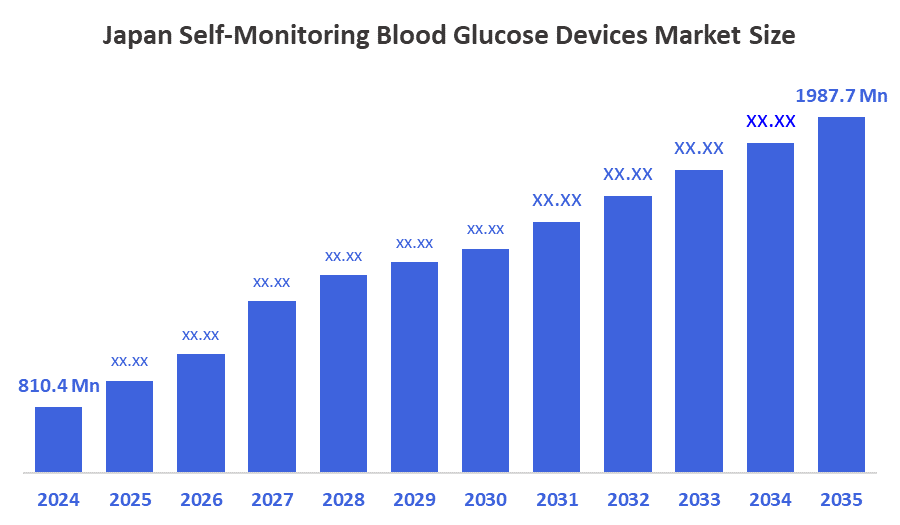

- The Japan Self-Monitoring Blood Glucose Devices Market Size Was Estimated at USD 810.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.5% from 2025 to 2035

- The Japan Self-Monitoring Blood Glucose Devices Market Size is Expected to Reach USD 1987.7 Million by 2035

According to a research report published by Decision Advisors, the Japan self-monitoring blood glucose devices market size is anticipated to reach USD 1987.7 million by 2035, growing at a CAGR of 8.5% from 2025 to 2035. The self-monitoring blood glucose devices market in Japan is driven by the rising incidence of diabetes in Japan as well as the expanding demand for practical and precise glucose monitoring devices.

Market Overview

The market for self-monitoring blood glucose devices comprises the sector involved in products and technologies that allow individuals, especially individuals with diabetes, to measure and monitor their blood glucose levels on a regular basis, with accuracy, in the home or clinical setting. Blood glucose meters, test strips, lancets, and smart connectivity to monitor trends and management of treatment make up this market. The Japanese market for SMBG is growing, driven by the rising incidence of diabetes and the increasing number of older individuals, creating demand for home glucose monitoring and diabetes self-management systems. Expanded government health policy and other insurance reimbursement for diabetes management coverage (most notable of these is expanded coverage of CGM systems such as FreeStyle Libre) have alleviated financial barriers to access. There are developments in technology such as Bluetooth-enabled meters, smartphone platform options, better BG washing devices & test strips, sensors, and data analytics integration, making clinical usage and workflow easier. There is room to engage in digitally enabled health integration, remote visit care, and partnership arrangements between device makers and health providers to assist adherence and clinical proof of benefit.

Report Coverage

This research report categorizes the market for the Japan self-monitoring blood glucose devices market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan self-monitoring blood glucose devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Japan self-monitoring blood glucose devices market.

Driving Factors

The self-monitoring blood glucose devices market in Japan is driven by the increasing prevalence of diabetes, coupled with the rapid growth of the older population reliant on constant glucose monitoring. Additionally, government reimbursement policies for diabetes testing supplies have also expanded coverage for their most advanced SMBG and continuous glucose monitoring (CGM) systems, lowering costs for families. Garrettting technology like Bluetooth-enabled meters, smartphone connectivity, and cloud analytics for patient use helps with patient convenience and clinical insight. Greater adoption of remote patient monitoring and a strong healthcare system continue to enhance the SMBG devices market by improving self-management practices toward long-term diabetes management.

Restraining Factors

The self-monitoring blood glucose devices market in Japan is mostly constrained by rising consumer preference for CGM systems, leading to a reduced reliance on test strips, high prices of advanced and newer devices, and some questions around accuracy and user error associated with home monitoring. Additional factors constraining the Japan SMBG devices market are limited knowledge for patient education and compliance.

Market Segmentation

The Japan self-monitoring blood glucose devices market share is classified into product and end user.

- The testing strips segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan self-monitoring blood glucose devices market is segmented by product into glucometer devices, testing strips, lancets, and others. Among these, the testing strips segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to testing strips are consumables needed for each glucose measurement, they have a higher recurrent demand than one-time equipment purchases, accounting for the greatest revenue share.

- The home care segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan self-monitoring blood glucose devices market is segmented by end user into hospitals, specialty facilities, home care, and others. Among these, the home care segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment dominance because most diabetic patients prefer frequent glucose testing at home for convenience, independence, and better disease control, it has the greatest revenue share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan self-monitoring blood glucose devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ARKRAY, Inc.

- Terumo Corporation

- Quantum Operation Inc.

- Provigate, Inc.

- Light Touch Technology Co., Ltd.

- Nipro Corporation

- Omron Corporation

- Panasonic Corporation

- Gunze Ltd.

- H.U. Group Research Institute G.K.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, Light Touch Technology Co., Ltd. raised $1.08 million to develop a mid-infrared laser-based non-invasive blood glucose sensor capable of measuring blood glucose levels in five seconds.

- In August 2024, Provigate, Inc., a company originating from UC Berkeley, formally launched a government-supported research effort focused on developing a non-invasive weekly average blood glucose monitoring system designed initially for home use.

- In October 2023, Terumo Corporation confirmed it will discontinue the sale of Dexcom, Inc. CGM systems in Japan on March 31, 2024, with that function moving to Dexcom.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Japan self-monitoring blood glucose devices market based on the below-mentioned segments:

Japan Self-Monitoring Blood Glucose Devices Market, By Product

- Glucometer Devices

- Testing Strips

- Lancets

- Others

Japan Self-Monitoring Blood Glucose Devices Market, By End User

- Hospitals

- Specialty Facilities

- Home Care

- Others

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |