Japan Smart Manufacturing Software Market

Japan Smart Manufacturing Software Market Size, Share, and COVID-19 Impact Analysis, By Software Type (Digital Twin, Enterprise Resource Planning (ERP), Asset Performance Management, MES Automation and Orchestration, Maintenance Management, 3D Printing/Modelling, Product Lifecycle Management, and Others), By Industry (Process Industry and Discrete Industry), and Japan Smart Manufacturing Software Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Smart Manufacturing Software Market Size Insights Forecasts to 2035

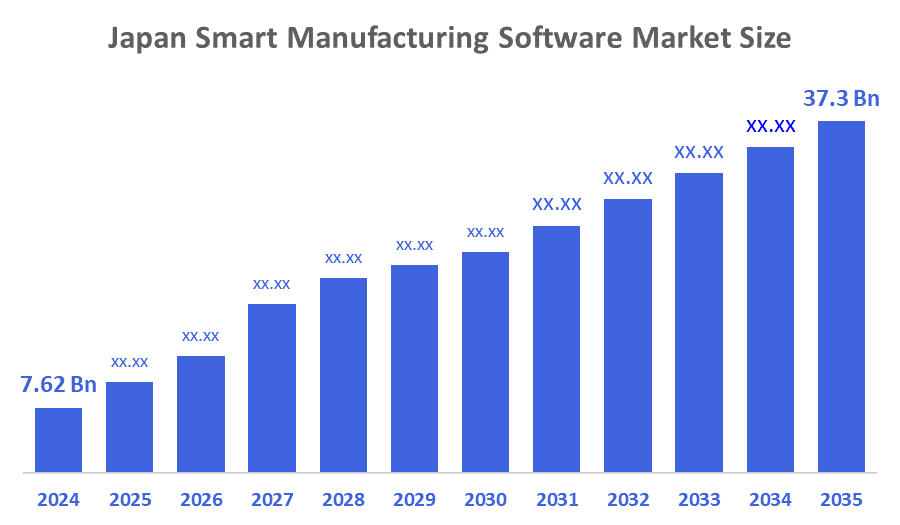

- The Japan Smart Manufacturing Software Market Size Was Estimated at USD 7.62 Billion in 2024.

- The Market Size is expected to Grow at a CAGR of around 15.53% from 2025 to 2035.

- The Japan Smart Manufacturing Software Market Size is expected to reach USD 37.3 Billion by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Smart Manufacturing Software Market Size is anticipated to Reach USD 37.3 Billion by 2035, Growing at a CAGR of 15.53% from 2025 to 2035. The market is driven due to increasing industrial automation, strong government support for Industry 4.0, and expanding integration of AI and IoT in production systems. Adoption in important industries, including automotive, electronics, and machinery, is being driven by the demand for real-time data insights, predictive maintenance, and operational efficiency.

Market Overview

The smart manufacturing software market in Japan is monitored with very close eyes for many reasons. In addition, there are other types of smart manufacturing software products available, including products for factory automation, data analytics, supply chain visibility, and quality control. Because of the government's commitment to creating the "Next Generation" of Japanese manufacturing, many companies have placed their faith in AI, IoT, and other advanced technologies to improve their operational performance. At present, areas of opportunity for further development of this industry include expanding apportionments for additional sectors beyond just manufacturing, such as the pharmaceuticals industry, the food processing industry, and other areas where there are greater demands or needs, and providing cloud-based, scalable solutions. Overall, the Japanese government's flagship vision for the development of a "Super-Smart Society" is at the heart of this initiative; therefore, it will continue to be the basis of development for smart manufacturing software products over the next several years, especially since manufacturing is a key sector within the overall plan for the Digital Transformation of many segments of the overall economy via AI, IoT, robotics, and enhanced use of data analytics.

Report Coverage

This research report categorizes the market for the Japan smart manufacturing software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan smart manufacturing software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan smart manufacturing software market.

Driving Factors

The Japanese smart manufacturing software market is mainly driven by government initiatives like "Society 5.0," which promotes digital transformation, and the urgent need to address labor shortages through automation. Additionally, a demand for increased efficiency and quality, the modernization of IT infrastructure, and the adoption of AI, IoT, and predictive analytics to enhance production processes and energy efficiency.

Restraining Factors

The Japanese smart manufacturing software market is restrained by high initial investment costs for technology, a significant shortage of skilled IT and tech professionals, and challenges in integrating new software with existing legacy systems. Additionally, historically conservative corporate culture that resists digital transformation, concerns over data security and privacy, and potential regulatory hurdles.

Market Segmentation

The Japan smart manufacturing software market share is classified into software type and industry.

- The 3D printing/modelling segment is expected to grow at the fastest CAGR during the predicted timeframe.

The Japan smart manufacturing software market is segmented by software type into digital twin, enterprise resource planning (ERP), asset performance management, MES automation and orchestration, maintenance management, 3d printing/modelling, product lifecycle management, and others. Among these, the 3D printing/modelling segment is expected to grow at the fastest CAGR during the predicted timeframe. This is due to the growing need for IoT in manufacturing's sophisticated automated processes. The electronics and automotive industries will be the next biggest consumers of 3D printing and modeling, after the manufacturing industry.

- The process industry segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan smart manufacturing software market is segmented by industry into process industry and discrete industry. Among these, the process industry segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Process industry manufacturing, many large companies in oil refining, pharmaceuticals, metals, and bulk chemicals have achieved various levels of digital maturity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan smart manufacturing software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hitachi Ltd.

- FANUC Corporation

- Mitsubishi Electric Corporation

- Yokogawa Electric Corporation

- Yaskawa Electric Corporation

- Toshiba Corporation

- Fujitsu Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Smart Manufacturing Software market based on the below-mentioned segments:

Japan Smart Manufacturing Software Market, By Software Type

- Digital Twin

- Enterprise Resource Planning (ERP)

- Asset Performance Management

- MES Automation and Orchestration

- Maintenance Management

- 3D Printing/Modelling

- Product Lifecycle Management

- Others

Japan Smart Manufacturing Software Market, By Industry

- Process Industry

- Discrete Industry

FAQ’s

Q: What is the Japan Smart Manufacturing Software Market size?

A: The Japan smart manufacturing software market was valued at USD 7.62 billion in 2024 and is projected to reach USD 37.3 billion by 2035, growing at a CAGR of 15.53% from 2025 to 2035.

Q: What factors are driving the growth of the smart manufacturing software market in Japan?

A: Key drivers include increasing industrial automation, strong government support for Industry 4.0 and Society 5.0, rising use of AI, IoT, and predictive analytics, and demand for real-time data insights and operational efficiency.

Q: Which software type is expected to grow the fastest?

A: The 3D printing/modelling segment is expected to record the fastest CAGR, driven by adoption in electronics, automotive, and advanced automated manufacturing processes.

Q: What are the major challenges restraining market growth?

A: Key restraints include high initial investment costs, a shortage of skilled digital-tech professionals, integration issues with legacy systems, conservative corporate culture, and data security concerns.

Q: Which industry segment holds the largest market share?

A: The process industry segment, which includes oil refining, pharmaceuticals, chemicals, and metals, held the largest market share in 2024 due to higher digital maturity and early adoption of automation technologies.

Q: Who are the key players in the Japan Smart Manufacturing Software Market?

A: Major companies include Hitachi Ltd., FANUC Corporation, Mitsubishi Electric, Yokogawa Electric, Yaskawa Electric, Toshiba Corporation, and Fujitsu Limited, among others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 163 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |