Japan Solar Energy Market

Japan Solar Energy Market Size, Share, and COVID-19 Impact Analysis, By Deployment (Rooftop, Ground-Mounted, Floating Solar, Building-Integrated PV, and Others), By Application (Residential, Commercial and Industrial, Utility-Scale, Agrivoltaics, and Others), By Component (PV Modules Inverters, Mounting and Tracking Systems, Balance-Of-System, Co-Located Battery Storage, and Others), and Japan Solar Energy Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Solar Energy Market Insights Forecasts to 2035

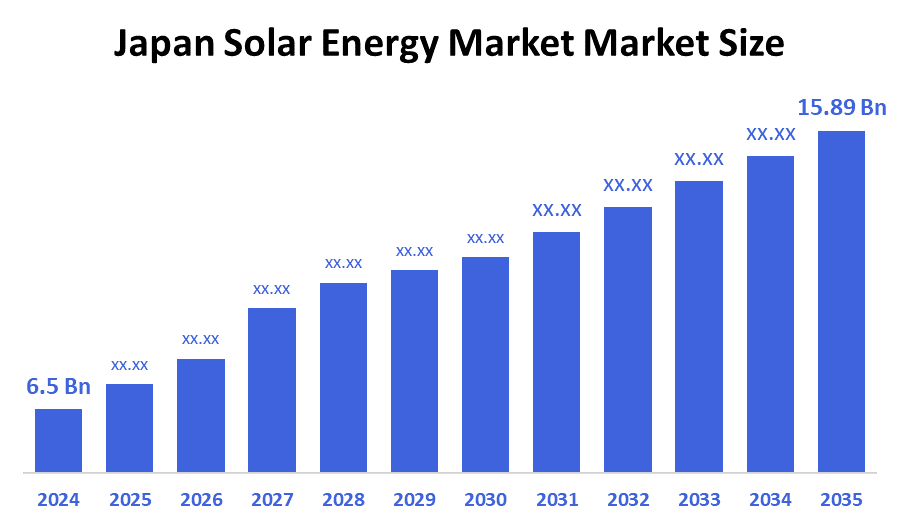

- The Japan Solar Energy Market Size Was Estimated at USD 6.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.47% from 2025 to 2035

- The Japan Solar Energy Market Size is Expected to Reach USD 15.89 Billion by 2035

According to a research report published by decision advisor & Consulting, the Japan Solar Energy Market size is anticipated to reach USD 15.89 Billion by 2035, growing at a CAGR of 8.47% from 2025 to 2035. The Japan solar energy market is driven by government decarbonization policies, declining solar panel costs, strong corporate renewable commitments, technological advancements, and growing demand for stable, clean energy amid rising energy security concerns.

Market Overview

Japan solar energy market is expected to experience robust growth due to a combination of factors, such as government initiatives aimed at achieving carbon neutrality by 2050, advancements in solar technology, and increasing public awareness of environmental issues. The Japanese government also encourages the integration of solar energy through several incentives for installations and campaigns aimed at raising public awareness, further propelling the expansion of the solar market in Japan.For example, in Japan, METI- the government's Ministry of Economy, Trade, and Industry, represents an important supporting factor for implementing solar energy systems and efforts toward a significant share of renewable energy sources in the country's energy mix. Additionally, technological advancements have introduced newer solar solutions that are more flexible, efficient, and cost-effective compared to traditional models. The manufacturing cost for photovoltaic components has declined, while electricity prices in Japan are rising; the commingling of these factors also contributes to rapid market growth.

Moreover, continuous advancements in energy storage technologies are addressing the intermittent nature of solar power, making it a more reliable source of energy. Innovations in energy storage systems will also drive the growth of the Japanese solar energy market in the forecasted years. For instance, in February 2022, JERA Co., Inc. and West Holdings Corporation entered into a head of agreement on a business alliance to develop solar power generation projects in Japan. This collaboration came amid increasing calls for energy decarbonization to achieve a sustainable society by 2050, with solar energy being recognized as a key near-term option due to its established technology and relatively short construction timelines.

Report Coverage

This research report categorizes the market for the Japan solar energy market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan solar energy market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan solar energy market.

Driving Factors

The solar energy markets in Japan are driven by the growth of solar power has led to the need for energy storage solutions to manage the inconsistent nature of renewable energy. For instance, on June 5, 2024, Sumitomo Corporation announced its plans to increase its battery storage capacity in Japan from the current 9 megawatts (MW) to over 500 MW by March 2031. This initiative aims to stabilize renewable energy output, improve grid reliability, and assist Japan in moving towards a more sustainable energy system.

Furthermore, Japan research institutions are leading the development of next-generation lithium-sulfur and solid-state battery technologies that promise higher energy densities and longer lifetimes. These developments will lead to better large-scale storage implementations that improve the overall efficiency of energy use. In addition, the integration of energy storage with AI-driven management systems has led to more precise load balancing, reduced energy waste, and optimized peak demand management.

Restraining Factors

The solar energy market in Japan is restrained by limited land availability, grid congestion, declining feed-in tariffs, stringent regulations, high installation costs, and intermittency challenges that complicate integration and stability.

Market Segmentation

The Japan solar energy market share is categorized by deployment, application and component.

- The rooftop segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan solar energy market is segmented by deployment into rooftop, ground-mounted, floating solar, building-integrated pv, and others. Among these, the rooftop segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by urban space utilization, lower installation costs, government incentives, increasing residential adoption, ease of grid connection, and rising awareness of sustainable energy solutions in Japan.

- The commercial and industrial segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan solar energy market is segmented by application into residential, commercial and industrial, utility-scale, agrivoltaics, and others. Among these, the commercial and industrial segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to high energy consumption, cost-saving incentives, corporate sustainability goals, large rooftop availability, supportive policies, and growing adoption of renewable energy to reduce operational expenses.

- The PV modules inverters segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan solar energy market is segmented by component into PV modules inverters, mounting and tracking systems, balance-of-system, co-located battery storage, and others. Among these, the PV modules inverters segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by increasing solar installations, technological advancements, efficiency improvements, government incentives, rising electricity demand, and growing adoption of residential, commercial, and utility-scale solar projects in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan solar energy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sharp Corporation

- Kyocera Corporation

- Panasonic Energy Co

- Canadian Solar Inc

- Trina Solar Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 23, 2024, Google announced two solar power purchase agreements in Japan, marking its first such contracts in the country. These agreements, with Clean Energy Connect and Shizen Energy, will add a combined 60 megawatts of new solar energy capacity to the Japan grid, supporting Google's data centers and aligning with Japan's clean energy goals. The projects are expected to be fully operational within four years, underscoring Google's commitment to sustainable infrastructure in Japan.

- In July 12, 2024, Sumitomo Mitsui Construction Co., Ltd. announced the installation of floating solar power generation facilities in Tokyo Bay as part of the Tokyo Metropolitan Government's eSG Project. This initiative aims to address land scarcity for solar installations and enhance efficiency through the cooling effect of water surfaces. The company is conducting demonstrations to assess the mooring system, power output, and resistance to salt damage, with plans to develop cost-effective offshore solar power systems.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. decision advisor has segmented the Japan Solar Energy Market based on the below-mentioned segments:

Japan Solar Energy Market, By Deployment

- Rooftop

- Ground-Mounted

- Floating Solar

- Building-Integrated PV

- Others

Japan Solar Energy Market, By Application

- Residential

- Commercial and Industrial

- Utility-Scale

- Agrivoltaics

- Others

Japan Solar Energy Market, By Component

- PV Modules Inverters

- Mounting and Tracking Systems

- Balance-Of-System

- Co-Located Battery Storage

- Others

FAQ’s

Q: What is the current size of the Japan solar energy market?

A: The Japan solar energy market was valued at USD 6.5 billion in 2024.

Q: What is the expected market size by 2035?

A: The market is projected to reach USD 15.89 billion by 2035, growing at a CAGR of 8.47%.

Q: Which deployment segment holds the largest share?

A: The rooftop segment accounted for the largest revenue share in 2024 due to urban space utilization and government incentives.

Q: Which application segment dominates the market?

A: The commercial and industrial segment dominated the market, driven by high energy consumption, cost-saving incentives, and corporate sustainability goals.

Q: What drives the growth of the Japan solar energy market?

A: Market growth is driven by government decarbonization policies, declining solar panel costs, corporate renewable commitments, technological advancements, and rising demand for clean energy.

Q: What are the key restraints in the market?

A: Growth is restrained by limited land availability, grid congestion, declining feed-in tariffs, high installation costs, and intermittency challenges.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | country |

| Pages | 171 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |