Japan Solar Encapsulation Market

Japan Solar Encapsulation Market Size, Share, and COVID-19 Impact Analysis, By Material (Ethylene Vinyl Acetate, Polyvinyl Butyral, Polyolefin, Ionomer, and Others), By Application (Ground-Mounted, Building-Integrated Photovoltaic, Floating Photovoltaic, And Others), and Japan Solar Encapsulation Market Insights, Industry Trend, Forecasts To 2035

Report Overview

Table of Contents

Japan Solar Encapsulation Market Size Insights Forecasts to 2035

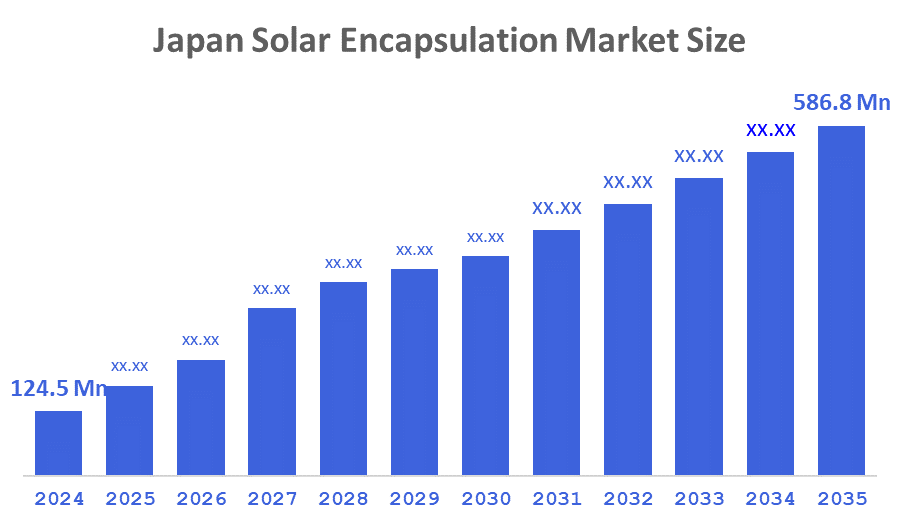

- The Japan Solar Encapsulation Market Size Was Estimated at USD 124.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.14% from 2025 to 2035

- The Japan Solar Encapsulation Market Size is Expected to Reach USD 586.8 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Solar Encapsulation Market Size?is anticipated to Reach USD 586.8 Million by 2035, Growing at a CAGR of 15.14% from 2025 to 2035. The Japanese solar encapsulation market is being driven by growing demand for a variety of advanced encapsulants that offer improved performance, durability, and sustainability to solar energy systems as a result of increased adoption of solar energy, advancements in solar module manufacturing technology that allow the production of higher-efficiency and more durable modules, and government regulations promoting the use of clean energy.

Market Overview

The Japanese market for encapsulation materials for Solar Energy is comprised of transparent polymers and adhesives such as EVA, PVB, and TPU, among others. These capsule materials surround PV cells within a Solar cell module and provide long-term performance and protection for Solar PV cells in a variety of climate conditions. In addition to enhancing durability, insulation, and light transmittance within Solar modules, encapsulants also offer greater reliability. With Japan's introduction of regulations to promote the development and increased use of renewable energy and to increase security of domestic energy supplies, the solar encapsulation market has a significant opportunity for growth. Encapsulation products are being applied to more and more residential and commercial rooftop installations, thereby creating demand for highly efficient encapsulation products. The accelerated growth in commercial use of innovative Solar technologies, including bifacial modules and higher efficiency Monocrystalline cells, is also driving the need for more advanced encapsulation materials. Companies producing these advanced encapsulating materials are, in turn, required to produce them to offer superior UV resistance, minimal degradation rates, and improved adhesive characteristics. To promote renewable energy and long-term decarbonization, the government of Japan supports the growth of solar energy with a combination of policies and funding. The programs developed by the government are consistent with Japan's goal to achieve carbon neutrality by 2050, and have enabled an increase in the usage of large-scale solar systems, along with further development of solar technology in Japan.

Report Coverage

This research report categorizes the Japan solar encapsulation market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan solar encapsulation market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan solar encapsulation market.

Driving Factor

The Japanese solar encapsulation market is expanding due to the increasing demand for durable and efficient photovoltaic modules for use in residential, commercial, and utility-scale development will increase due to continuing technological advancements in UV-resistant and moisture-resistant encapsulation materials. These advancements improve both the performance of solar panels over time and their energy output, thus increasing the demand for the adoption of solar PV systems.

Restraining Factor

The Japanese solar encapsulation market is constrained by raw material prices and the impact on the production cost of their encapsulation, as well as the technical challenges associated with encapsulation, which will continue to impede market development. In addition, the limited recycling options for encapsulation materials will continue to exacerbate the environmental concerns regarding encapsulation materials and impede profitability and overall market expansion.

Market Segmentation

The Japan solar encapsulation market share is classified into material and application.

- The ethylene vinyl acetate segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The Japanese solar encapsulation market is segmented by material into ethylene vinyl acetate, polyvinyl butyral, polyolefin, ionomer, and others. Among these, the ethylene vinyl acetate segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. Ethylene vinyl acetate prominence is largely attributed to the result of its proven performance, high optical transmission capability, and excellent adhesion strength.

- The ground-mounted segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Japanese solar encapsulation market is segmented by application into ground-mounted, building-integrated photovoltaic, floating photovoltaic, and others. Among these, the ground-mounted segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Ground-mounted PV systems provide more electricity generation because they can be oriented more effectively and are not subject to shading. Also, these systems are suited for large-scale projects eligible for Federal tax credits and utility purchase agreements.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the Japan solar encapsulation market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsui Chemicals, Inc.

- Sumitomo Chemical Co., Ltd.

- Sekisui Chemical Co., Ltd.

- Toray Industries, Inc.

- Kuraray Co., Ltd.

- Teijin Limited

- Asahi Kasei Corporation

- Fujifilm Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities?

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan solar encapsulation market based on the below-mentioned segments:

Japan Solar Encapsulation Market, By Material

- Ethylene Vinyl Acetate

- Polyvinyl Butyral

- Polyolefin

- Ionomer

- Others

Japan Solar Encapsulation Market, By Application

- Ground-Mounted

- Building-Integrated Photovoltaic

- Floating Photovoltaic

- Others

FAQ’s

Q: What is the Japan Solar Encapsulation Market?

A: The Japan Solar Encapsulation Market refers to the production, supply, and application of protective polymer films and adhesives, such as EVA, PVB, TPU, used to laminate and protect photovoltaic (PV) solar cells within solar modules. These encapsulants enhance durability, insulation, light transmittance, and overall solar module efficiency.

Q: What is the current size of the Japan Solar Encapsulation Market?

A: The market size of Japan Solar Encapsulation was estimated at USD 124.5 Million in 2024 and is projected to reach USD 586.8 Million by 2035, growing at a CAGR of approximately 15.14% from 2025 to 2035.

Q: What are the key drivers of the Japan Solar Encapsulation Market?

A: The market is driven by increasing adoption of solar energy, technological advancements in solar module manufacturing, rising demand for durable and efficient solar panels, and supportive government policies promoting renewable energy and carbon neutrality.

Q: Which application segment leads the Japan Solar Encapsulation Market?

A: The ground-mounted photovoltaic segment dominated the market in 2024 and is projected to grow at a significant CAGR. Ground-mounted systems offer better energy production, optimized orientation, minimal shading, and benefits from government incentives.

Q: Who are the key players in the Japan Solar Encapsulation Market?

A: Major companies include Mitsui Chemicals, Sumitomo Chemical, Sekisui Chemical, Toray Industries, Kuraray, Teijin Limited, Asahi Kasei, and Fujifilm Corporation, along with several other regional and international manufacturers.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 179 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |