Global Jetstream Atherectomy Market

Global Jetstream Atherectomy Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Application (Peripheral Artery Disease, Coronary Artery Disease, and In?Stent Restenosis, Others), By End?User (Hospitals & Surgical Centers, Ambulatory Surgery Centers, and Cardiology Clinics), and By Region (Asia Pacific, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Jetstream Atherectomy Market Summary, Size & Emerging Trends

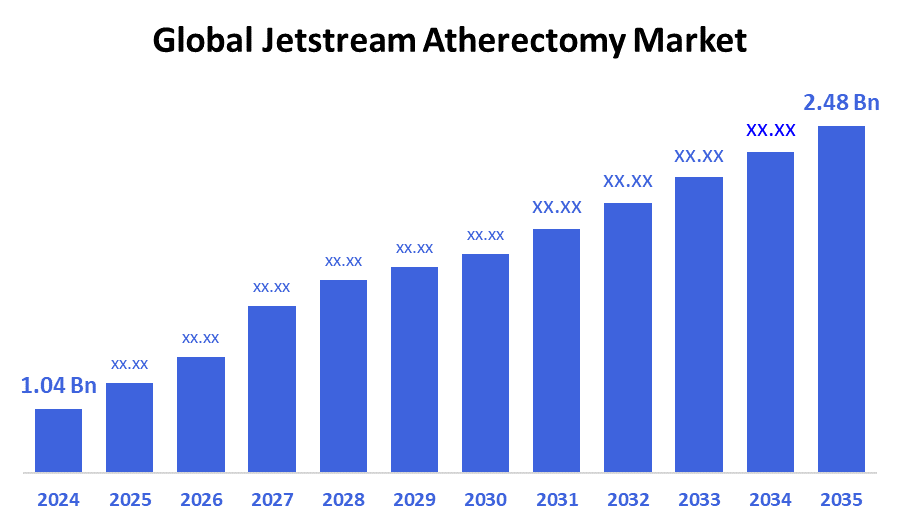

According to Decision Advisors, The Global Jetstream Atherectomy Market Size is expected to grow from USD 1.04?Billion in 2024 to USD 2.48 Billion by 2035, at a CAGR of 8.25% during the forecast period 2025-2035. Rising preference for treating in?stent restenosis and complexity of PAD lesions, plus regulations favoring ambulatory settings, are propelling demand for devices such as Jetstream.

Key Market Insights

- North America remains the dominant region for Jetstream usage, by virtue of high procedural volume and reimbursement favorability.

- Peripheral Artery Disease (PAD) and in?stent restenosis applications are where Jetstream tends to be most used.

- Hospitals and surgical centers currently account for the bulk of procedure settings; ASCs (Ambulatory Surgical Centers) are increasing share due to lower cost and regulatory support.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.10 Billion

- 2035 Projected Market Size: USD 2.48 Billion

- CAGR (2025-2035): 8.25%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Jetstream Atherectomy Market

The Jetstream atherectomy system is a device that integrates front?cutting blades with aspiration capability to remove plaque and thrombus in diseased arteries. It is particularly suited to complex, calcified lesions, in?stent restenosis, and peripheral arterial disease (PAD). Jetstream offers the advantages of reduced distal embolization by aspirating debris, and more efficient plaque removal versus some pure directional or rotational systems. COVID?19 impacted procedure volume, but demand rebounded, especially with outpatient procedures. Trade and tariff issues on medical devices affect costs of components such as turbine/aspiration motors, blades, and sterile packaging thus impacting pricing and profitability.

Jetstream Atherectomy Market Trends

- Increased interest in devices that combine debulking + aspiration to minimize complications.

- Expanding use in treating in?stent restenosis and heavily calcified PAD lesions.

- Shift to outpatient/Ambulatory Surgery Center (ASC) settings for cost efficiency.

- R&D improvements in cutter design, clearance, and imaging guidance to improve lesion reach.

- Regulatory approvals and guidelines increasingly supporting lesion preparation before drug therapies.

Jetstream Atherectomy Market Dynamics

Driving Factors: The Jetstream atherectomy market is driven by the global rise in peripheral artery disease (PAD)

The Jetstream atherectomy market is driven by the global rise in peripheral artery disease (PAD) and coronary artery disease (CAD), prompting the need for advanced endovascular tools. Jetstream’s dual-action design, combining plaque excision and aspiration, appeals to physicians for its efficiency and procedural safety. Favorable reimbursement policies, particularly in outpatient settings, are encouraging wider adoption. Additionally, technological improvements in device precision, ease of use, and complication reduction have made Jetstream more attractive for use in both hospitals and ambulatory surgical centers. As minimally invasive techniques become the norm, demand for such versatile and clinically efficient devices continues to grow.

Restrain Factors: The system's high acquisition and per-use cost can deter adoption

Despite its advantages, the Jetstream device faces several market restraints. The system's high acquisition and per-use cost can deter adoption, particularly in budget-conscious settings. Clinicians require time and training to become proficient with the device, adding a barrier to routine use. Additionally, optimal use requires intravascular imaging or guidance tools, which further raises procedural cost and complexity. In markets where reimbursement is limited or inconsistent—especially in emerging economies—adoption is slower. Competing technologies such as orbital atherectomy, laser atherectomy, or drug-coated balloons also offer alternatives, diluting market share and influencing procedural decision-making.

Opportunity: Opportunities exist to combine Jetstream use with complementary therapies

The Jetstream market holds promising growth potential, particularly in underserved regions where vascular disease prevalence is high and healthcare access is expanding. Opportunities exist to combine Jetstream use with complementary therapies, such as drug-coated balloons or polymer-based agents, enhancing treatment efficacy. As healthcare shifts toward minimally invasive remote procedures, Jetstream could play a key role in mobile or telemedicine-supported interventions. Additionally, reducing manufacturing costs and simplifying device usability can facilitate adoption in non-specialist centers or outpatient clinics. Such strategic improvements may open new distribution channels, drive global expansion, and broaden Jetstream’s application beyond traditional vascular centers.

Challenges: Several challenges hinder the wider adoption of the Jetstream system

Several challenges hinder the wider adoption of the Jetstream system. One critical concern is the need for more robust, long-term clinical data demonstrating superiority over competing methods. While the device includes an aspiration mechanism, risks like distal embolization persist, requiring skilled operation and sometimes adjunctive protection devices. Securing regulatory approvals across global markets can be complex and time-consuming. Furthermore, the availability and timely delivery of consumable components are essential to maintaining procedural efficiency. Finally, hospitals must balance the high upfront cost of the system against perceived clinical and economic value, particularly when less expensive alternatives are available.

Global Jetstream Atherectomy Market Ecosystem Analysis

The ecosystem includes device OEMs (Boston Scientific as flagship Jetstream provider), hospital purchase departments, cardiovascular interventionalists, ambulatory surgery centers, reimbursement authorities, imaging & guidance system providers, and component suppliers (blades, aspiration motor, sterile packaging). Competitive differentiation is built around cutter design, aspiration efficiency, procedural outcomes, and consumables cost. Regulatory and clinical trial evidence serve as key gatekeepers of adoption, especially in Europe and Asia where guidelines require safety data.

Global Jetstream Atherectomy Market, By Application

The peripheral artery disease (PAD) application segment accounts for the largest share of Jetstream device usage and revenue, representing approximately 50% of total Jetstream revenues in 2024. This dominance is due to the extensive use of Jetstream devices in treating complex calcified lesions, particularly in femoropopliteal arteries and below-the-knee vessels. These vascular territories commonly suffer from calcification, which makes lesion removal critical for restoring blood flow. Jetstream’s dual-functionality and precision make it highly effective for these indications, driving strong demand among clinicians managing challenging PAD cases worldwide.

The in-stent restenosis (ISR) segment is one of the fastest-growing applications for Jetstream devices, accounting for around 25% of its usage, especially in the U.S. market. ISR occurs when neointimal hyperplasia causes re-narrowing within previously placed stents, leading to reduced vessel patency. Jetstream’s ability to mechanically remove this excess tissue and restore the vessel lumen makes it highly valuable in ISR management. The increasing adoption reflects clinicians’ preference for effective solutions to improve long-term outcomes for patients experiencing restenosis after stent implantation.

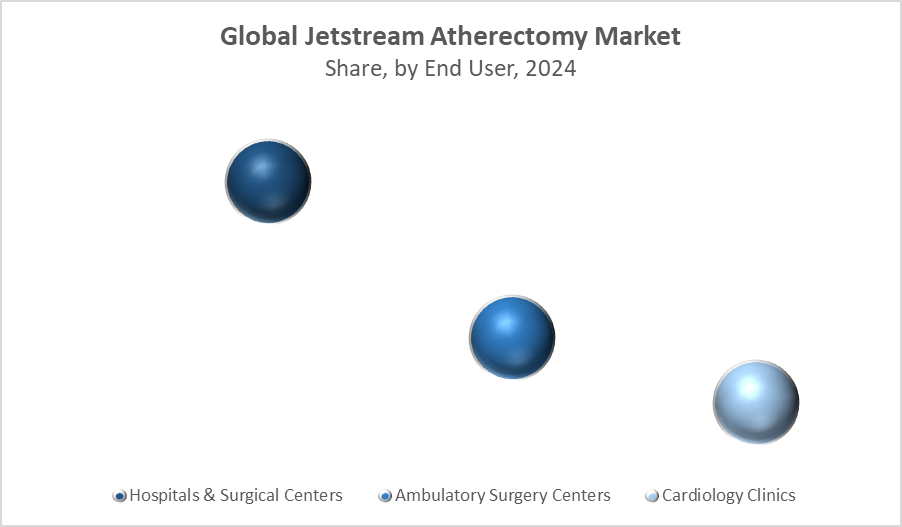

Global Jetstream Atherectomy Market, By End User

Hospitals and surgical centers currently account for approximately 70% of Jetstream device deployments. This large share is due to the complex nature of Jetstream procedures, which often require advanced imaging systems, surgical backup, and specialized clinical expertise available in these settings. Moreover, hospitals have well-established reimbursement frameworks that support the use of high-cost, specialized devices like Jetstream. The availability of comprehensive facilities makes them the preferred choice for treating severe and complicated vascular cases, ensuring patient safety and optimal clinical outcomes.

Ambulatory surgery centers are rapidly growing in their share of Jetstream procedures, projected to reach around 25% by 2035. This growth is driven by favorable outpatient reimbursement models and a general trend toward lower facility costs. ASCs offer a more cost-effective alternative to hospitals for less complex cases, allowing providers to deliver efficient care with reduced overhead. As Jetstream devices become easier to use and procedures less invasive, ASCs are increasingly adopting them to capitalize on outpatient care benefits while maintaining high-quality treatment standards.

North America holds the largest share of the Jetstream atherectomy market in 2024, accounting for approximately 45% of total revenue.

This dominance is driven by strong healthcare infrastructure, early and widespread clinical adoption of Jetstream devices, and favorable reimbursement policies that support advanced vascular interventions. Additionally, the presence of major players like Boston Scientific, which markets Jetstream devices, further strengthens North America’s leadership position. The region’s established interventional cardiology and peripheral vascular treatment facilities contribute significantly to sustained market growth.

Europe accounts for about 25% of the Jetstream atherectomy market revenue in 2024.

Adoption rates are robust primarily in Western European countries, where reimbursement frameworks and regulatory policies around device safety influence market dynamics. While the volume growth in Europe is moderate compared to other regions, ongoing investments in vascular healthcare and evolving clinical practices support steady demand. However, the pace of growth is influenced by regional variations in healthcare infrastructure and regulatory requirements.

Asia Pacific is the fastest-growing region for the Jetstream atherectomy market, with a projected compound annual growth rate (CAGR) of around 10%.

fueled by a rising prevalence of cardiovascular diseases, increasing approvals for innovative medical devices, and the expansion of interventional cardiology facilities across emerging economies such as China, India, and Southeast Asia. Growing healthcare investments and improving access to advanced therapies further accelerate market adoption.

WORLDWIDE TOP KEY PLAYERS IN THE JETSTREAM ATHERECTOMY MARKET INCLUDE

- Boston Scientific Corporation

- Medtronic plc

- Abbott Laboratories

- Terumo Corporation

- Cardiovascular Systems, Inc.

- Avinger, Inc.

- Biotronik

- Teleflex

- Philips Healthcare

- Minnetronix Inc.

- Others

Product Launches in Jetstream Atherectomy Market

- In July 2025, Boston Scientific unveiled an upgraded version of their Jetstream X device, introducing a front-cutting plus aspiration module with enhanced dual-blade geometry. This improvement is designed to minimize the generation of debris during procedures, which in turn reduces the risk of complications such as distal embolization. Additionally, the new design aims to shorten procedural times, making treatments more efficient for clinicians and patients alike. This update reflects ongoing innovation to improve device performance and patient outcomes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the Jetstream atherectomy market based on the below-mentioned segments:

Global Jetstream Atherectomy Market, By Application

- Peripheral Artery Disease (PAD)

- In?Stent Restenosis (ISR)

- Coronary Artery Disease (CAD)

- Other Applications

Global Jetstream Atherectomy Market, By End?User

- Hospitals & Surgical Centers

- Ambulatory Surgery Centers

- Cardiology / Specialty Clinics

Global Jetstream Atherectomy Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What is the current market size of the Global Jetstream Atherectomy Market?

The market size in 2024 is estimated to be USD 1.04 billion.

Q. What is the projected market size by 2035?

The market is projected to reach USD 2.48 billion by 2035.

Q. What is the expected CAGR for the forecast period (2025–2035)?

The market is expected to grow at a CAGR of 8.25% during the forecast period.

Q. Which region is currently dominating the Jetstream Atherectomy Market?

North America is the leading region in 2024 due to high procedural volume and favorable reimbursement.

Q. Which region is expected to grow the fastest?

Asia Pacific is expected to register the fastest growth due to rising cardiovascular cases and expanding healthcare infrastructure.

Q. What are the key application segments in this market?

Peripheral Artery Disease (PAD), In-Stent Restenosis (ISR), Coronary Artery Disease (CAD), and Others.

Q. Which application segment holds the largest market share?

Peripheral Artery Disease (PAD) holds the largest share, accounting for approximately 50% of market revenue.

Q. Who are the major end users of Jetstream atherectomy systems?

Hospitals & Surgical Centers, Ambulatory Surgery Centers, and Cardiology Clinics.

Q. What are the key factors driving market growth?

Rising incidence of PAD and ISR, preference for minimally invasive treatments, favorable reimbursement policies, and advancements in device technology.

Q. What are the major challenges faced by the Jetstream Atherectomy Market?

High device and procedural costs, need for operator training, regulatory hurdles, and competition from alternative treatment modalities.

Q. Who are the major players in the Global Jetstream Atherectomy Market?

Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Terumo Corporation, Cardiovascular Systems Inc., and others.

Q. Are there any recent product launches in this market?

Yes, in July 2025, Boston Scientific launched an enhanced version of the Jetstream X device with improved cutting and aspiration capabilities.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |