Japan Toothpaste Market

Japan Toothpaste Market Size, Share, and COVID-19 Impact Analysis, By Type (Conventional Toothpaste, Herbal Toothpaste, Whitening and Sensitive Toothpaste), By Distribution Channel (Supermarkets and Hypermarkets, Retail Stores, Pharmacies, Online Stores), By End User (Adults, Kids), and Japan Toothpaste Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Toothpaste Market Size Insights Forecasts to 2035

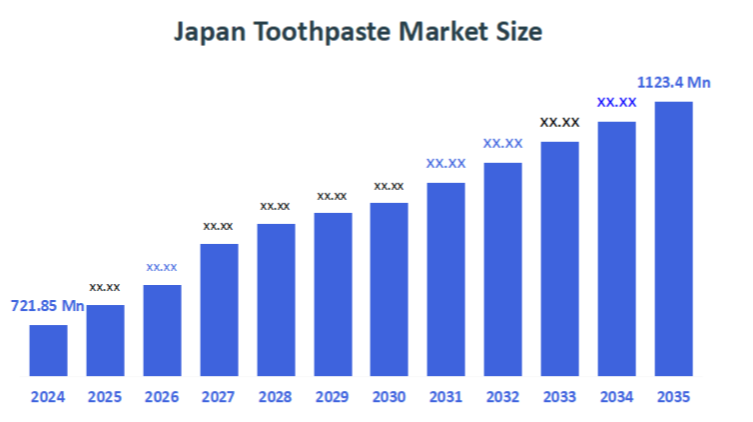

- The Japan Toothpaste Market Size Was Estimated at USD 721.85 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.1% from 2025 to 2035

- The Japan Toothpaste Market Size is Expected to Reach USD 1123.4 Million by 2035

According To a Research report published by Decision Advisors & Consulting, The Japan Toothpaste Market Size is anticipated to Reach USD 1123.4 Million by 2035, Growing at a CAGR of 4.1% from 2025 to 2035. The Japanese toothpaste Market is increasing due to several factors, including an ageing population that requires specialised products, increased consumer awareness of oral health, and rising demand for innovative, functional toothpastes designed to address specific problems, such as sensitivity and gum disease.

Market Overview

Japan's toothpaste market consists of manufacturing & distributing toothpaste in Japan. It has a high awareness surrounding oral health, an aging population, and A general growing trend towards premium functional types of toothpaste with benefits that address different concerns such as sensitivity, dry mouth, and enamel repair. The toothpaste market in Japan continues to grow rapidly as consumers become increasingly aware of the importance of maintaining healthy teeth throughout their lives. Dental problems such as cavities are common problems for adults and children alike, so there is an increasing demand for the best possible products to protect teeth from damage caused by these conditions. At present, there is a noticeable trend towards the purchase of specialty toothbrushes and premium-quality toothpaste in addition to the regular dental care products available through grocery stores. Therefore, many consumers are turning to online retailers to meet their needs rather than relying solely on local grocery stores for their purchases. Trends in the market for toothpaste include the development of therapeutic and paediatric toothpastes, high-tech formulations that utilize new ingredients such as hydroxyapatite nanoparticles, and the growing preference among consumers to use "green" products. The market is also beginning to develop new formats of toothpastes, such as tablets, and several online sales channels for selling toothpastes.

The Dental Health Promotion Act is the primary piece of legislation that informs national programme and policy development around oral health and, therefore, the promotion of optimal oral health throughout the nation; indirectly, this legislation will increase the demand for effective dental products such as toothpaste. Japan has established regulations limiting the concentration of fluoride in toothpaste to prevent adverse health effects, with a mandated maximum of 0.8 mg/litre as of a 2024 regulation.

Report Coverage

This research report categorizes the market for the Japan toothpaste market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan toothpaste market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan toothpaste market.

Driving Factor

The Japanese toothpaste market is driven by an increasing need and desire for functional toothpastes addressing age-related dental concerns due to Japan's aging population, as well as a greater awareness of oral hygiene among consumers of all ages. Some additional influences driving this segment include the demand for new and improved technologically advanced products like enamel-renewing formulations, and government programs like the 8020 initiative that promote the preservation of natural teeth throughout one's life span.

Restraining Factor

The Japanese toothpaste market is restrained by its reaching maturity, and has become a very valuable market because of the lifestyle of Japan's growing elderly population. The cost of producing toothpaste comes from chemical ingredients that are the same as dental powder. The increasing prices on these chemicals, such as calcium carbonate and sodium bicarbonate, translate into increased production costs and higher pricing of final products going into the marketplace.

Market Segmentation

The Japan Toothpaste Market share is categorized by type, distribution channel, and end user.

- The conventional toothpaste segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan toothpaste market is segmented by type into conventional toothpaste, herbal toothpaste, whitening, and sensitive toothpaste. Among these, the conventional toothpaste segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by their daily use, affordability, and high accessibility. Conventional toothpaste has become a staple for most consumers. Consumers rely on conventional toothpaste for basic benefits such as plaque prevention and cavity protection. With the continuing growth of whitening and sensitive toothpaste segments, however, conventional toothpaste will continue to be a critical component of mass-marketed oral care products as a result of continuing everyday demand by large consumer segments.

- The supermarket and hypermarket segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan toothpaste market is segmented by distribution channel into supermarkets and hypermarkets, retail stores, pharmacies, and online stores. Among these, the supermarket and hypermarket segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the reason that large retail establishments continue to play such an important role in the retailing environment is because they are widely available, provide a large number of product choices, and are located in both urban and suburban areas. By providing a single point of purchase for many items, large retailers offer consumers a more convenient and preferable shopping experience. In addition, the continued growth of store networks, private labels, and their unique ability to provide a physical environment in which shoppers can touch products and experience them will keep them relevant as a major component of retailing.

- The adult segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan toothpaste market is segmented by end user into adults and kids. Among these, the adult segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the high prevalence of chronic and lifestyle-related diseases like diabetes and heart disease, along with the rising popularity of preventive healthcare and increased focus on fitness and well-being, which is driving adults to try to improve their overall health and well-being through supplementation. Increasing stress, busy schedules, and environmental toxins such as pollution only add to the existing causes of many adults experiencing low energy, digestive issues, and sleep disorders, all of which have increased demand for supplements, as claimed by Vision Research Reports and PR Newswire.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan toothpaste market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lion Corporation

- Kao Corporation

- Sunstar Suisse S.A. (Japan Branch/Operations)

- Shiseido Company, Limited

- Sangi Co., Ltd.

- Kobayashi Pharmaceutical Co., Ltd.

- GC Corporation

- The Yoshida Dental Mfg. Co., Ltd.

- Tokuyama Dental Corporation

- Nissin Dental Products Inc.

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In March 2025, Lion Corporation announced the nationwide launch of its CLINICA PRO plus Periodontal Barrier Toothpaste, a medicated formula featuring Japan’s only enzyme-based active ingredient designed to break down and remove plaque, offering a double-action approach to help prevent gum disease and maintain healthy gums.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Japan toothpaste market based on the below-mentioned segments:

Japan Toothpaste Market, By Type

- Conventional Toothpaste

- Herbal Toothpaste

- Whitening

- Sensitive Toothpaste

Japan Toothpaste Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Retail Stores

- Pharmacies

- Online Stores

Japan Toothpaste Market, By End User

- Adults

- Kids

FAQs

Q: What is the estimated size of the Japanese Toothpaste Market in 2024?

A: The Japanese toothpaste Market is estimated at USD 721.85 million in 2024.

Q: What CAGR is the Japan Toothpaste Market expected to grow at from 2025 to 2035?

A: The market is expected to grow at a CAGR of 4.1% during 2025–2035.

Q: Which toothpaste type held the largest market share in Japan in 2024?

A: Conventional toothpaste held the largest market share in 2024.

Q: Which distribution channel dominated the Japanese toothpaste market in 2024?

A: Supermarkets and hypermarkets accounted for the largest share in 2024.

Q: What recent development did Lion Corporation announce in March 2025?

A: Lion Corporation announced the nationwide launch of its CLINICA PRO plus Periodontal Barrier Toothpaste, featuring Japan’s only enzyme-based active ingredient for plaque removal.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 210 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |