Japan Warehouse Automation Market

Japan Warehouse Automation Market Size, Share, and COVID-19 Impact Analysis, By Component Type (Hardware, Software, and Services), By End User (Food and Beverage, Post and Parcel, Retail, Apparel, Manufacturing, and Others), and Japan Warehouse Automation Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Warehouse Automation Market Size Insights Forecasts to 2035

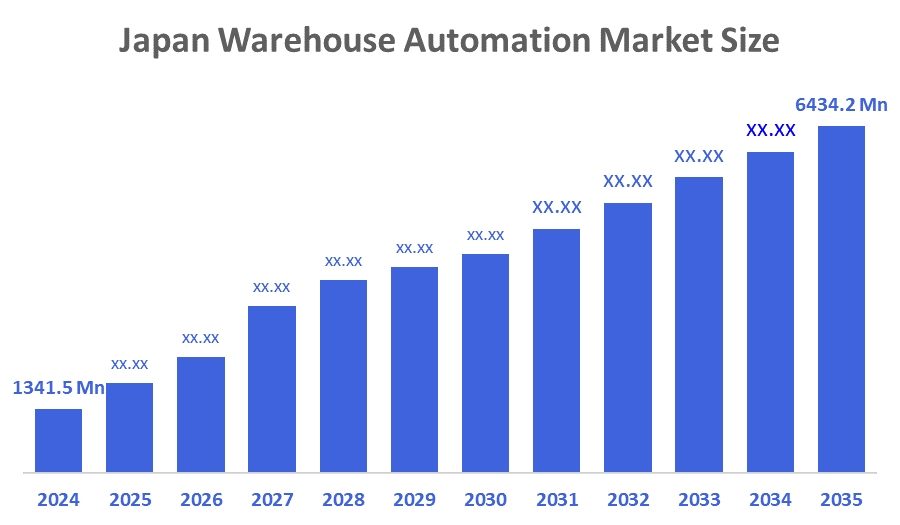

- The Japan Warehouse Automation Market Size Was Estimated at USD 1341.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 15.32% from 2025 to 2035

- The Japan Warehouse Automation Market Size is Expected to Reach USD 6434.2 Million by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The Japan Warehouse Automation Market Size is anticipated to Reach USD 6434.2 Million by 2035, Growing at a CAGR of 15.32% from 2025 to 2035. The warehouse automation market in Japan is driven by increased industrial investments, government-backed automation projects, growing e-commerce fulfillment demands, acute labor shortages brought on by overtime restrictions, and Japan's aging workforce with a declining youthful labor population.

Market Overview

The automated warehouse market is the domain of technology, systems, and solutions that are capable of performing the operations inside the warehouse, like storage, picking, packing, sorting, and material handling, to gain time, precision, and labor productivity enhancements. The Japan warehouse automation market is going through a fast and continuous development process mainly due to the severe shortage of labor, the aged workforce, and the heavier overtime regulations imposed on the logistics industry. On the other hand, the e-commerce boom and the need for quicker, more accurate order fulfillment are pushing companies more towards the use of automated storage, robot systems, and intelligent warehouse technologies.

Through METI and MLIT initiatives aimed at logistics digital transformation, the Japanese government assists with warehouse automation. The subsidy programs provide financial backing of up to ¥50 million for each project, with approximately 50% of the cost covered for the adoption of various technologies such as robotics, AS/RS, AMRs, and WMS. This is mainly advantageous to small and medium enterprises (SMEs) and pilot automation projects that are initiated to solve the problem of labor shortages.

Moreover, there are numerous areas where automation will be the future, such as cold storage, pharmaceuticals, urban micro-fulfillment centers, and small warehouses. Some of the recent trends are the heightened activities in robot-enabled distribution centers and advanced fulfillment hubs.

Report Coverage

This research report categorizes the market for the Japan warehouse automation market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan warehouse automation market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan warehouse automation market.

Driving Factors

The warehouse automation market in Japan is driven by the severe labor shortage that Japan is currently suffering from due to Japan's rapidly aging population, coupled with lower participation by individuals in the workforce and stricter regulations related to overtime hours worked within the logistics sector. Japan's increasing eCommerce activity & omnichannel retailing require higher volumes of accurately fulfilled orders at a much greater speed than companies could have fulfilled prior to the explosion of online retail. Logistics companies have increased labour and operating costs, and must increase warehouse and distribution centre productivity through automation. In addition, the government of Japan takes a supportive approach to the digital transformation of logistics operations, and Japan has extensive domestic expertise in robotics/automation technology, enabling quick adoption of warehouse and distribution centre automations.

Restraining Factors

The warehouse automation market in Japan is mostly constrained by the high initial capital investment, the complex system integration with the legacy infrastructure, the limited automation readiness among small warehouses, and the issue of return on investment, especially for SMEs that have low-volume or seasonal operations.

Market Segmentation

The Japan warehouse automation market share is classified into component type and end user.

- The hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan warehouse automation market is segmented by component type into hardware, software, and services. Among these, the hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. High investments in physical automation infrastructure, including AS/RS, AGVs, AMRs, conveyors, sortation systems, and robotic picking solutions, are the cause of this. In order to immediately solve labor shortages, increase throughput, and enable high-speed, large-volume operations in Japanese warehouses with limited space, companies emphasize the deployment of hardware.

- The post and parcel segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan warehouse automation market is segmented by end user into food and beverage, post and parcel, retail, apparel, manufacturing, and others. Among these, the post and parcel segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The quick growth of e-commerce, large parcel quantities, and the need for quick, precise sorting and last-mile fulfillment are the main causes of this. To effectively handle peak delivery loads, logistics companies make significant investments in robots, automated sorting, and AS/RS.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan warehouse automation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daifuku Co., Ltd.

- Murata Machinery, Ltd.

- Toyota Industries Corporation

- Okamura Corporation

- IHI Logistics Machinery Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Sumitomo Heavy Industries, Ltd.

- Yaskawa Electric Corporation

- Panasonic Connect Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, the International Logistics Exhibition 2025 was the platform where advanced warehouse automation technologies were presented, including the new Rotary Rack H of the automated storage system by Okamura.

- In August 2025, the utilization of AI-based palletizing robots throughout its logistics centers was the choice made by Hitachi Transport System, thus increasing automation and throughput.

- In July 2025, Fanuc, along with the development of robots with AI-assisted path correction for dynamic warehouse workflows, also made a gain in the field of collaborative robots.

- In April 2025, Rakuten Group, by introducing autonomous robots for e-commerce delivery and goods movement in urban logistics, extended the automation beyond the warehouses and integrated it with the whole logistics process.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Japan warehouse automation market based on the below-mentioned segments:

Japan Warehouse Automation Market, By Component Type

- Hardware

- Software

- Services

Japan Warehouse Automation Market, By End User

- Food and Beverage

- Post and Parcel

- Retail

- Apparel

- Manufacturing

- Others

FAQ’s

Q: What is the Japan warehouse automation market size?

A: Japan warehouse automation market size is expected to grow from USD 1341.5 million in 2024 to USD 6434.2 million by 2035, growing at a CAGR of 15.32% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by the severe labor shortage that Japan is currently suffering from due to Japan's rapidly aging population, coupled with lower participation by individuals in the workforce and stricter regulations related to overtime hours worked within the logistics sector. Japan's increasing eCommerce activity & omnichannel retailing require higher volumes of accurately fulfilled orders at a much greater speed than companies could have fulfilled prior to the explosion of online retail. Logistics companies have increased labour and operating costs, and must increase warehouse and distribution centre productivity through automation.

Q: What factors restrain the Japan warehouse automation market?

A: Constraints include the high initial capital investment, the complex system integration with the legacy infrastructure, the limited automation readiness among small warehouses, and the issue of return on investment, especially for SMEs that have low-volume or seasonal operations.

Q: How is the market segmented by component type?

A: The market is segmented into hardware, software, and services.

Q: Who are the key players in the Japan warehouse automation market?

A: Key companies include Daifuku Co., Ltd., Murata Machinery, Ltd., Toyota Industries Corporation, Okamura Corporation, IHI Logistics Machinery Co., Ltd., Kawasaki Heavy Industries, Ltd., Sumitomo Heavy Industries, Ltd., Yaskawa Electric Corporation, Panasonic Connect Co., Ltd., and Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 174 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |