Japan Styrene Acrylic Latex Market

Japan Styrene Acrylic Latex Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Water-based, Solvent-based, Hybrid, and Others), By End-user (Construction, Automotive, Textiles, Packaging), and Japan Styrene Acrylic Latex Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Styrene Acrylic Latex Market Insights Forecasts to 2035

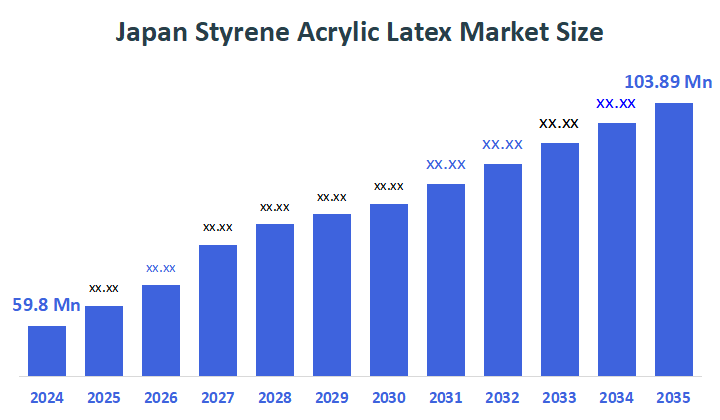

- The Japan Styrene Acrylic Latex Market Size Was Estimated at USD 59.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.15% from 2025 to 2035

- The Japan Styrene Acrylic Latex Market Size is Expected to Reach USD 103.89 Million by 2035

According to a research report published by Decisions Advisors, the Japan Styrene Acrylic Latex Market size is anticipated to reach USD 103.89 million by 2035, growing at a CAGR of 5.15% from 2025 to 2035. The Japan styrene acrylic latex market is driven by growing demand for high-performance water-based coatings, expanding construction and automotive sectors, strict environmental regulations, and rising adoption of eco-friendly, low-VOC adhesive and paint formulations.

Market Overview

The Styrene-Acrylic Latex (SAL) Market is growing with technical advancement and increased product demand in the marketplace. Research on the compatibility of resin with various types of substrates has played an essential role in being able to effectively select the correct resin for optimal performance of all types of applications, including adhesives and coatings. Evaluation of the chemical resistance of resins will assist in determining if a specific type of resin would be suitable for a particular coating application, based on the type of chemical environment to which the coating will be subjected. The shelf life of a binder is a critical factor because prolonged storage of an SAL contains the possibility of affecting the degree of crosslinking density, the phosphorous content, and the level of VOC. For example, spraying, dipping, or roller coating are common application methods used to apply coatings, and it is crucial that each method provides sufficient control over the uniformity of the coating thickness.

Both mechanical properties and performance characteristics will be measured through hardness testing, as well as through water resistance testing. Emulsion polymerization is an on-going process, as there is an ever-present need for acrylic polymer dispersions to develop satisfactory performance and properties of copolymer film formation when applied as coatings or in adhesives. The property of curing kinetics continues to be developed, as elongation at break value, tensile strength measurement, thermal stability, surface tension etc. will all provide valuable data to assess mechanical strength as well as durability. The automotive and construction industries have their own specific needs regarding UV resistance, impact resistance, and co-polymer composition analysis. Additionally, glass transition temperatures and coating viscosity control are the two most important properties that will ensure optimal performance and ease of application with regards to SAL.

Report Coverage

This research report categorizes the market for the Japan styrene acrylic latex market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan styrene acrylic latex market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan styrene acrylic latex market.

Driving Factors

The styrene acrylic latex markets in Japan are driven by the stringent environmental regulations and the pervasive sustainability ethos serve as the primary drivers of the market, emphasizing the importance of adhering to eco-friendly practices and principles. The market is significantly influenced by the country's stringent environmental regulations and societal commitment to sustainability. Decades of government policies aimed at improving air quality and protecting public health have led to rigorous controls on volatile organic compound (VOC) emissions. This legislative pressure has driven a shift from solvent-based chemical systems to waterborne alternatives in various industries.

According to industry reports, the Japanese waterborne coatings market is projected to grow at a steady rate of 4% annually over the next five years, further bolstering the demand for styrene acrylic latex binders. A notable example of this trend is the 15% sales increase observed by a leading manufacturer in the paint industry after switching to styrene acrylic latex binders in their formulations. Styrene acrylic latex, as a low-VOC aqueous dispersion, is a preferred choice for manufacturers of paints, coatings, adhesives, and inks, enabling them to maintain performance while ensuring compliance.

Restraining Factors

The styrene acrylic latex market in Japan is restrained by the volatility in raw material pricing and supply chain vulnerabilities pose significant challenges to the industry's growth, requiring companies to adapt and mitigate risks through strategic sourcing, supply chain diversification, and price risk management strategies.

Market Segmentation

The Japan styrene acrylic latex market share is categorized by product type and end-user.

- The water-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan styrene acrylic latex market is segmented by product type into water-based, solvent-based, hybrid, and others. Among these, the water-based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by increasing demand for eco-friendly, low-VOC formulations, strong adoption in architectural and industrial coatings, regulatory support for water-based technologies, and rising use across adhesives, paints, and construction applications.

- The construction segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Japan styrene acrylic latex market is segmented by end-user into construction, automotive, textiles, packaging. Among these, the construction segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to rising construction and infrastructure projects, increasing use of latex-based coatings and adhesives, demand for durable weather-resistant materials, and a shift toward eco-friendly, water-based building solutions across Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan styrene acrylic latex market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arkema Arkema

- Asahi Kasei Advance Corp.

- BASF SE

- Celanese Corp.

- DIC Corp.

- Dow Chemical Co.

- Evonik Industries AG

- H.B. Fuller Co.

- JSR Corp.

- Kaneka Corp.

- KURARAY Co. Ltd.

- LG Chem Ltd.

- Mitsui Chemicals Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, BASF SE, a leading global chemical producer, announced the expansion of its production capacity for styrene acrylic latex binders at its site in Schkopau, Germany. This expansion aimed to meet the growing demand for sustainable building materials

- In April 2025, Lanxess AG, a specialty chemicals company, entered into a strategic partnership with a leading Chinese paint manufacturer, China National Chemical Corporation (ChemChina). The collaboration aimed to produce and market styrene acrylic latex binders in China, expanding Lanxess' reach in the Asian market

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan Styrene Acrylic Latex Market based on the below-mentioned segments:

Japan Styrene Acrylic Latex Market, By Product Type

- Water-based

- Solvent-based

- Hybrid

- Others

Japan Styrene Acrylic Latex Market, By End-user

- Construction

- Automotive

- Textiles

- Packaging

FAQ’s

Q: What was the size of the Japan styrene acrylic latex market in 2024?

A: The market size was estimated at USD 59.8 million in 2024.

Q: What is the expected market size by 2035?

A: The Japan styrene acrylic latex market is projected to reach USD 103.89 million by 2035.

Q: What is the CAGR during 2025–2035?

A: The market is expected to grow at a CAGR of 5.15% during the forecast period.

Q: What factors are driving market growth in Japan?

A: Growth is driven by strict environmental regulations, expanding construction and automotive industries, and rising demand for eco-friendly, low-VOC coatings and adhesives.

Q: Which product type segment dominated the market in 2024?

A: The water-based segment held the largest revenue share in 2024 due to strong adoption of low-VOC, eco-friendly formulations.

Q: Which end-user segment accounted for the largest share?

A: The construction segment dominated in 2024, supported by increasing infrastructure projects and demand for durable, water-based coatings and adhesives.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |