Japan Wound Care Management Devices Market

Japan Wound Care Management Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Wound Care, Wound Closure), By Wound Type (Chronic Wound, Acute Wound), and Japan Wound Care Management Devices Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Japan Wound Care Management Devices Market Insights Forecasts to 2035

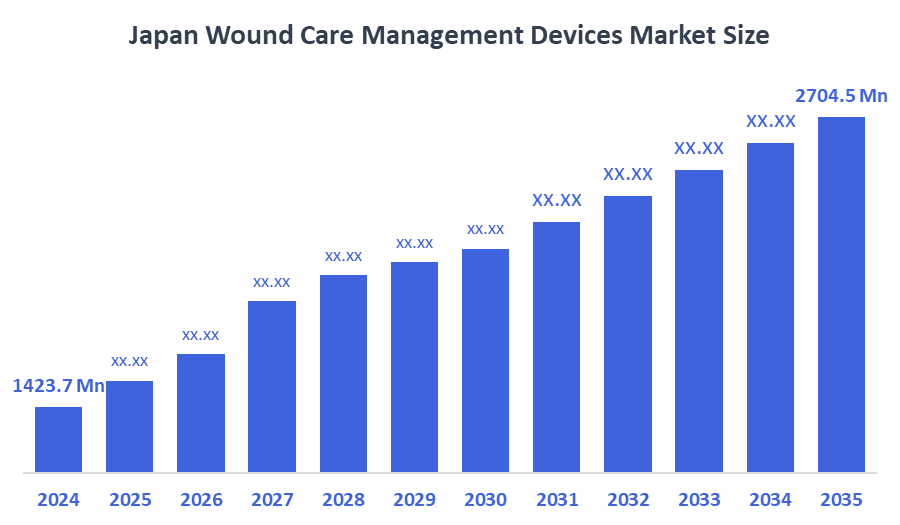

- The Japan Wound Care Management Devices Market Size Was Estimated at USD 1423.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.01% from 2025 to 2035

- The Japan Wound Care Management Devices Market Size is Expected to Reach USD 2704.5 Million by 2035

According to a research report published by Spherical Insights & Consulting, The Japan Wound Care Management Devices Market Size is anticipated to reach USD 2704.5 Million by 2035, Growing at a CAGR of 6.01% from 2025 to 2035. The wound care management devices market in Japan is driven by an aging population, a rising prevalence of chronic conditions such as diabetes, growing awareness of advanced therapeutic options, stringent safety and efficacy regulations, and the continuous introduction of innovative products.

Market Overview

The market for wound care management devices involves a variety of medical products and technologies to facilitate the healing of acute, chronic, and surgical wounds. This would include products such as dressings, bandages, negative pressure wound therapy (NPWT) systems, compression therapy, and other advanced wound care management solutions. This market has an emphasis on infection prevention, accelerated tissue repair, avoiding complications, and improving patient outcomes. This market serves hospitals, clinics, and home care settings and treats diabetic ulcers, pressure ulcers, burns, and wounds from surgical procedures. More than 200 research initiatives centered on improved wound care, such as bioengineered skin substitutes and AI-powered wound assessment systems, have received significant funding from the government. The Japanese market for wound care management devices is growing steadily, driven by the aging population in the country and the increasing prevalence of chronic conditions, such as diabetes and pressure ulcers. Awareness among healthcare providers and patients about advanced wound care therapies, including negative pressure wound therapy (NPWT), bioengineered dressings, and smart monitoring systems, is increasing. Furthermore, the rigorous regulatory environment in Japan ensures high product quality and safety, fostering innovation among domestic and international manufacturers. In addition, the ongoing launch of wound care products with new and patient-centric technology will further sustain long-term market growth.

Report Coverage

This research report categorizes the market for the Japan wound care management devices market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan wound care management devices wound care management devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan wound care management devices market.

Driving Factors

The wound care management devices market in Japan is driven by a quickly aging demographic that tends to experience chronic wounds, pressure ulcers, and slow healing. The increasing prevalence of diabetes and circulatory disorders is leading to increased demand for treatment modalities such as Negative Pressure Wound Therapy (NPWT) and smart dressing technologies. Well-established infrastructure, technological developments, and reimbursement accessibility all contribute to increased market penetration. Furthermore, the spike in adoption has been confirmed by patients' and healthcare professionals' growing appreciation for sophisticated wound care procedures and early management, which supports improved outcomes and quality of life.

Restraining Factors

The wound care management devices market in Japan is mostly constrained by Strict regulatory requirements from the Pharmaceuticals and Medical Devices Agency (PMDA), elongating approval times, as PMDA also requires domestic clinical data and post-marketing surveillance, producing additional costs for manufacturers. National Health Insurance (NHI) reimbursement obstacles for Japan include the constant pressure on price, with the prevalent limitation of price adjustments, which is inhibiting profitability for manufacturers. Advanced wound therapy treatments also do not have separate reimbursement options, limiting access to the market.

Market Segmentation

The Japan wound care management devices market share is classified into product and wound type.

- The wound care segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan wound care management devices market is segmented by product into wound care and wound closure. Among these, the wound care segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is fueled by the rising incidence of chronic wounds, diabetic ulcers, and pressure ulcers, primarily in the aging population. Advanced wound dressings, which include hydrocolloid, foam, and antimicrobial versions, have gained considerable traction in the market, given their high healing efficiency, infection protection, and comfort.

- The chronic wound segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan wound care management devices market is segmented by wound type into chronic wound and acute wound. Among these, the chronic wound segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is mainly the result of the country's quickly aging population and the high incidence of chronic problems such as diabetes, vascular issues, and pressure wounds. Chronic wounds require long treatment durations, frequent clinical examinations, and treatments with advanced wound care products such as negative pressure wound therapy (NPWT) and hydrocolloid dressings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan wound care management devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gunze Medical Limited

- Kuraray Medical Inc.

- Nichiban Co., Ltd.

- Nitto Denko Corporation

- Nipro Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2025, Gunze Medical became the exclusive distribution partner for HistoSonics, Inc. for its non-invasive histotripsy ultrasound therapy device in Japan. The technology uses focused sound waves to destroy targeted tissue without an incision. Gunze will obtain regulatory approval, secure reimbursement, and teach the clinical providers how to deliver the new therapy to patients, and scale this technology into the medical ecosystem across Japan.

- In April 2023, the Japanese wound care sales channel was reinforced by Gunze Medical, a full-service medical device firm that manages everything from research to sales. As a result, Gunze began marketing wound dressings (fiber pads for debridement), artificial dermis (PELNAC), and other wound care products directly to Japanese consumers.

- In January 2023, for the sale of EPIFIX in Japan, MiMedx Group, Inc. and GUNZE MEDICAL LIMITED signed an exclusive distribution contract. EPIFIX provides patients with persistent wounds with a tried-and-true therapeutic solution.

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan wound care management devices market based on the below-mentioned segments:

Japan Wound Care Management Devices Market, By Product

- Wound Care

- Wound Closure

Japan Wound Care Management Devices Market, By Wound Type

- Chronic Wound

- Acute Wound

FAQ’s

Q: What is the Japan wound care management devices market size?

A: Japan wound care management devices market size is expected to grow from USD 1423.7 million in 2024 to USD 2704.5 million by 2035, growing at a CAGR of 6.01% during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Market growth is driven by a quickly aging demographic that tends to experience chronic wounds, pressure ulcers, and slow healing. The increasing prevalence of diabetes and circulatory disorders is leading to increased demand for treatment modalities such as Negative Pressure Wound Therapy (NPWT) and smart dressing technologies.

Q: What factors restrain the Japan wound care management devices market?

A: Constraints include the high costs of the devices, preventing rural market usage, and strict regulatory approvals, delaying market access.

Q: How is the market segmented by product type?

A: The market is segmented into wound care and wound closure.

Q: Who are the key players in the Japan wound care management devices market?

A: Key companies include Gunze Medical Limited, Kuraray Medical Inc., Nichiban Co., Ltd., Nitto Denko Corporation, and Nipro Corporation.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 241 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |