Global Juice Testing Market

Global Juice Testing Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Test Type (Microbiological Testing, Chemical Testing, Sensory Testing, and Physical Testing), By Juice Type (Fruit Juice, Vegetable Juice, and Blends), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Juice Testing Market Summary, Size & Emerging Trends

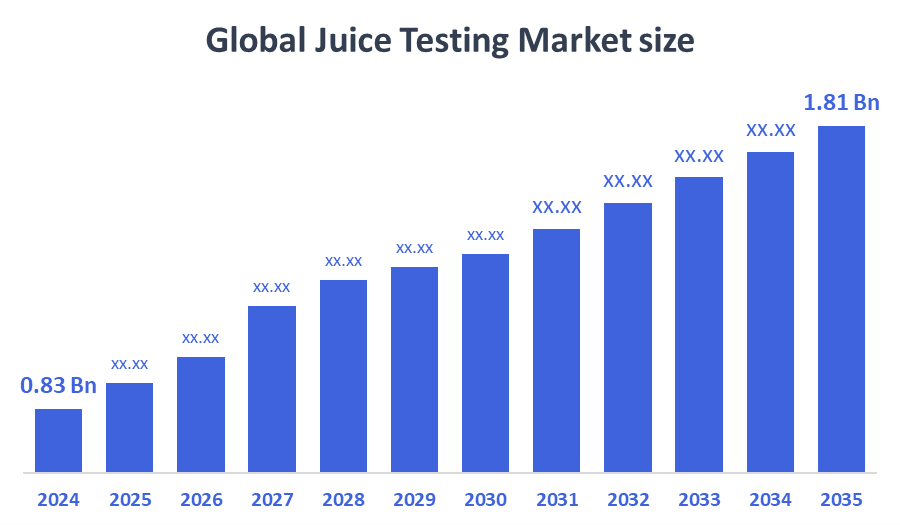

According to Decision Advisors, The Global Juice Testing Market Size is Expected to Grow from USD 0.83 Billion in 2024 to USD 1.81 Billion by 2035, at a CAGR of 7.35% during the forecast period 2025-2035. Increasing consumer demand for safe, high-quality, and standardised juice products, along with stringent food safety regulations, are major growth drivers. Technological advancements in rapid and automated testing methods enhance efficiency and accuracy, boosting market expansion.

Key Market Insights

- North America is anticipated to hold the largest share in the juice testing market during the forecast period.

- Microbiological testing dominates in terms of revenue, due to the critical need to detect microbial contaminants.

- Fruit juice remains the largest segment by juice type, driven by high consumer consumption and regulatory scrutiny.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 0.83 Billion

- 2035 Projected Market Size: USD 1.81 Billion

- CAGR (2025-2035): 7.35%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Juice Testing Market

The juice testing market focuses on ensuring the safety, quality, and authenticity of juice products through various testing methodologies. Testing helps identify contaminants like pathogens, pesticides, and adulterants, while also verifying nutritional content and sensory qualities. The rising awareness of foodborne illnesses, strict government regulations, and consumer demand for transparency fuel market growth. Innovations in testing technologies, such as real-time PCR and spectrometry, improve detection speed and accuracy. The market serves juice manufacturers, food safety agencies, and third-party testing labs. As health and safety concerns escalate globally, juice testing becomes critical in maintaining consumer trust and compliance with international food standards.

Juice Testing Market Trends

- Increasing adoption of rapid testing technologies reduces turnaround times.

- Integration of automation and AI in testing improves precision and data management.

- Rising demand for organic and natural juices increases the need for pesticide residue testing.

- Emphasis on authenticity and traceability drives the use of advanced analytical methods.

Juice Testing Market Dynamics

Driving Factors: Increased consumption of juices worldwide has raised concerns about product quality

The juice testing market is primarily driven by growing consumer and regulatory focus on food safety. Increased consumption of juices worldwide has raised concerns about product quality, encouraging stringent testing. Regulatory bodies like the FDA (USA), EFSA (Europe), and FSSAI (India) enforce strict safety standards that manufacturers must meet. Additionally, advances in testing technologies such as molecular diagnostics and sensory analysis have improved detection speed and accuracy, making testing more efficient. The rise of e-commerce channels for juice products also requires rigorous quality assurance to maintain consumer trust, further fueling market demand.

Restrain Factors: Varying regulatory standards across countries complicate compliance for global players

Market growth is limited by the high costs associated with advanced testing instruments and the shortage of skilled professionals who can operate them. Moreover, varying regulatory standards across countries complicate compliance for global players, increasing operational challenges. The lengthy duration of some testing procedures and the complexity involved in preparing samples slow down testing throughput, reducing efficiency. These factors combined restrict the rapid expansion of the juice testing market.

Opportunity: Adopting blockchain technology for supply chain transparency

Emerging regions like Asia Pacific and Latin America offer significant growth opportunities due to rising juice consumption and enhanced food safety infrastructure. Innovations such as portable, easy-to-use testing kits can make quality testing more accessible and affordable. Furthermore, adopting blockchain technology for supply chain transparency and product traceability can build consumer confidence. Strategic collaborations between juice manufacturers and testing laboratories can also improve quality control processes, opening new revenue streams in the market.

Challenges: Competition from cheaper

The juice testing market faces risks from supply chain disruptions, especially related to raw material testing, which can delay product launches. Geopolitical tensions affecting the trade of testing equipment and technologies may also hamper smooth market operations. Additionally, competition from cheaper, less comprehensive testing methods can undermine the adoption of more reliable but costlier solutions, posing a challenge to market growth.

Global Juice Testing Market Ecosystem Analysis

The ecosystem comprises raw material suppliers, testing equipment manufacturers (such as Thermo Fisher Scientific and Merck), juice producers, third-party testing laboratories, regulatory bodies, and research institutions. Cooperation between these entities ensures innovation, compliance, and market expansion. Regulatory agencies set safety standards, while manufacturers and labs focus on accurate and efficient testing solutions. The growing consumer emphasis on transparency encourages ecosystem players to enhance traceability and product authenticity measures.

Global Juice Testing Market, By Test Type

Microbiological testing leads the global juice testing market, holding approximately 40% market share. This segment plays a vital role in ensuring juice safety by detecting harmful pathogens such as Salmonella, E. coli, and Listeria, which can cause serious foodborne illnesses. With increasing global focus on hygiene and food safety standards, especially in freshly squeezed and cold-pressed juices, microbiological testing is considered mandatory in most regions. Regulatory agencies such as the FDA and EFSA require stringent microbial testing before juices hit the shelves, further driving the dominance of this segment.

Chemical testing accounts for nearly 30% of the market, focusing on identifying pesticide residues, heavy metals, and verifying nutritional content in juices. This type of testing is crucial for detecting chemical contaminants that can enter the supply chain through agricultural practices or packaging materials. Chemical testing ensures compliance with global food safety regulations and labelling accuracy. It is especially important for organic and health-focused juice brands, where traceability and clean-label claims need to be verified. The growing demand for nutrient-rich and residue-free products keeps this segment highly relevant in both developed and developing markets.

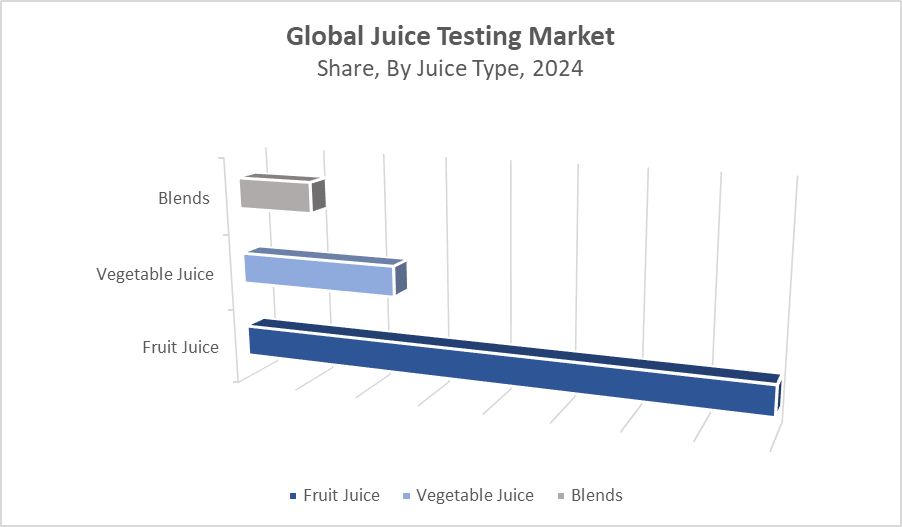

Global Juice Testing Market, By Juice Type

Fruit juice dominates the juice testing market with a 55% share, primarily due to its high global consumption across all age groups. Popular varieties like orange, apple, grape, and mixed fruit juices are consumed both fresh and packaged, requiring strict testing to ensure safety, quality, and nutritional accuracy. Regulatory bodies such as the FDA, EFSA, and FSSAI closely monitor fruit juice for microbial contamination, sugar content, preservatives, and pesticide residues. As consumer demand for organic and cold-pressed fruit juices rises, testing requirements become even more stringent, reinforcing this segment's dominance.

Vegetable juice holds a 25% market share and is the fastest-growing segment, fueled by increasing health consciousness and trends like detox, keto, and plant-based diets. Juices made from carrots, beets, spinach, and kale are gaining popularity for their nutritional benefits. However, due to their shorter shelf life and higher microbial risk, vegetable juices require robust testing for pathogens, nitrates, and chemical residues. As consumers demand cleaner labels and functional health benefits, comprehensive testing becomes essential to validate safety and compliance, supporting the steady growth of this segment.

North America holds the position of the largest market, contributing to approximately 35% of the global juice testing market share.

This dominance is driven by stringent food safety regulations enforced by agencies like the FDA and USDA, which mandate comprehensive testing of juice products before they enter the consumer market. High levels of consumer awareness about product quality, foodborne illness risks, and label accuracy further support the demand for robust testing services. The presence of advanced testing infrastructure, well-established juice brands, and health-focused consumers continues to strengthen North America's leadership in this space.

The United States is the largest market for juice testing globally,

supported by strict regulatory frameworks, advanced laboratory infrastructure, and a highly aware consumer base. Regulatory bodies like the Food and Drug Administration (FDA) and United States Department of Agriculture (USDA) enforce rigorous quality and safety standards, particularly under regulations such as the Food Safety Modernization Act (FSMA).

Asia Pacific is the fastest-growing region, projected to grow at a CAGR of 7.8% during the forecast period.

This growth is driven by rising juice consumption, increasing disposable incomes, and growing health awareness among urban populations. Countries like China, India, and Japan are investing heavily in food safety infrastructure, improving their laboratory capabilities and regulatory oversight. In addition, the rise of local and international juice brands catering to health-conscious consumers creates a growing need for standardized and efficient juice testing. The region’s growth potential is also enhanced by government initiatives promoting food quality and safety compliance.

India is one of the most promising and rapidly growing markets in the juice testing segment,

driven by a combination of rising juice consumption, increasing health awareness, and tightening food safety regulations. With a projected CAGR of over 9%, the market is expanding as both domestic and international juice brands penetrate urban and semi-urban areas.

WORLDWIDE TOP KEY PLAYERS IN THE JUICE TESTING MARKET INCLUDE

- Thermo Fisher Scientific

- Merck KGaA

- SGS SA

- Eurofins Scientific

- Bureau Veritas

- Intertek Group plc

- ALS Limited

- Mérieux NutriSciences

- TUV SUD

- Q Laboratories

- Others

Product Launches in Juice Testing Market

- In January 2024, Thermo Fisher Scientific introduced a cutting-edge PCR-based pathogen detection kit specifically designed for the juice industry. This innovative solution reduces testing time by up to 50%, allowing juice manufacturers to quickly identify harmful microorganisms such as Salmonella, E. coli, and Listeria. The rapid turnaround not only improves safety compliance but also enhances production efficiency by minimizing delays in batch releases. This launch addresses the industry's growing need for faster, more reliable microbiological testing, especially for cold-pressed and minimally processed juice products.

- In October 2023, Merck launched a new line of pesticide residue analysis kits tailored for large-scale juice production facilities. These kits offer enhanced sensitivity, enabling detection of even trace levels of pesticides that may remain from fruit and vegetable farming. Designed for ease of use, the kits simplify the testing process, making them suitable for both in-house labs and third-party testing services. This product launch supports the industry's shift toward clean-label, organic, and export-compliant juices, where meeting strict global safety standards is critical.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the juice testing market based on the below-mentioned segments:

Global Juice Testing Market, By Test Type

- Microbiological Testing

- Chemical Testing

- Sensory Testing

- Physical Testing

Global Juice Testing Market, By Juice Type

- Fruit Juice

- Vegetable Juice

- Blended Juice

Global Juice Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What is the expected growth rate of the Global Juice Testing Market from 2025 to 2035?

The market is expected to grow at a CAGR of 7.35% during the forecast period 2025-2035.

Q. Which region holds the largest share in the juice testing market?

North America holds the largest market share, contributing approximately 35% of the global juice testing market.

Q. What are the key drivers fueling the growth of the juice testing market?

Growth is driven by increasing consumer demand for safe, high-quality juices, stringent food safety regulations, and technological advancements in rapid and automated testing methods.

Q. Which test type dominates the juice testing market?

Microbiological testing dominates, accounting for around 40% of the market, due to its importance in detecting harmful pathogens.

Q. What are the major challenges faced by the juice testing market?

Challenges include high costs of advanced testing instruments, shortage of skilled professionals, varying regulatory standards across countries, and competition from cheaper, less comprehensive testing methods.

Q. Which segment of juice type is growing the fastest?

The vegetable juice segment is the fastest growing, driven by increasing health awareness and trends like detox and plant-based diets.

Q. How are technological innovations impacting the juice testing market?

Innovations like PCR-based pathogen detection kits and portable pesticide residue analysis kits improve testing speed, accuracy, and accessibility, supporting market expansion.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |