Global Kapok Fiber Market

Global Kapok Fiber Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Fiber Type (Natural Kapok Fiber and Processed Kapok Fiber), By Application (Textiles, Upholstery, Bedding, and Automotive), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Kapok Fiber Market Summary, Size & Emerging Trends

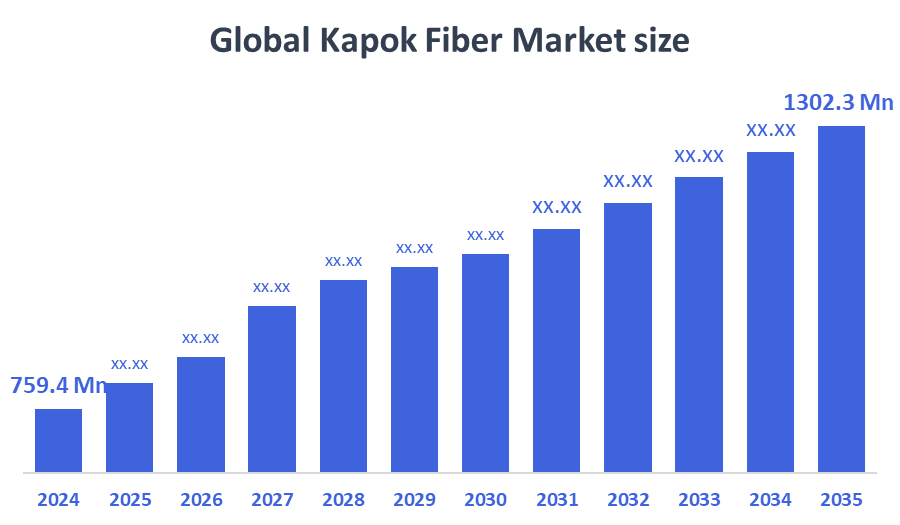

According to Decision Advisor, The Global Kapok Fiber Market Size is Expected to Grow from USD 759.4 Million in 2024 to USD 1302.3 Million by 2035, at a CAGR of 5.03% during the forecast period 2025-2035. Increasing demand for sustainable and biodegradable fibers in textile and automotive industries is a key driving factor for the kapok fiber market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the kapok fiber market during the forecast period.

- In terms of fiber type, the natural kapok fiber segment dominated in terms of revenue during the forecast period.

- In terms of application, the textiles segment accounted for the largest revenue share in the global kapok fiber market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 759.4 Million

- 2035 Projected Market Size: USD 1302.3 Million

- CAGR (2025-2035): 5.03%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Kapok Fiber Market

The kapok fiber market centers on the production and utilization of kapok, a natural fiber obtained from the seed pods of the kapok tree (Ceiba pentandra). Known for its lightweight, buoyant, and hypoallergenic properties, kapok fiber is widely used as an eco-friendly alternative to synthetic fibers in textiles, upholstery, bedding, and automotive applications. Its biodegradability and sustainability align with growing consumer demand for green products. Governments and environmental organizations support kapok fiber through initiatives promoting sustainable agriculture and fiber processing technologies. Increasing awareness of environmental impact and the push towards circular economies contribute to the rising adoption of kapok fiber worldwide.

Kapok Fiber Market Trends

- Growing preference for natural and sustainable fibers over synthetic alternatives in the textile and automotive sectors.

- Innovations in processing techniques enhancing fiber quality and durability.

- Collaborations between fiber producers and manufacturers to expand applications in automotive and home furnishings.

Kapok Fiber Market Dynamics

Driving Factors: Rising demand for eco-friendly and biodegradable materials

Key growth drivers for the kapok fiber market include increasing environmental concerns encouraging substitution of synthetic fibers with natural fibers such as kapok. Expanding applications in textiles, automotive interiors, and bedding further stimulate market demand. Government policies promoting sustainable agriculture and environmental conservation bolster kapok cultivation and processing. Consumer preference for hypoallergenic and renewable fibers in home furnishings and apparel also drives growth.

Restrain Factors: Seasonal availability and limited processing infrastructure

Challenges in the kapok fiber market include seasonal fluctuations in kapok production and limited industrial-scale processing facilities that impact supply consistency. Lack of awareness in some regions about kapok’s properties and benefits restricts market penetration. Additionally, competition from cheaper synthetic fibers and variability in fiber quality due to natural factors limit broader adoption.

Opportunity: Growing interest in sustainable fashion and green automotive interiors

Opportunities for the kapok fiber market arise from the increasing global shift towards sustainable fashion and eco-friendly automotive interiors. Investments in research for fiber modification and composite materials open new avenues for kapok fiber applications. Emerging economies with kapok cultivation potential provide untapped markets. Strategic partnerships with textile and automotive manufacturers can accelerate market expansion and product innovation.

Challenges: Supply chain limitations and competition from synthetic fibers

The kapok fiber market faces challenges including fragmented supply chains, transportation delays, and lack of standardized quality control. Competition from well-established synthetic fiber producers offering cost-effective alternatives pressures market growth. Seasonal disruptions in raw material supply due to climate variability also pose risks. Moreover, educating manufacturers and consumers about kapok’s advantages requires ongoing efforts.

Global Kapok Fiber Market Ecosystem Analysis

The global kapok fiber market ecosystem includes kapok seed producers primarily in Southeast Asia, fiber processors converting raw kapok into usable forms, manufacturers of textiles and automotive components, and end-users across various industries. Regional cooperatives and government agencies promote sustainable kapok cultivation practices. Quality control institutions and certification bodies play key roles in ensuring fiber standards. This ecosystem’s development depends on improving supply chain efficiency, investing in processing technology, and fostering demand through awareness campaigns.

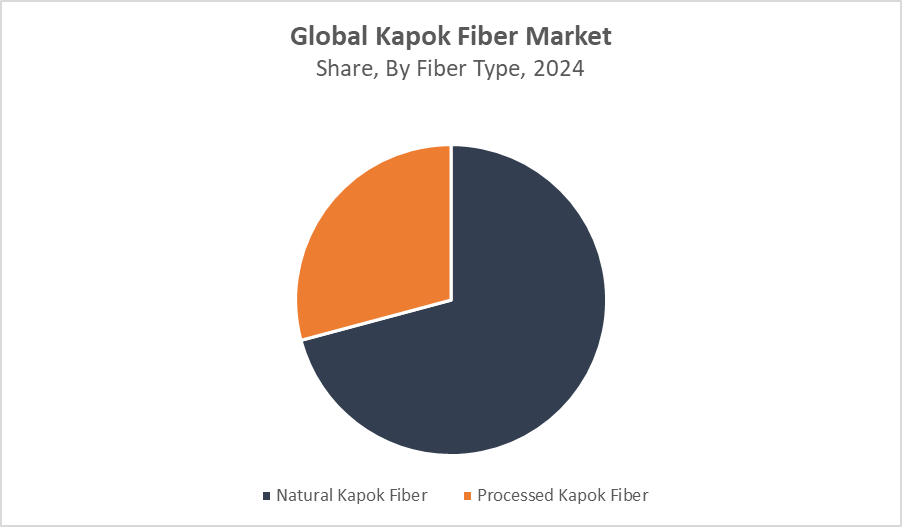

Global Kapok Fiber Market, By Fiber Type

The natural kapok fiber segment accounted for the largest revenue share of approximately 68% in the global kapok fiber market in 2024. This dominance is attributed to its abundant availability, particularly in Southeast Asia, and its traditional use in textiles, bedding, and upholstery. Natural kapok fiber is prized for its lightweight, buoyant, and hypoallergenic properties, making it an attractive material in both home furnishings and handcrafted products. Additionally, the low processing cost and minimal environmental impact of natural kapok align well with increasing consumer demand for sustainable and biodegradable materials.

The processed kapok fiber segment held a revenue share of approximately 32% in the global kapok fiber market in 2024 and is expected to grow at a higher CAGR compared to the natural segment during the forecast period. This growth is driven by rising demand in automotive, insulation, and composite applications, where modified kapok fibers are engineered to enhance performance. Through processing, kapok fibers are treated for improved tensile strength, blending compatibility, and fire retardancy, making them suitable for technical textiles and high-performance materials.

Global Kapok Fiber Market, By Application

The textiles segment accounted for the largest revenue share of approximately 40% in the global kapok fiber market in 2024. This segment leads the market due to the growing global demand for natural, lightweight, and breathable fabrics in fashion and home textiles. Kapok fiber is especially valued for its hypoallergenic, moisture-resistant, and insulating properties, making it ideal for use in eco-conscious clothing, quilts, pillows, and mattress fillings. The rising trend of sustainable fashion and an increasing shift toward organic and biodegradable materials have significantly driven the use of kapok fiber in textile manufacturing.

The upholstery segment held a notable revenue share of approximately 27% in the global kapok fiber market in 2024. Kapok’s natural buoyancy, softness, and resilience make it an excellent filling material for cushions, sofas, chairs, and other upholstered furniture. Its anti-microbial and dust-resistant properties also contribute to growing demand in the furniture and hospitality sectors, particularly among manufacturers seeking non-toxic and sustainable materials. As consumer preferences shift toward green and ethical home decor, kapok fiber is increasingly used in both premium and mid-range upholstered product lines.

Asia Pacific region is expected to account for the largest share of approximately 50% of the global kapok fiber market revenue during the forecast period.

This dominant position is attributed to the abundant natural availability of kapok trees in countries such as Indonesia, Malaysia, and the Philippines, where the crop is traditionally cultivated. These countries form the backbone of the global kapok supply chain, providing both raw material and low-cost labor for processing. Moreover, the region benefits from a booming textile industry, especially in countries like China, India, and Vietnam, which are increasingly integrating natural and biodegradable fibers like kapok into their production lines to meet international sustainability standards. The automotive sector in Asia Pacific is also adopting kapok fiber for interior components to comply with environmental regulations and reduce synthetic material usage.

India is projected to grow at a CAGR of approximately 9% during the forecast period.

This strong growth is driven by rising awareness about eco-friendly and sustainable fibers among both manufacturers and consumers, as well as the expansion of the textile export sector, which is increasingly prioritizing natural fibers to meet global demand. The Indian government’s Make in India initiative, combined with subsidies for natural fiber processing technologies and the promotion of organic farming, supports domestic kapok cultivation and processing.

North America is anticipated to hold a market share of approximately 18% in the global kapok fiber market during the forecast period.

This growth is largely fueled by the increasing consumer shift toward organic, allergen-free, and eco-conscious products, especially in the United States, where the sustainable fashion and natural home furnishings markets are growing rapidly. Kapok fiber is gaining popularity in mattresses, cushions, insulation materials, and automotive interiors across North America due to its biodegradability, low carbon footprint, and hypoallergenic properties.

WORLDWIDE TOP KEY PLAYERS IN THE KAPOK FIBER MARKET INCLUDE

-

- PT Kapok Indonesia

- Kapok Natural Fibers Ltd.

- GreenFiber Co.

- EcoKapok Industries

- BioFiber Global

- Sustainable Textiles Pvt. Ltd.

- NatureWeave Corp.

- Forest Fiber Ltd.

- Earth Friendly Fibers

- Others

Product Launches in Kapok Fiber Market

- In March 2024, GreenFiber Co., a key player in the sustainable materials industry, launched a new line of kapok-based eco-friendly insulation materials specifically designed for the construction and green building sectors. This innovative product line focuses on improving energy efficiency, indoor air quality, and overall sustainability performance in residential and commercial buildings.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the kapok fiber market based on the below-mentioned segments:

Global Kapok Fiber Market, By Fiber Type

-

- Natural Kapok Fiber

- Processed Kapok Fiber

Global Kapok Fiber Market, By Application

-

- Textiles

- Upholstery

- Bedding

- Automotive

Global Kapok Fiber Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Kapok Fiber Market in 2025?

A: The Global Kapok Fiber Market size is projected to reach approximately USD 795 million in 2025, growing from USD 759.4 million in 2024.

Q: What is the forecasted CAGR of the Global Kapok Fiber Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of 5.03% during the period 2025–2035.

Q: What is the projected revenue of the Global Kapok Fiber Market by 2035?

A: The market is forecasted to reach USD 1302.3 million by 2035.

Q: Which region dominates the global kapok fiber market?

A: Asia Pacific holds the largest market share, accounting for approximately 50% of the global revenue in 2024.

Q: Which country is expected to grow the fastest in the kapok fiber market?

A: India is projected to grow at a CAGR of around 9% during the forecast period, driven by government support and increased demand for sustainable textiles.

Q: What fiber type leads the global kapok fiber market?

A: The natural kapok fiber segment dominated the market in 2024, accounting for about 68% of the revenue share.

Q: Which application segment generated the highest revenue in 2024?

A: The textiles segment held the largest revenue share, approximately 40%, due to rising demand for natural and breathable fabrics.

Q: What are the key drivers of growth in the kapok fiber market?

A: Key drivers include increasing environmental awareness, demand for biodegradable materials, government policies promoting sustainable agriculture, and growing use in textiles, bedding, and automotive applications.

Q: What challenges are limiting the kapok fiber market growth?

A: Seasonal availability of raw materials, limited processing infrastructure, supply chain inefficiencies, and competition from cheaper synthetic fibers are major challenges.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 255 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |