Japan Smart Transportation Market

Japan Smart Transportation Market Size, Share, By Transportation Mode (Roadways, Railways, Airways, and Maritime), By Solution (Traffic Management, Public Transport Systems, and Fleet Management) Japan Smart Transportation Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Smart Transportation Market Size Insights Forecasts to 2035

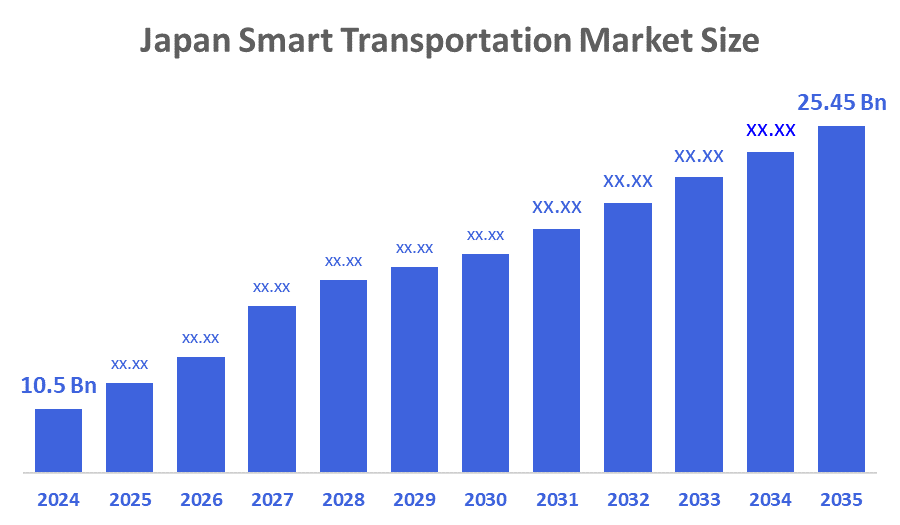

- Japan Smart Transportation Market Size 2024: USD 10.5 Bn

- Japan Smart Transportation Market Size 2035: USD 25.45 Bn

- Japan Smart Transportation Market CAGR: 8.38%

- Japan Smart Transportation Market Segments: Transportation Mode and Solution

Japan's demographic trends, particularly its aging population, are having a significant impact on the adoption of smart transportation solutions meant to increase accessibility. According to estimates from the United Nations Population Fund (UNFPA), 122.6 billion people will reside in Japan in 2024, with nearly 30% of them being 65 or older. This population shift is accelerating the development of transportation systems that cater to the elderly and people with disabilities.

Governing the Japanese nation is the most important factor in the progress of the intelligent transport system. The Society 5.0 vision is one of the initiatives that aims at making a human-centered, data-driven society by the amalgamation of AI, IoT, and big data. The government is in favor of such policies, which are going to train self-driving cars, build smart roads, and develop electric vehicle (EV) charging stations. The implementation of ITS Spot for vehicle-to-infrastructure communication, financial support for electric vehicle acquisition, and so on are among the projects that are driving the market forward.

The market is further strengthened by technological advancements. Japan has taken the lead in research on autonomous cars, advanced driver-assist systems (ADAS), and AI-based traffic control. Among the innovations are such systems as vehicle-to-infrastructure (V2I), real-time traffic prediction algorithms, and smart logistics using IoT sensors along with cloud computing technology. In 2024, Hyundai launched the Elec City Town, a medium-sized electric bus, in Japan. The bus features a 145 kWh battery offering up to 330 km range, advanced safety systems, and supports bidirectional charging. Furthermore, the connection with mobile apps improves the user experience by providing smooth multimodal transport and optimized route planning.

Market Dynamics of the Japan Smart Transportation Market:

The Japan Smart Transportation Market is mainly propelled by the fast technology advancements, such as AI, IoT, connected cars, and real-time traffic control systems, which provide better mobility, safety, and efficacy. The rising population in cities and the increasing problem of traffic jams in places like Tokyo are also strong reasons for the need of smart transport solutions. The government backing through programs like Society 5.0, self-driving car trials, and urban development with technology is also boosting the market. The drive for less traffic accidents and CO2 emissions is a reason why eco-friendly and safe transportation technologies are being more and more widely used.

The vast investments needed for the infrastructure and advanced systems, the strict compliance with regulations, and the worry about the safety of the data and cybersecurity are the main factors restraining and thus preventing the general acceptance of the said technology.

Japan's aging society presents various opportunities, which include a rise in demand for self-driving shuttles and disability-friendly transport services, urban smart city systems integration, expansion of electric and low-emission vehicles, and cooperation among the government, tech companies, and car makers to create future-oriented transport solutions.

Market Segmentation

Japan's smart transportation market share is classified into transportation mode and solution.

By Transportation Mode:

The Japanese smart transportation market is divided by transportation mode into roadways, railways, airways, and maritime. Among these, the roadways held the largest market share in 2024 compared with other types and is expected to grow at a remarkable CAGR during the forecast period. Road transport is the main form of transport for both passenger traffic and goods movement in Japan. Mainly focusing on road transportation and attending to its market share increase are the developments in electric vehicle (EV) adoption, self-driving shuttles, and intelligent road networks in the first place.

By Solution:

The Japanese smart transportation market is classified by solution into traffic management, public transport systems, and fleet management. Among these, the traffic management segment commands the largest market share in 2024 and is anticipated to grow at a substantial rate over the projected period. The country is experiencing a heavy traffic load, particularly in urban places such as Tokyo, Osaka, and Nagoya. Meanwhile, traffic management has become a necessity. The adoption of modern technology like smart traffic lights, continuous traffic surveillance, adjustable signal control, and demand forecasting is playing a big role in enabling cities to effectively manage traffic flow and minimize delays.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan smart transportation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Smart Transportation Market:

- Toyota Motor Corporation

- Nissan Motor Co.

- Honda Motor Co.

- GO Inc.

- Japan Airlines (JAL) & Lime partnership

- East Japan Railway Company (JR East)

- Kinki Sharyo Co., Ltd.

- Other

Recent Developments in Japan's Smart Transportation Market:

- In January 2025, Koito (Japan) successfully acquired Cepton, a LiDAR technology company, obtaining cutting-edge LiDAR technology essential for autonomous driving and intelligent sensor systems in automobiles.

- In June 2025, Toyota featured prototypes at Woven City, showcasing driverless cars, robotics, and renewable-powered mobility systems in its smart city testbed near Mt. Fuji.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan smart transportation market based on the following segments:

Japan Smart Transportation Market, By Transportation Mode

- Roadways

- Railways

- Airways

- Maritime

Japan Smart Transportation Market, By Solution

- Traffic Management

- Public Transport Systems

- Fleet Management

- Others

FAQ

- What is the base year and historical data period for the Japan Smart Transportation Market?

The base year is 2024, and the historical data covers the period from 2020 to 2023.

- What are the key segments of the Japan Smart Transportation Market?

The market is segmented by Transportation Mode (Roadways, Railways, Airways, Maritime) and Solution (Traffic Management, Public Transport Systems, Fleet Management, Autonomous Vehicles, Ticketing, Parking).

- Which transportation mode holds the largest market share?

Roadways held the largest market share in 2024 due to its dominance in passenger and freight transport, adoption of electric vehicles, autonomous shuttles, and intelligent road networks.

- Which solution segment commands the largest market share?

Traffic management commands the largest market share in 2024.

- Who are the key players in the Japan Smart Transportation Market?

Major companies include Toyota Motor Corporation, Nissan Motor Co., Honda Motor Co., GO Inc., Japan Airlines & Lime partnership, East Japan Railway Company (JR East), and Kinki Sharyo Co., Ltd.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 166 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |