Japan Travel Insurance Market

Japan Travel Insurance Market Size, Share, By Insurance Type (Single-Trip Travel Insurance, Annual Multi-Trip Insurance, Long-Stay Travel Insurance), By Distribution Channel (Insurance Intermediaries, Banks, Insurance Companies, Insurance Aggregators, Insurance Brokers, Others), By End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, Others), Japan Travel Insurance Market Insights, Industry Trends, Forecasts to 2035

Report Overview

Table of Contents

Japan Travel Insurance Market Insights Forecasts to 2035

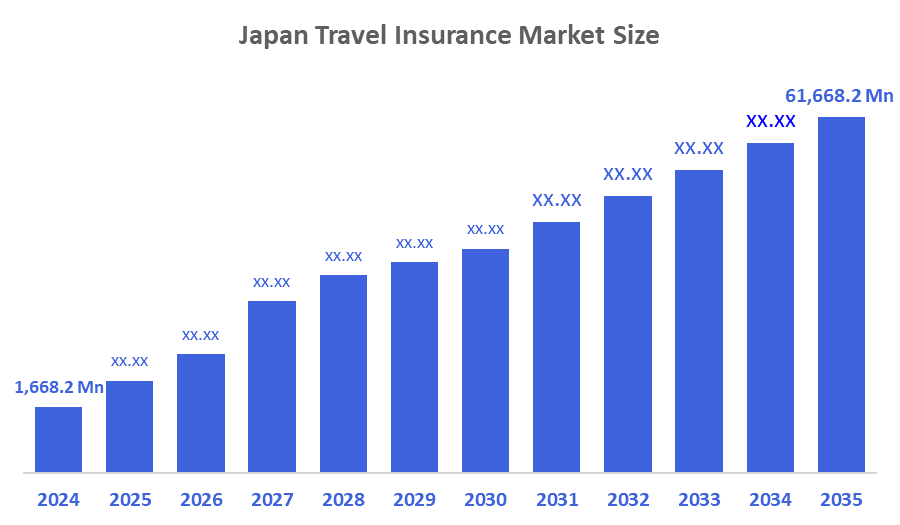

- Japan Travel Insurance Market Size 2024: USD 1,668.2 Mn

- Japan Travel Insurance Market Size 2035: USD 61,668.2 Mn

- Japan Travel Insurance Market Size CAGR 2024: 15.73%

- Japan Travel Insurance Market Size Segments: Insurance Type, Distribution Channel, End User

The Japan travel insurance market size is made up of different insurance products whose main purpose is to protect financially against the various risks that come with traveling, both within the country and abroad. These risks include medical emergencies, cancellations of trips, delays in traveling, loss of luggage, and personal liability. The insurance policy market is marked by a trend toward greater customization of policies, flexible coverage periods, and an increasing number of people using digital buying platforms. Travelers’ greater awareness of risks, changes in their lifestyles, and movements abroad are the main reasons that the market has been expanding.

Government counselling for the recovery of tourism, international exchange programs, along with the growth of inbound travel, have led to an increasing number of travelers needing insurance coverage. Furthermore, cooperation between private insurers and travel service providers is quite strong as they are already working together to integrate insurance products into the booking process, airline platforms, and even visa applications, thus making it easier for different types of travelers to access and purchase insurance.

The future of travel insurance in Japan is being shaped by technological advancements, and the innovations that are mainly mentioned here, like digital underwriting, AI-based risk assessment, and mobile policy management, are the primary drivers of that transformation. Insurers are also utilizing data analytics, automation in claims processing, as well as assistance services that are provided in real-time, to improve the customer experience. The combination of technologies like insurtech, chatbots, and app-based claims filing is increasing the efficiency of operations while facilitating quick settlements and achieving high levels of customer satisfaction at the same time.

Market Dynamics of the Japan Travel Insurance Market

The Japan travel insurance market size is driven by the continuous return of international tourism, the growth of outbound tourism, and the increasing involvement of people in foreign education and business travels. Knowledge of medical costs abroad, travel interruptions, and emergency evacuation is making insurance coverage more attractive to travelers. Elderly people in Japan are a driving force behind the senior-specific travel insurance policies. Furthermore, the use of online sales channels, the offering of travel packages, and the quick issuance of policies are still pushing the market's penetration.

The market is restrained by low insurance penetration among travelers who are very attentive to prices, poor comprehension of what is included in the policy and fears related to claims process. Difficult words used in policy, covering areas not included in it and thinking of no or little information provided may push away beginner buyers especially the younger travelers and short-term domestic visitors who are less patient.

The Japan travel insurance market's future scenario is very bright, as there are plenty of good chances coming up from personalized insurance products, pay-per-trip models, and AI-driven flexible pricing. Besides, the market will be gradually opened up by the growth in inbound tourists, long-stay travelers, digital nomad visas, and educational mobility. Also, the combination of travel insurance with digital travel ecosystems and finance technology platforms will create new avenues for growth.

Market Segmentation

The Japan Travel Insurance Market share is classified into insurance type, distribution channel, and end user.

By Insurance Type

The Japan travel insurance market size is segmented by insurance type into single-trip travel insurance, annual multi-trip insurance, and long-stay travel insurance. Among these, the single-trip travel insurance segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance is attributed to a lot of leisure and short-term international travel from Japan, with the preference for cost effective trip specific coverage among travelers. Single-trip insurance policies simplicity, affordability, and flexibility keep on being the main factors for the wide acceptance of this insurance type.

By Distribution Channel

The Japan travel insurance market size is segmented by distribution channel into insurance intermediaries, banks, insurance companies, insurance aggregators, insurance brokers, and others. Among these, the insurance companies segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The selling of policies straight from the insurance companies' digital platforms and mobile apps is giving customers the benefit of easy comparison of different policies, instant issuance of the selected one, and effective support for claims. At the same time, the growth of insurance aggregators is becoming faster and faster due to the growing online buying habits.

By End User

The Japan travel insurance market size is segmented by end user into senior citizens, education travelers, business travelers, family travelers, and others. Among these, the senior citizens segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by Japan's elderly population, and the high number of senior citizens traveling overseas has been the case for a long time. Medical insurance, emergency support, and the duration of coverage are the most important considerations for elderly travelers. These aspects are the main factors that lead to the premiums of this particular group being in the higher range.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the Japan travel insurance market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Japan Travel Insurance Market

- Tokio Marine & Nichido Fire Insurance Co., Ltd.

- MS&AD Insurance Group Holdings, Inc.

- Sompo Holdings, Inc.

- AIG Japan Holdings K.K.

- Chubb Insurance Japan

- Zurich Insurance Japan

- Allianz Partners Japan

- AXA Life Insurance Japan

- Japan Post Insurance Co., Ltd.

- Others

Recent Developments in Japan Travel Insurance Market

In September 2025, Tokio Marine & Nichido enhanced its overseas travel insurance offerings with digital claims submission and real-time multilingual assistance services.

In June 2025, Sompo Holdings introduced AI-based travel insurance underwriting to improve risk assessment for senior and long stay travelers.

In August 2024, MS&AD Insurance Group partnered with major travel booking platforms to offer embedded travel insurance solutions during ticket and accommodation purchases.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment Outlook

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan travel insurance market based on the following segments:

Japan Travel Insurance Market, By Insurance Type

- Single-Trip Travel Insurance

- Annual Multi-Trip Insurance

- Long-Stay Travel Insurance

Japan Travel Insurance Market, By Distribution Channel

- Insurance Intermediaries

- Banks

- Insurance Companies

- Insurance Aggregators

- Insurance Brokers

- Others

Japan Travel Insurance Market, By End User

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Others

FAQ

Q: What is the Japan travel insurance market size?

A: Japan Travel Insurance Market is expected to grow from USD 1,668.2 million in 2024 to USD 61,668.2 million by 2035, at a CAGR of 15.73% during the forecast period 2025–2035.

Q: What are the key growth drivers of the market?

A: Key drivers include increasing international travel, rising awareness of travel risks, growth in senior travel, and expansion of digital insurance distribution platforms.

Q: What factors restrain the Japan travel insurance market?

A: Market restraints include low awareness among price-sensitive travelers, perceived complexity of policy terms, and concerns related to claim settlement transparency.

Q: Who are the key players in the Japan travel insurance market?

A: Key players include Tokio Marine & Nichido, MS&AD Insurance Group, Sompo Holdings, AIG Japan, Chubb Insurance Japan, and others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |